|

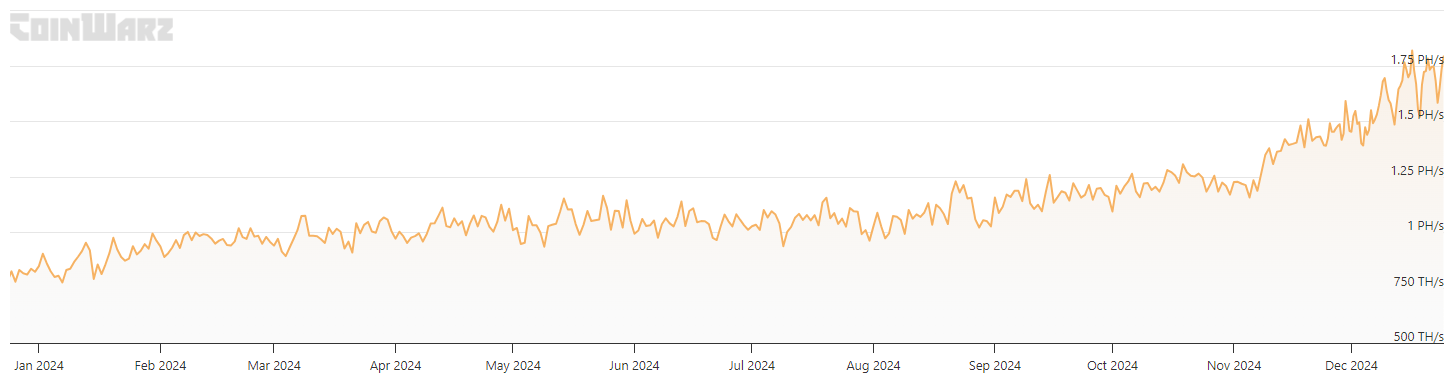

I write about high-potential altcoins for a living, and as I see more and more new investors come to the space, I see more and more misconceptions about how altcoins work, grow, and behave. To help educate newer members of the community and refresh experienced ones on the fundamentals, today I’m going to discuss five metrics that are absolutely necessary to understand if you want to make informed investments into altcoins. What these metrics all have in common is the fact that they’re objective and indisputable; the reality can be interpreted in different ways, but these metrics are unarguable. Due to this certainty, they represent a foundation on which we can come to more reasoned and (hopefully) profitable conclusions. Not only can these stats help us find hidden altcoin gems, they can also help us avoid red flags. The concepts are in no particular order. 1. Market CapWhere It’s Found: CoinGecko, CoinMarketCap, TradingView Definition: Market Cap is a measure of the total size of a cryptocurrency. It’s the price of a single token multiplied by the total amount of tokens in circulation. Diluted market cap reflects the price of a single token multiplied by the total amount of tokens that will ever be created. Interpreting Market Cap: Market cap is meaningful because the size of a crypto helps us understand how much growth is possible or reasonable. For a given cryptocurrency to double in price, it requires an exponential increase in the input of capital. Check out the graph below: For a real-life example, Bitcoin experienced a 1000x that took only 30 months (Sep 2010 - Mar 2013) when price went from $0.06 to $60. The next 1000x took 96 months. Another 1000x from today would value Bitcoin at 1.14 quadrillion dollars, over 12 times the size of the entire world economy. It probably just won’t happen. And for Bitcoin to double from today’s price, it would require an injection of over $1 trillion of capital. It’s possible, but no small feat. But a $1 million altcoin could absolutely experience a 1000x. It would require less than $1 billion of new capital, which wouldn’t even put it in the top 100 cryptos by market cap. This is also the reason Shiba Inu won't go to a dollar. Why It’s Important: The previous graph shows us that the majority of an altcoin’s gains happen early in its life cycle. So although smaller cryptos are a lot riskier, they have a lot more upside because less capital can move the price. 2. Total Value LockedWhere It’s Found: CoinGecko Definition: The sum of all assets deposited (or locked) in a given protocol. Assets are locked up to provide collateral for loans, generate interest, or be staked for more coins. Interpreting Total Value Locked: Cryptocurrencies are valuable for all kinds of reasons—Bitcoin is valuable because it’s a decentralized, transferrable store of value. Monero is valuable because it’s a private currency. Ethereum is valuable because it creates smart contracts, decentralized agreements to store and transfer value between network users across time. Total Value Locked (TVL) is based on that third type of value, the idea that value can be stored within a crypto by being deposited, used as collateral, used as liquidity, or staked for interest. The dollar value locked within a protocol is one way to estimate the intrinisic, fundamental value of that asset. So what does this TVL mean for the value of a given cryptocurrency? Some ecosystems generate enormous cash flows and fees on value locked, which are then distributed back to users (Maker Dao and Abracabra Money would be some examples). With protocols like AAVE, the fees generated are used to buy back the token and burn it, creating a deflationary supply. Uniswap doesn’t even charge fees for the use of their protocol, but all of the assets locked up inside represent real value. A closely related statistic to TVL is the TVL ratio, which is the ratio of a crypto's market cap to its total value locked. In many cases, investors see a crypto with a TVL ratio of less than one as a signal that it’s undervalued, while a TVL ratio of over one means that the asset may be overvalued. That’s an oversimplification, and some valuable cryptos (Bitcoin, for one) have no TVL. That doesn’t make them valueless by any means. Instead of using TVL to value the protocol itself, use it to understand how that value generates wealth for token holders and demand for the cryptocurrency. Why It’s Important: Total value locked can give you a look at the health of a crypto ecosystem and an idea of the intrinsic value created by the protocol. 3. Inflation RateWhere It’s Found: Whitepapers, Official Documentation, Google Definition: Inflation rate is the rate at 4 the supply of tokens of a cryptocurrency increases. A supply inflates as coins/tokens are mined or created via staking. Interpreting Inflation Rate: Inflation represents how tokens are created in a crypto ecosystem, a key aspect of the supply side of a crypto. As tokens are created, they are added to the market and must be offset by more demand for the token. If demand doesn’t outpace that new supply, he crypto will go down in price. Some cryptos are deflationary. Bitcoin will one day have no inflation, and once Ethereum mines its whole supply, it will be deflationary, with tokens burned in every transaction. You can see the token issuance schedules of those cryptos in the graphs below. An inflationary supply isn’t necessarily a bad thing, and a deflationary supply isn’t always a good thing, but if we understand how the production affects supply and demand, we can better understand the forces causing a crypto to move up or down in price. Why It’s Important: The inflation rate allows us to understand how the supply of a given cryptocurrency changes. The higher the inflation, the bigger the crypto needs to grow to hold the same token price. 4. Coin Distribution Where It’s Found: Official Documentation, White Papers, Blockchain explorers Definition: Analyzing coin distribution involves looking at the spread of tokens across the network and seeing if that distribution is overly concentrated. Interpreting Coin Distribution: Perhaps the most important principle behind cryptocurrency is decentralization: the idea that distributing power over a network gives us freedom and autonomy. When coins are concentrated, the integrity of that network is compromised and the power becomes concentrated. Uneven distribution also creates issues around price manipulation. Distributed networks prevent small groups of people from gaining too much control over the protocol or manipulating the price. When a token is launched, a distribution is slayed out for founders and investors. You can see this distribution for some of the biggest cryptos below. But as the crypto grows and matures, that distribution changes. Since most blockchains are public, we can actually use blockchain explorers like etherscan.io to see what percentage of supply the biggest wallets control. Here are the biggest wallets on Shiba Inu, for example: Some of the addresses are known, and are labeled. The #1 address is a burn address, meaning SHIB was sent there and can't be recovered (cryptos do use burns as a deflationary tactic). The #4 wallet holds $2 billion in Shiba, over 4%. A sale that big could tank the price. Why It’s Important: If coins or tokens are unevenly distributed, it means certain groups and individuals have more power over the token and its price. This is bound to happen to some extent, but the bigger the disparity becomes, the bigger the problem becomes. 5. Volume TradedWhere It’s Found: CoinGecko, CoinMarketCap Definition: Volume traded is the amount of value, typically measured in dollars, being traded back and forth over a given time period. Interpreting Volume Traded: When we enter or exit a trade, we’re participating in an open market where we interact with a real person on the other side of the screen. The sum of all the people trading in a given market is the volume, and the more value being traded back and forth, the more efficient and liquid that market typically is. Volume is important because it can help us avoid participating in illiquid markets that are likely to be manipulated. Iliquid markets also make it dificult to enter and exit trades. Take a look at the graph below: Each of those flat spots is a time period where there were no trades happening—you couldn’t have exited the trade for the market price at that point in time. Services like CoinGecko can show you all the markets and volume metrics for a cryptocurrency in a single place. Large cap cryptos will obviously have more volume, but plenty of small cap cryptos have enough volume to be liquid for small investors. Centralized exchanges (CEXes) can provide valuable signals regarding liquidity and volume. When an altcoin is listed on a CEX, it means the team has deemed the asset liquid enough to have a fair and efficient market, and that there will be enough trading volume around that asset to produce fee revenue for the exchange. Why It’s Important: Cryptos that don’t trade on much volume are more inefficient markets and may result in you getting a raw deal when you enter and exit the trade. More liquid markets with higher volume are less likely to be manipulated. Wrapping UpMy goal as an independent altcoin researcher is to help crypto investors make thesis-backed, intelligent investing decisions. While these statistics are all-encompassing by no means, they will help you avoid common red flags and aid in your search for undervalued gems. Happy hunting! EDIT: Thanks for the upvotes! I know Reddit hates self-promo, but if you liked this, you'll love my email newsletter on altcoin investing and altcoin analysis. Check it out here: CryptoPragmatist.com/sign-up/. If it's not your thing, please ignore. Thanks! [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments