TL;DR: I know a boring, virgin-tier amount about financial conduct, and I'm going to make the case that as a Barclays customer you have a very solid mandate to challenge their recent embargo on Binance. Failure to uphold your complaint will place them in violation of the FCA's regulations, specifically the Banking Conduct of Business Sourcebook, which typically triggers fines enumerated in tens or hundreds of millions of GBP.

At the bottom of this post I will provide an example complaint you can send them, how to go about submitting it, what I expect it to achieve and what you should do next when they inevitably claim innocence. Read the whole post or just skip to the action - your choice. If you find this helpful please upvote for visibility.

---------------------

THE LONG VERSION

---------------------

All financial service providers in the UK are authorised and regulated by a series of independent governing bodies. The main one to be aware of in this case is the FCA (Financial Conduct Authority). The FCA's goal is to ensure that service providers such as Barclays, who hold enormous power over their customers' money and affairs, aren't able to manipulate matters to their advantage.

The FCA handbook is some 30,000 pages long - about three times the length of the combined works of Shakespeare - so today we're going to zero in on a couple of key points:

- The FCA's eleven guiding principles (the TL:DR version of the FCA handbook);

- BCOBS - the Banking Conduct of Business Sourcebook.

The FCA handbook is horrifying long and complicated, but EVERYONE who works in financial services is required to understand it at a basic level. Everyone. Right down to the lowliest data entry monkey. The FCA therefore quite neatly condenses the whole 30,000 pages into eleven guiding principles, allowing even someone totally new to the industry to take a stab at whether a given action seems "wrong" or "right". I'm going to list the ones that Barclays has violated in the order I believe they apply (not numerical order):

- #11: Conflicts of interest

"A firm must manage conflicts of interest fairly, both between itself and its customers and between a customer and another client."

It is self-evident that traditional finance providers (Tradfi) are in direct competition with crypto and decentralised finance providers (DeFi). They are, quite literally, providing the same services. It therefore follows that OUTRIGHT BANNING transferring funds to a competitor is equivalent to outright banning customers from moving their funds from Barclays to HSCB or Natwest. It violates both the FCA regs and broader antitrust / anti-competition laws, which apply to every industry (not just financial services). Even if I only sell ice cream I can't ban people from using the ice cream shop next door. I will go to jail and forfeit all my assets.

- #6: Customers’ interests

"A firm must pay due regard to the interests of its customers and treat them fairly."

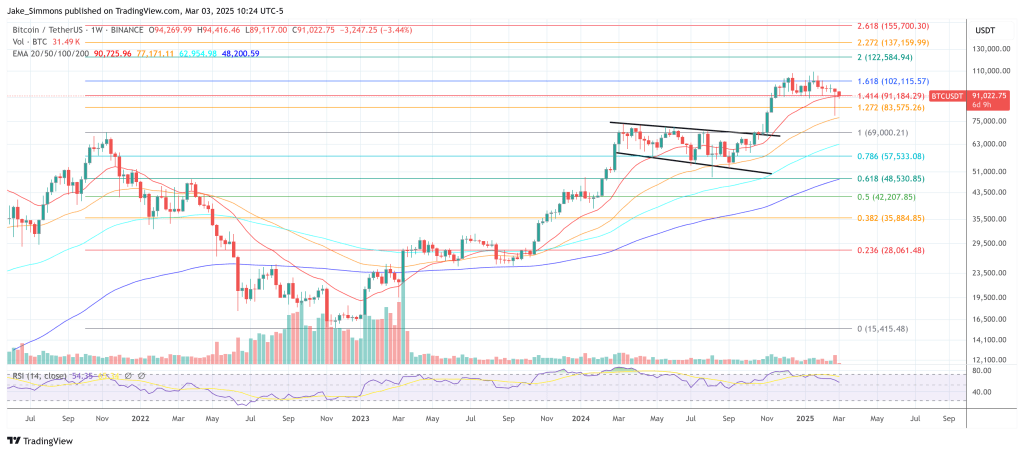

Treating customers fairly (TCF) typically refers to things like treating all customers the same - e.g. I can't decline to offer you a mortgage because of your race or sexual orientation. But "the interests of its customers" also encompasses financial interests. Bitcoin is the best-performing asset class of the last decade. To wilfully prevent customers from accessing it is axiomatically harmful to their interests. Furthermore, note that TCF emphasises "treating people the same" - "one rule for all". In this case, Barclays permits funds transfers to gambling providers and traditional investment vehicles (rocks and stocks). When cryptoassets have empirically, provably, outperformed these same vehicles over a ten-year stretch (it is clearly not anomolous) - THE ONUS IS ON BARCLAYS TO DEMONSTRATE WHY it has decided to treat these asset classes, and the customers who deal in them, in radically different ways. I cannot stress this enough - unlike criminal law where one is innocent until proven guilty, in financial regulation the balance of fairness must always lie with the individual, not the service provider. I.e.: when challenged by the FCA, Barclays must be able to hand over a book of evidence as to why its customers need protection from the top-perfoming asset class and not, for example, from purchases in casinos, or of tobacco or alcohol.

- To a lesser extent - points #1 and #7, which are, respectively -

Communications with clients

A firm must pay due regard to the information needs of its clients, and communicate information to them in a way which is clear, fair and accurate.

It follows that Barclays is not communicating a clear information picture to clients, and must provide evidence to support its picture that the harm from a top-performing asset class exceeds that of lesser-performing asset classes such as stock and rocks. To put a crude turn on it, it appears Barclays has "lied" about its motivations. The onus is on it to prove otherwise.

And,

Integrity

A firm must conduct its business with integrity.

Perhaps the hardest of the eleven rules to interpret - but a failure on any of the above would provide the basis for a lack-of-integrity claim.

Now let's take a look a BCOBS, the Banking Conduct Sourcebook.

The FCA's rules have to cover a huge spectrum of products and services, so they have to be flexible at the wide end. That's why we see statements like "conduct yourself with integrity". As we drill down into different industries, we start to get very empirical rulesets that apply specifically to that product or service. BCOBS is the bible for banking businesses like Barclays.

BCOBS weighs in at a mere 152 pages, and I'm sure you'd love to read the whole thing, but the part I'd like to draw attention to is BCOBS 5 - a bank's obligations to customers after the "point of sale" (after the point you've chosen them as your bank and opened an account with them):

5.1.5: A firm must provide a prompt and efficient service to enable a banking customer to move to a retail banking service (including a payment service) provided by another firm.

Binance is not a retail banking service, but as a provider of VISA debit cards IT IS A PAYMENT SERVICE. Barclays therefore MUST provide a prompt and efficient service to you when you want to transfer funds to Binance. An outright block on a competitor can hardly be considered to meet the criteria.

Barclays may well argue that in fact they're complying with 5.1.10A R, which states they have to take due care to protect you from accidentally moving your account to a fraudulent service. But in fact:

"this means such procedures should include authentication procedures for the verification of the identity of the banking customer or the validity of the use of a particular payment instrument, proportionate to the risks involved. Where appropriate, firms may wish to consider the adoption of ‘strong customer authentication’, as defined in the Payment Services Regulations, and specified in the SCA RTS."

In other words, Barclays' obligation is not to try to control where you send your money, but just to conduct basic due diligence to ensure it is indeed you making the transfer, and that the service you wish to transfer TO has the appropriate regulatory checks and approvals in place. Binance (not Binance UK yet) does hold these licenses and therefore their duties are amply met.

We could continue in this vein for some time, but I'm conscious most readers won't even make it this far. So let's cut to the action.

-----------------------------------------

THE ACTION - WHAT CAN I DO ABOUT IT?

-----------------------------------------

By this point you've either read and agreed with the arguments presented above, or decided that anyone who knows THIS MUCH about UK financial regulations can't possibly have enough of a sense of humour to be pranking you. So let's assume you're ready to challenge Barclays illegal conduct.

The first thing you should do is submit a complaint here.

https://www.barclays.co.uk/help/making-a-complaint/how-do-i-make-a-complaint/

You can write your own, or here's a draft complaint you can use in full or in part.

-----------------------------------

EXAMPLE COMPLAINT

------------------------------------

"Dear Sir / Madam,

I'm writing to complain in the strongest possible terms about Barclays' recent decision to prohibit UK customers from making transfers to Binance.

I strongly believe you are not acting in your customers' best interests in doing so, and are therefore in violation of points 11, 6, 7 and 1 of the FCA's 11 guiding principles.

Decentralised finance providers are an alternative to traditional banking services like yours, and to outright ban customers from moving funds from their Barclays account to another financial service provider is anticompetitive and demonstrates a clear conflict of interests (point 11). It is equivalent to preventing a customer moving their funds from Barclays to another bank, and therefore also puts you in clear contravention of BCOBS 5.1.5.

The reason you have given for doing so is to "protect customers", but decentralised assets have demonstrably provided the best return on investment for the last decade. That is not an opinion - it is empirically provable and beyond doubt, whatever your own subjective views on whether financial authority ought to be concentrated in the hands of the few or the many. Therefore, you are either willfully ignorant of the perfomance of the markets for the last decade, putting you in contravention of FCA principles 2 and 3; or, you have another motive not disclosed in your communications to customers, and are in breach of principles 6, 7, 8 and 1.

Regardless, the onus is now on you to justify why you allow customers to purchase lower-performing assets such as stocks, or higher-risk instruments such as sports bets, and not decentralised assets. You are clearly required to treat customers fairly and equally, yet you allow more harmful transactions while prohibiting those which - purely coincidentally, I'm sure - compete directly with your own.

The best possible outcome for you in this scenario is that your customers desert you in droves for your more progressive competitors, of which there are countless. An equally likely scenario is that complaints such as these reach the eyes of the regulators and you are handed a fine enumerated in seven or eight figures. The FCA, as you are no doubt aware, "fines to hurt" firms such as yourselves. With £1.3tn under management, a "hurtful fine" for you would be rather eyewatering. A third outcome is that in trying to fight the tide of technological progress you inevitably get left behind. For a bank that has survived over 300 years, from the steam engine to the internet, it seems rather sad that the one innovation you couldn't understand would be a new and popular way of exchanging value between people and businesses. Nonetheless, the choice is yours to make.

The only satisfactory resolution of this complaint will be the reversal of your short-sighted ban on cryptoasset exchanges like Binance. Please do consider it carefully and with an open heart and mind.

Yours, a previously loyal Barclays customer.

-------------------------------------------

AND FINALLY.....

--------------------------------------------

What do I do if Barclays decide to fob me off?

One of the great things about regulated industries is that, if your financial service provider can't resolve your complaint to your satisfaction, you can escalate it to an independent third party who will help to mediate. These guys are called the Ombudsmen. Barclays will legally have to tell you about this option if they don't uphold your complaint and overturn their ban.

Not only do the Ombudsmen take these matters very seriously, they also charge Barclays for the priviledge. It's expensive and time-consuming to unpick these complaints, so every time one lands on their desk, they charge the service provider a fee to cover their costs. There's therefore a phenomenon whereby EVEN IF BARCLAYS REALLY DON'T WANT TO DO THIS, if enough people complain and escalate, it just becomes too financially painful for them not to. Kinda like a short squeeze, I guess.

I hope this is useful to our friends in the UK, and I urge you to take the fight to Barclays and stand up for what you believe in. If Barclays get away with it, who's next?

Respectfully

Meowface the cat.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments