A former Celsius executive revealed that the company may have manipulated the CLE token price. Timothy Cradle started working at Celsius as an anti-money laundering (AML) analyst. After two years Cradle was promoted to Head of Monitoring and then Director of Financial Crimes Compliance for 3 months.

Going back to 2019, Cradle said he heard senior executives discussing CEL at a Christmas party. He heard the executives discuss deliberate price movements, which he found disturbing.

While there are rules against market manipulations, there are no specific rules for cryptocurrencies Cryptocurrencies By using cryptography, virtual currencies, known as cryptocurrencies, are nearly counterfeit-proof digital currencies that are built on blockchain technology. Comprised of decentralized networks, blockchain technology is not overseen by a central authority.Therefore, cryptocurrencies function in a decentralized nature which theoretically makes them immune to government interference. The term, cryptocurrency derives from the origin of the encryption techniques that are employed to secure the networks which are used to authenticate blockchain technology. Cryptocurrencies can be thought of as systems that accept online payments which are denoted as “tokens.” Tokens are represented as internal ledger entries in blockchain technology while the term crypto is used to depict cryptographic methods and encryption algorithms such as public-private key pairs, various hashing functions, and an elliptical curve. Every cryptocurrency transaction that occurs is logged in a web-based ledger with blockchain technology.These then must be approved by a disparate network of individual nodes (computers that maintain a copy of the ledger). For every new block generated, the block must first be authenticated and confirmed ‘approved’ by each node, which makes forging the transactional history of cryptocurrencies nearly impossible. The World’s First CryptoBitcoin became the first blockchain-based cryptocurrency and to this day is still the most demanded cryptocurrency and the most valued. Bitcoin still contributes the majority of the overall cryptocurrency market volume, though several other cryptos have grown in popularity in recent years.Indeed, out of the wake of Bitcoin, iterations of Bitcoin became prevalent which resulted in a multitude of newly created or cloned cryptocurrencies. Contending cryptocurrencies that emerged after Bitcoin’s success is referred to as ‘altcoins’ and they refer to cryptocurrencies such as Bitcoin, Peercoin, Namecoin, Ethereum, Ripple, Stellar, and Dash. Cryptocurrencies promise a wide range of technological innovations that have yet to be structured into being. Simplified payments between two parties without the need for a middle man is one aspect while leveraging blockchain technology to minimize transaction and processing fees for banks is another. Of course, cryptocurrencies have their disadvantages too. This includes issues of tax evasion, money laundering, and other illicit online activities where anonymity is a dire ingredient in solicitous and fraudulent activities. By using cryptography, virtual currencies, known as cryptocurrencies, are nearly counterfeit-proof digital currencies that are built on blockchain technology. Comprised of decentralized networks, blockchain technology is not overseen by a central authority.Therefore, cryptocurrencies function in a decentralized nature which theoretically makes them immune to government interference. The term, cryptocurrency derives from the origin of the encryption techniques that are employed to secure the networks which are used to authenticate blockchain technology. Cryptocurrencies can be thought of as systems that accept online payments which are denoted as “tokens.” Tokens are represented as internal ledger entries in blockchain technology while the term crypto is used to depict cryptographic methods and encryption algorithms such as public-private key pairs, various hashing functions, and an elliptical curve. Every cryptocurrency transaction that occurs is logged in a web-based ledger with blockchain technology.These then must be approved by a disparate network of individual nodes (computers that maintain a copy of the ledger). For every new block generated, the block must first be authenticated and confirmed ‘approved’ by each node, which makes forging the transactional history of cryptocurrencies nearly impossible. The World’s First CryptoBitcoin became the first blockchain-based cryptocurrency and to this day is still the most demanded cryptocurrency and the most valued. Bitcoin still contributes the majority of the overall cryptocurrency market volume, though several other cryptos have grown in popularity in recent years.Indeed, out of the wake of Bitcoin, iterations of Bitcoin became prevalent which resulted in a multitude of newly created or cloned cryptocurrencies. Contending cryptocurrencies that emerged after Bitcoin’s success is referred to as ‘altcoins’ and they refer to cryptocurrencies such as Bitcoin, Peercoin, Namecoin, Ethereum, Ripple, Stellar, and Dash. Cryptocurrencies promise a wide range of technological innovations that have yet to be structured into being. Simplified payments between two parties without the need for a middle man is one aspect while leveraging blockchain technology to minimize transaction and processing fees for banks is another. Of course, cryptocurrencies have their disadvantages too. This includes issues of tax evasion, money laundering, and other illicit online activities where anonymity is a dire ingredient in solicitous and fraudulent activities. Read this Term

Cradle told CNBC that Celsius allegedly manipulated the CLE price by triggering a rally. “I don’t know what better way to phrase it. But they were in the market, they were actively trading and increasing the price of the token," said Cradle.

He added that the Celsius compliance department was understaffed with limited resources.

'Mining Out of Debt' Plan Celsius applied for Chapter 11 earlier this month. The company owes its users $4.7 billion. The rapid decline in Bitcoin and the company's misjudgment of clients' growth led to the bankruptcy Bankruptcy Bankruptcy or insolvency constitutes a legal term and refers to being unable to repay debts. A business and a person can declare bankruptcy. When a person or company claims bankruptcy, it is described as a voluntary bankruptcy, and when your debtors force you into bankruptcy, it is referred to as involuntary. A voluntary bankruptcy occurs when the debtor or borrower, the party that owes the money files with the courts. Involuntary bankruptcy happens when your credits file a petition with the courts. Bankruptcy can only occur with a court filing. Since bankruptcy is a legal state, once the petition is filed with the appropriate court, local and state laws vary greatly. Different Kinds of Bankruptcy In the US, these legalities are referred to as Chapters 7 and 11, 12, and 13. Chapter 7 is a liquidation procedure, where all assets are sold, and the court oversees the distribution of the money to creditors based on their standing. Both businesses and individuals can file for chapter 7. Chapter 11 is a reorganization process where businesses are allowed to freeze their debts and continue to operate. In contrast, a method and procedure are negotiated through the courts to satisfy the obligations of the company. Chapter 13 is called a wage earner plan and helps people attempt to restructure their debts to repay their debts. This can include some debt forgiveness by creditors or reduced interest rates or balances. Not all private persons are eligible for Chapter 13, high amounts of debt don't qualify, and the person must file Chapter 11 or 7. Most individuals choose Chapter 13 over Chapter 11 or Chapter 7 because it aids them in avoiding foreclosure on their residence. The filing of bankruptcy is considered a last resort when businesses and persons have not been able to negotiate terms directly with their creditors. Bankruptcy or insolvency constitutes a legal term and refers to being unable to repay debts. A business and a person can declare bankruptcy. When a person or company claims bankruptcy, it is described as a voluntary bankruptcy, and when your debtors force you into bankruptcy, it is referred to as involuntary. A voluntary bankruptcy occurs when the debtor or borrower, the party that owes the money files with the courts. Involuntary bankruptcy happens when your credits file a petition with the courts. Bankruptcy can only occur with a court filing. Since bankruptcy is a legal state, once the petition is filed with the appropriate court, local and state laws vary greatly. Different Kinds of Bankruptcy In the US, these legalities are referred to as Chapters 7 and 11, 12, and 13. Chapter 7 is a liquidation procedure, where all assets are sold, and the court oversees the distribution of the money to creditors based on their standing. Both businesses and individuals can file for chapter 7. Chapter 11 is a reorganization process where businesses are allowed to freeze their debts and continue to operate. In contrast, a method and procedure are negotiated through the courts to satisfy the obligations of the company. Chapter 13 is called a wage earner plan and helps people attempt to restructure their debts to repay their debts. This can include some debt forgiveness by creditors or reduced interest rates or balances. Not all private persons are eligible for Chapter 13, high amounts of debt don't qualify, and the person must file Chapter 11 or 7. Most individuals choose Chapter 13 over Chapter 11 or Chapter 7 because it aids them in avoiding foreclosure on their residence. The filing of bankruptcy is considered a last resort when businesses and persons have not been able to negotiate terms directly with their creditors. Read this Term

source: law firm Kirkland & Ellis

From the above document, it appears Celsius was unprepared for a downturn in the crypto markets. $720 million are tied to mining equipment.

Celsius is planning to use bitcoin mining to pay off its debts. The crypto firm asked the court for approval of $5 million for completing the construction of the mining rigs in Texas, which may take 60 days to complete).

ADVERTISEMENT

It has been estimated that 43,000 mining rigs will be deployed initially and a total of 112,000 rigs will be available in mid-2023. Celsius expects it will earn 14.2 BTC per day and a total of 10,100 BTC in 2022.

The next hearing will take place on 10 August 2022.

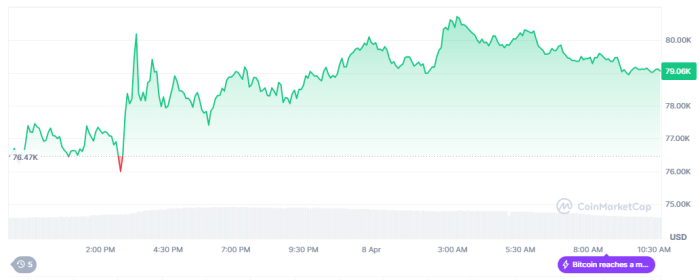

Mining your way out of debt will require Bitcoin to hold onto its current levels if not higher. A depreciation in BTC price may burden the company's ability to pay off its debt.

A former Celsius executive revealed that the company may have manipulated the CLE token price. Timothy Cradle started working at Celsius as an anti-money laundering (AML) analyst. After two years Cradle was promoted to Head of Monitoring and then Director of Financial Crimes Compliance for 3 months.

Going back to 2019, Cradle said he heard senior executives discussing CEL at a Christmas party. He heard the executives discuss deliberate price movements, which he found disturbing.

While there are rules against market manipulations, there are no specific rules for cryptocurrencies Cryptocurrencies By using cryptography, virtual currencies, known as cryptocurrencies, are nearly counterfeit-proof digital currencies that are built on blockchain technology. Comprised of decentralized networks, blockchain technology is not overseen by a central authority.Therefore, cryptocurrencies function in a decentralized nature which theoretically makes them immune to government interference. The term, cryptocurrency derives from the origin of the encryption techniques that are employed to secure the networks which are used to authenticate blockchain technology. Cryptocurrencies can be thought of as systems that accept online payments which are denoted as “tokens.” Tokens are represented as internal ledger entries in blockchain technology while the term crypto is used to depict cryptographic methods and encryption algorithms such as public-private key pairs, various hashing functions, and an elliptical curve. Every cryptocurrency transaction that occurs is logged in a web-based ledger with blockchain technology.These then must be approved by a disparate network of individual nodes (computers that maintain a copy of the ledger). For every new block generated, the block must first be authenticated and confirmed ‘approved’ by each node, which makes forging the transactional history of cryptocurrencies nearly impossible. The World’s First CryptoBitcoin became the first blockchain-based cryptocurrency and to this day is still the most demanded cryptocurrency and the most valued. Bitcoin still contributes the majority of the overall cryptocurrency market volume, though several other cryptos have grown in popularity in recent years.Indeed, out of the wake of Bitcoin, iterations of Bitcoin became prevalent which resulted in a multitude of newly created or cloned cryptocurrencies. Contending cryptocurrencies that emerged after Bitcoin’s success is referred to as ‘altcoins’ and they refer to cryptocurrencies such as Bitcoin, Peercoin, Namecoin, Ethereum, Ripple, Stellar, and Dash. Cryptocurrencies promise a wide range of technological innovations that have yet to be structured into being. Simplified payments between two parties without the need for a middle man is one aspect while leveraging blockchain technology to minimize transaction and processing fees for banks is another. Of course, cryptocurrencies have their disadvantages too. This includes issues of tax evasion, money laundering, and other illicit online activities where anonymity is a dire ingredient in solicitous and fraudulent activities. By using cryptography, virtual currencies, known as cryptocurrencies, are nearly counterfeit-proof digital currencies that are built on blockchain technology. Comprised of decentralized networks, blockchain technology is not overseen by a central authority.Therefore, cryptocurrencies function in a decentralized nature which theoretically makes them immune to government interference. The term, cryptocurrency derives from the origin of the encryption techniques that are employed to secure the networks which are used to authenticate blockchain technology. Cryptocurrencies can be thought of as systems that accept online payments which are denoted as “tokens.” Tokens are represented as internal ledger entries in blockchain technology while the term crypto is used to depict cryptographic methods and encryption algorithms such as public-private key pairs, various hashing functions, and an elliptical curve. Every cryptocurrency transaction that occurs is logged in a web-based ledger with blockchain technology.These then must be approved by a disparate network of individual nodes (computers that maintain a copy of the ledger). For every new block generated, the block must first be authenticated and confirmed ‘approved’ by each node, which makes forging the transactional history of cryptocurrencies nearly impossible. The World’s First CryptoBitcoin became the first blockchain-based cryptocurrency and to this day is still the most demanded cryptocurrency and the most valued. Bitcoin still contributes the majority of the overall cryptocurrency market volume, though several other cryptos have grown in popularity in recent years.Indeed, out of the wake of Bitcoin, iterations of Bitcoin became prevalent which resulted in a multitude of newly created or cloned cryptocurrencies. Contending cryptocurrencies that emerged after Bitcoin’s success is referred to as ‘altcoins’ and they refer to cryptocurrencies such as Bitcoin, Peercoin, Namecoin, Ethereum, Ripple, Stellar, and Dash. Cryptocurrencies promise a wide range of technological innovations that have yet to be structured into being. Simplified payments between two parties without the need for a middle man is one aspect while leveraging blockchain technology to minimize transaction and processing fees for banks is another. Of course, cryptocurrencies have their disadvantages too. This includes issues of tax evasion, money laundering, and other illicit online activities where anonymity is a dire ingredient in solicitous and fraudulent activities. Read this Term

Cradle told CNBC that Celsius allegedly manipulated the CLE price by triggering a rally. “I don’t know what better way to phrase it. But they were in the market, they were actively trading and increasing the price of the token," said Cradle.

He added that the Celsius compliance department was understaffed with limited resources.

'Mining Out of Debt' Plan Celsius applied for Chapter 11 earlier this month. The company owes its users $4.7 billion. The rapid decline in Bitcoin and the company's misjudgment of clients' growth led to the bankruptcy Bankruptcy Bankruptcy or insolvency constitutes a legal term and refers to being unable to repay debts. A business and a person can declare bankruptcy. When a person or company claims bankruptcy, it is described as a voluntary bankruptcy, and when your debtors force you into bankruptcy, it is referred to as involuntary. A voluntary bankruptcy occurs when the debtor or borrower, the party that owes the money files with the courts. Involuntary bankruptcy happens when your credits file a petition with the courts. Bankruptcy can only occur with a court filing. Since bankruptcy is a legal state, once the petition is filed with the appropriate court, local and state laws vary greatly. Different Kinds of Bankruptcy In the US, these legalities are referred to as Chapters 7 and 11, 12, and 13. Chapter 7 is a liquidation procedure, where all assets are sold, and the court oversees the distribution of the money to creditors based on their standing. Both businesses and individuals can file for chapter 7. Chapter 11 is a reorganization process where businesses are allowed to freeze their debts and continue to operate. In contrast, a method and procedure are negotiated through the courts to satisfy the obligations of the company. Chapter 13 is called a wage earner plan and helps people attempt to restructure their debts to repay their debts. This can include some debt forgiveness by creditors or reduced interest rates or balances. Not all private persons are eligible for Chapter 13, high amounts of debt don't qualify, and the person must file Chapter 11 or 7. Most individuals choose Chapter 13 over Chapter 11 or Chapter 7 because it aids them in avoiding foreclosure on their residence. The filing of bankruptcy is considered a last resort when businesses and persons have not been able to negotiate terms directly with their creditors. Bankruptcy or insolvency constitutes a legal term and refers to being unable to repay debts. A business and a person can declare bankruptcy. When a person or company claims bankruptcy, it is described as a voluntary bankruptcy, and when your debtors force you into bankruptcy, it is referred to as involuntary. A voluntary bankruptcy occurs when the debtor or borrower, the party that owes the money files with the courts. Involuntary bankruptcy happens when your credits file a petition with the courts. Bankruptcy can only occur with a court filing. Since bankruptcy is a legal state, once the petition is filed with the appropriate court, local and state laws vary greatly. Different Kinds of Bankruptcy In the US, these legalities are referred to as Chapters 7 and 11, 12, and 13. Chapter 7 is a liquidation procedure, where all assets are sold, and the court oversees the distribution of the money to creditors based on their standing. Both businesses and individuals can file for chapter 7. Chapter 11 is a reorganization process where businesses are allowed to freeze their debts and continue to operate. In contrast, a method and procedure are negotiated through the courts to satisfy the obligations of the company. Chapter 13 is called a wage earner plan and helps people attempt to restructure their debts to repay their debts. This can include some debt forgiveness by creditors or reduced interest rates or balances. Not all private persons are eligible for Chapter 13, high amounts of debt don't qualify, and the person must file Chapter 11 or 7. Most individuals choose Chapter 13 over Chapter 11 or Chapter 7 because it aids them in avoiding foreclosure on their residence. The filing of bankruptcy is considered a last resort when businesses and persons have not been able to negotiate terms directly with their creditors. Read this Term

source: law firm Kirkland & Ellis

From the above document, it appears Celsius was unprepared for a downturn in the crypto markets. $720 million are tied to mining equipment.

Celsius is planning to use bitcoin mining to pay off its debts. The crypto firm asked the court for approval of $5 million for completing the construction of the mining rigs in Texas, which may take 60 days to complete).

ADVERTISEMENT

It has been estimated that 43,000 mining rigs will be deployed initially and a total of 112,000 rigs will be available in mid-2023. Celsius expects it will earn 14.2 BTC per day and a total of 10,100 BTC in 2022.

The next hearing will take place on 10 August 2022.

Mining your way out of debt will require Bitcoin to hold onto its current levels if not higher. A depreciation in BTC price may burden the company's ability to pay off its debt.

You can get bonuses upto $100 FREE BONUS when you:💰 Install these recommended apps: SocialGood - 100% Crypto Back on Everyday Shopping xPortal - The DeFi For The Next Billion CryptoTab Browser - Lightweight, fast, and ready to mine! 💰 Register on these recommended exchanges: Binance 🟡 Bitfinex 🟡 Bitmart 🟡 Bittrex 🟡 Bitget CoinEx 🟡 Crypto.com 🟡 Gate.io 🟡 Huobi 🟡 Kucoin .

Comments