Grayscale looks to be seeking to restructure its Bitcoin Trust into a physically backed fund after the SEC approved a Bitcoin futures ETF.

Institutional investment giant Grayscale is reportedly considering converting its Bitcoin Trust into a physically settled exchange-traded fund (ETF).

On Sunday, Barry Silbert, CEO of Grayscale’s parent company, Digital Currency Group, hinted that Grayscale is making plans to convert its Bitcoin Trust into a spot-settled Bitcoin (BTC) fund.

After having taken to Twitter to criticize the cash-settled Bitcoin futures ETF recently approved by the United States Securities and Exchange Commission, Bitcoin commentator Preston Pysh chimed in to ask Silbert when Grayscale’s Bitcoin Trust would be converted into a BTC-settled ETF. “Stay tuned,” Silbert responded.

stay tuned

— Barry Silbert (@BarrySilbert) October 17, 2021

However, Grayscale Bitcoin Trust investors appear to have been unsettled by Silbert’s remarks, with Twitter user Sovereign Individual questioning what a restructure would mean for investors holding shares in Grayscale’s Bitcoin Trust.

“What happens to us Grayscale investors once the spot ETF is approved? Is our investment converted into ETF shares?” they tweeted.

Rumors of Grayscale’s purported ambitions for a Bitcoin ETF began circulating last week after a CNBC report citing anonymous insiders claimed that Grayscale was waiting for the SEC to finally approve a Bitcoin ETF.

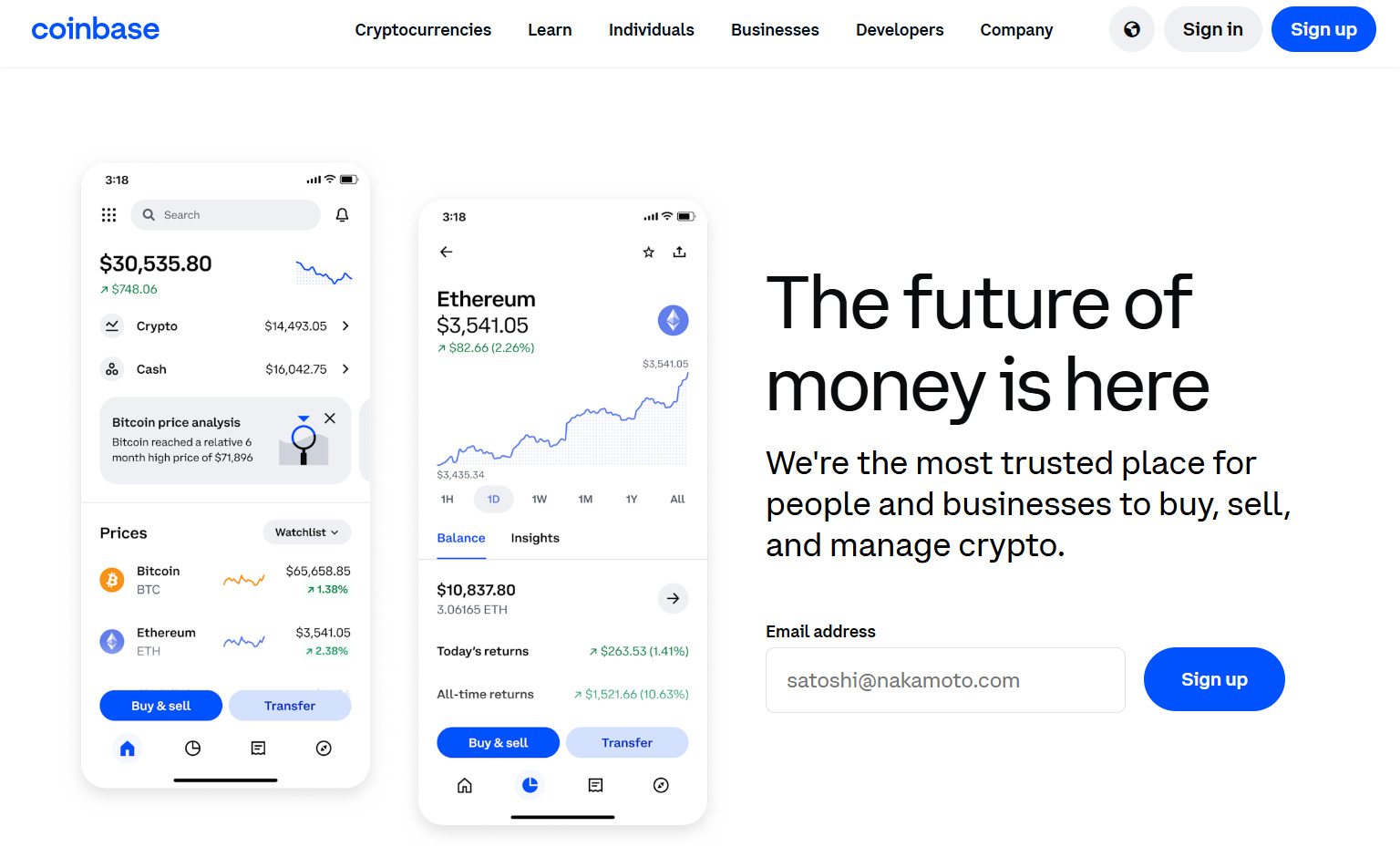

On Friday, the SEC announced it had accepted the registration of securities from ProShares Trust’s futures-based Bitcoin exchange-traded fund. ProShares’ ETF offers investors exposure to contracts that speculate on the future price of BTC that are settled in cash.

Related: Grayscale Bitcoin Trust FUD is now over as the last GBTC unlock totals just 58 BTC

Despite the ETF’s approval being cited as the primary catalyst for Bitcoin’s recent bullish market action, many analysts have criticized the fund for its cash-settled structure, instead advocating for the SEC to approve a Bitcoin ETF that is backed by and settled in BTC.

According to Grayscale’s latest holdings update on Friday, the firm boasts $52.6 billion in assets under management — 73% of which is held in the Bitcoin Trust. The data suggests that Grayscale’s Bitcoin stash comprises roughly 620,000 BTC or 3.3% of Bitcoin’s total supply.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments