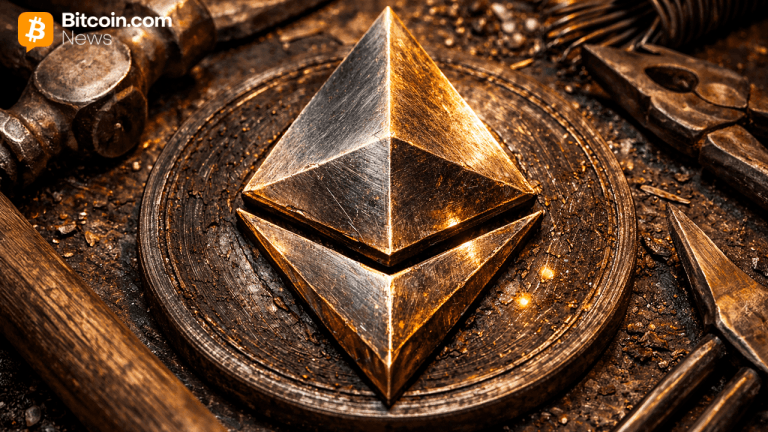

Grayscale became the first US crypto fund issuer to feature staking for its Ethereum and Solana exchange-traded products.

Crypto asset manager Grayscale has introduced staking for its exchange-traded products (ETPs), becoming the first US-based crypto fund issuer to offer staking-based passive income opportunities.

Grayscale said Monday its Ether (ETH) ETFs — the Grayscale Ethereum Mini Trust ETF (ETH) and Grayscale Ethereum Trust ETF (ETHE) — are now the first US-listed spot crypto funds to offer staking, calling the development “another first-mover milestone.”

Grayscale’s Solana (SOL) fund, the Grayscale Solana Trust (GSOL), has also enabled staking and is awaiting regulatory approval for uplisting to an ETP, which would make it one of the first spot Solana ETPs to enable staking, according to the company’s Monday X post.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments