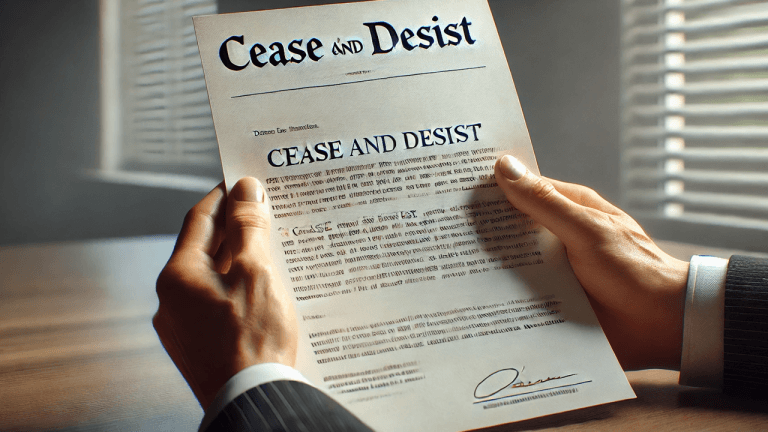

A letter to the secretary of the SEC outlines discrepancies in its rejection of Bitcoin spot ETFs and acceptance of Bitcoin futures ETFs.

Grayscale Investments has fired back at the U.S. Securities and Exchange Commission (SEC) over its recent rejection of VanEck’s spot Bitcoin ETF application.

The operator of the Grayscale Bitcoin Trust (GBTC) issued a letter to the secretary of the SEC, Vanessa Countryman, on Monday to argue the SEC is wrong to reject spot Bitcoin ETFs since it has now approved three Bitcoin futures ETFs, one each from VanEck, Valkyrie and ProShares.

Grayscale argues that the SEC has “no basis for the position that investing in the derivatives market for an asset is acceptable for investors while investing in the asset itself is not.”

It claims the SEC violated the Administrative Protections Act (APA) by failing to treat the two Bitcoin ETF products the same.

A Bitcoin futures ETF allows traders to speculate on the future price of Bitcoin (BTC) via derivatives, while a spot Bitcoin ETF would allow traders to trade on the current price of the asset, thereby functioning similarly to holding the asset.

Grayscale is hardly a disinterested party with an application filed in October to list GBTC as a Bitcoin spot ETF, with a decision possible as on Christmas Eve. On Nov. 12, the SEC rejected VanEck’s similar application on the grounds that it was not consistent with the requirements of the Securities Exchange Act of 1934 (Exchange Act).

Grayscale disagrees with those grounds for rejection.

“We believe this rationale failed adequately to take account of significant regulatory and competitive developments since 2017 when the Commission first considered, and denied, a national securities exchange’s application to list and trade shares of a spot Bitcoin ETP.”

In approving Bitcoin futures ETFs, Grayscale believes the SEC allowed applicants how to sidestep the requirements of Section 6(5)(b) under the Exchange Act, which Bitcoin spot ETF applicants must adhere to.

Section 6(5)(b) is designed to “protect investors and the public interest” by preventing fraud and market manipulation while also disallowing “unfair discrimination between customers, issuers, brokers, or dealers.”

Related: Invesco launches spot Bitcoin ETP on Deutsche Borse

Grayscale had predicted that its Bitcoin spot ETF could be listed as soon as July 2022, but it is unclear whether that prediction will become reality.

GBTC has about $37.1 billion assets under management with 692,370,100 shares outstanding.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments