One of the arguments for Bitcoin is that its supply is not controlled by any entity, so the government cannot just pump more money and cause inflation like we have seen in the last couple of years.

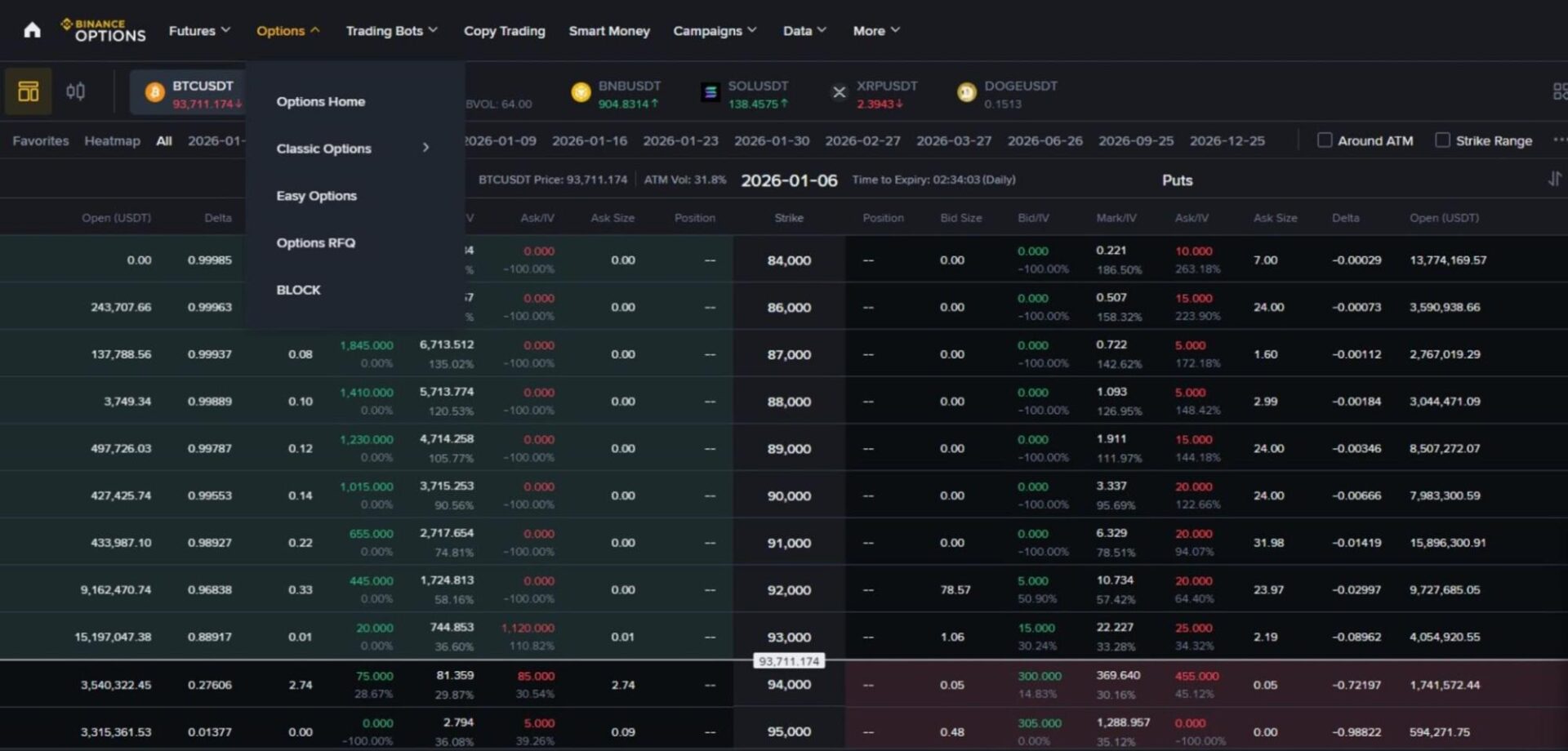

But my question is -- if there can be a vibrant financial sector lending bitcoin, doesn't that also alter the supply of bitcoin in a way that can actually have a similar effect as the Fed pumping fiat? Like I understand that there can be no new bitcoin created by lending it, but if people use centralized exchanges (even though they shouldn't), I feel like we would run it a similar problem (i.e. boom and bust cycles), no?

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments