In this week’s crypto highlights, we explore the price movements of BTC, LTC, LDO, and CAKE. Additionally, this recap includes other notable industry news items that occurred over the last seven days. Without further ado, let’s dive into the latest market developments.

Table of contents

- Bittrex Inc. filed for bankruptcy protection

- Voyager is preparing to liquidate its assets

- New York Attorney General drafts stricter crypto regulations

- Cardano developers launched Hydra protocol on the mainnet

- One sentence news

- Network overflow slightly pushed the BTC price down

- Litecoin brought attention due to Bitcoin transaction issues

- LDO is preparing for a new protocol release

- The CAKE price reached its two-year low

Noteworthy market events

Bittrex Inc. filed for bankruptcy protection

After announcing in March that it would end all operations by the end of April, Bittrex Inc., the U.S. arm of the Bittrex crypto exchange, filed for bankruptcy protection in Delaware. According to a court filing, the platform believes it has more than 100,000 creditors, with estimated liabilities and assets both within the $500 million to $1 billion range.&

It is noteworthy that the filling will not affect Bittrex Global’s business, which operates outside the U.S. In mid-April, the U.S. Securities and Exchange Commission (SEC) sued Bittrex, alleging that it operates a national securities exchange, broker, and clearing agency, in the country. The SEC also sued former Bittrex CEO Bill Shihara, and Bittrex Global.&

Voyager is preparing to liquidate its assets

After failing to sell its assets, bankrupt crypto lender Voyager Digital will wind down its operations, and self-liquidate. According to the filing, the platform’s customers will receive 36% of the company’s assets. This is considered quite a low recovery rate compared to previous Voyager’s estimates, as well as the liquidation plans of other bankrupt crypto platforms.&

For instance, Celsius’ creditors will obtain an estimated 70% of their holdings. However, Voyager’s recovery rate could rise if defunct crypto trading firm Alameda Research’s attempt to claw back $446 million from the company’s estate, fails.&

Users with supported crypto holdings, like Bitcoin and Ethereum, should be able to directly withdraw the allocated percentage. For those with any of the 36 “unsupported tokens,” including Solana (SOL) and Algorand (ALGO), Voyager will pay customers back in USDC stablecoin.

New York Attorney General drafts stricter crypto regulations

The New York Attorney General (NYAG) Letitia James proposed her own measures for investor protection, demanding more power to regulate the crypto industry. According to Bloomberg, the NYAG’s crypto regulations proposal will be discussed in the 2023 legislative session. The legislation includes:&

- Requirements for crypto companies to refund customers who are victims of fraud.

- Independent and public auditing of crypto companies.

- Preventing people who create crypto assets from also owning crypto platforms.

- Stopping crypto companies from borrowing or lending investors’ assets.

- Providing investors with risk and conflict of interest information about crypto companies.

- Giving the NYAG office the power to enforce these laws, and shut down companies that violate them.

If the bill becomes law, lending and borrowing platforms may no longer be able to operate in New York. Additionally, crypto exchanges that have issued their tokens would be unable to provide their services to residents of New York.

Cardano developers launched Hydra protocol on the mainnet

IOG, the Cardano development team, announced the successful deployment of its layer 2 (L2) solution, called Hydra, on the mainnet. The initiative aims to make the network “more scalable and adaptable for various use cases that require fast and cheap transactions.”

Developer Sebastian Nagel noted that Hydra is the first of the protocols that will help Cardano achieve its desired maximum throughput. The solution will enable the implementation of several new features, including micropayments and insurance contracts.

Hydra is based on a sharding technology, and utilizes so-called “hydra heads.” Preliminary tests have shown that each “head” can process up to 1,000 transactions per second. With 1,000 pools using the technology, throughput could potentially reach 1 million transactions.

One sentence news

- MakerDAO developers launched Spark Protocol, which is set to be the first native liquidity and lending marketplace.

- Sui developers launched the project’s mainnet, but struggled with network throughput, experiencing a speed of around four transactions per second after the release.&

- Paxful co-founder shared a plan to reopen the P2P platform, which was closed in April, using Lightning Network and Nostr technologies.

- The U.S. Council of Economic Advisers (CEA) will push for a special 30% tax on crypto mining to combat its effect on the environment.

Network overflow slightly pushed the BTC price down

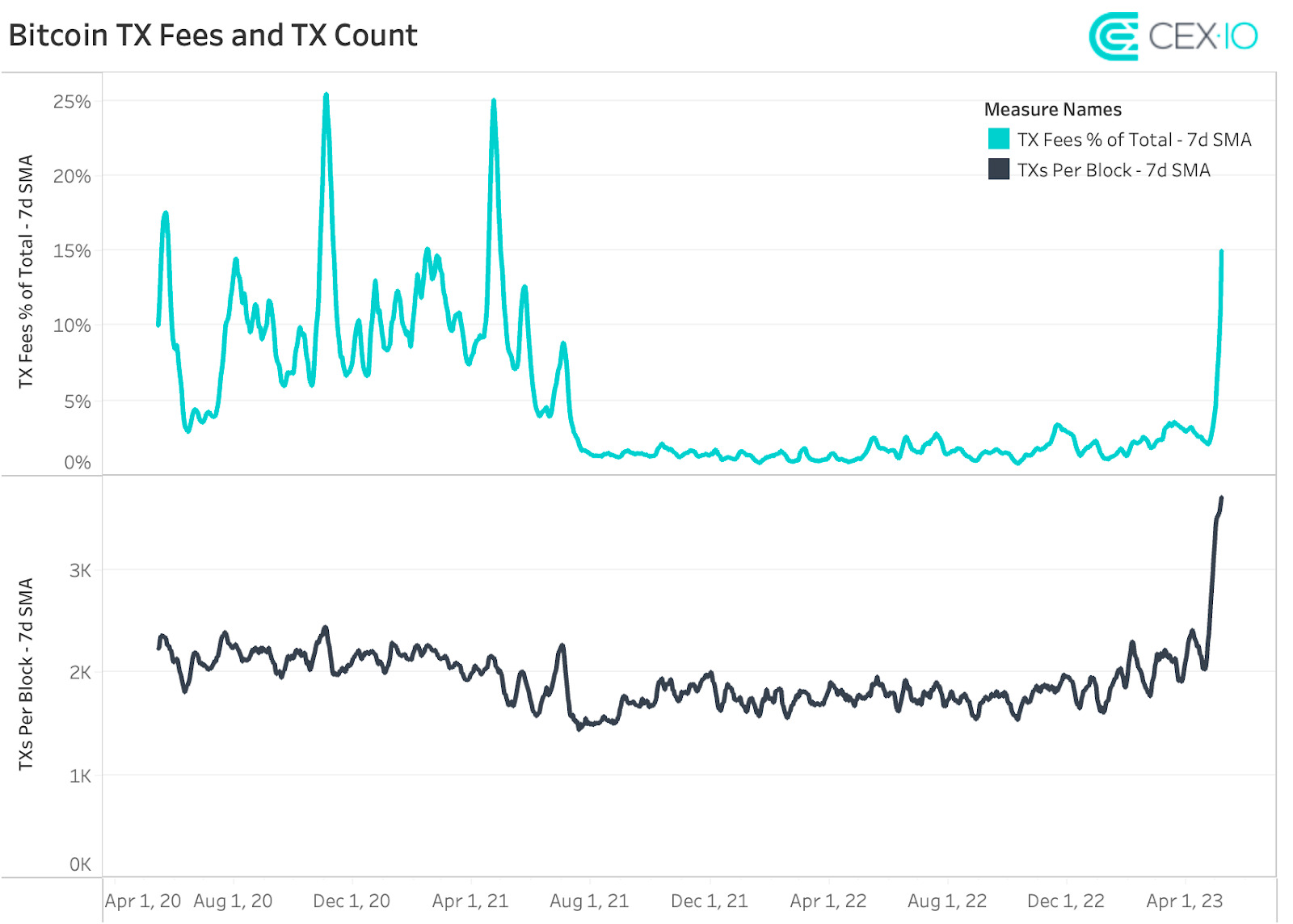

Lately, the Bitcoin network has been experiencing the equivalent of a huge traffic jam. According to BitInfoCharts, the average Bitcoin transaction fee reached $31 on May 8, surging by more than 1,000% in a week. In addition, on May 9, over 400,000 transactions were awaiting confirmations in the Bitcoin mempool, setting a new all-time high.

Due to increased network activity, Bitcoin miners managed to earn more rewards from commissions, than from finding a block. The latter last happened in December 2017, when the Bitcoin price reached its cycle’s high.&

At the time of this writing, the number of unconfirmed transactions continues to decrease, approaching 300,000, while average fees temporarily dropped to $2. Considering the existing pace, it could take a day or two for the Bitcoin network to stabilize.

But what’s causing this? A fancy new crypto term, called BRC-20. Although BRC-20 sounds like something similar to Ethereum’s ERC-20 token standard, it works in a completely different way, and is considered extremely inefficient. Instead of smart contracts, BRC-20 tokens build upon the concept of Ordinals, or marking single satoshis (the smallest unit of BTC). While Ordinals tag individual satoshis to serve as non-fungible tokens (NFTs), BRC-20 tokens involve “minting” satoshis. They hold information about a whole collection of tokens, making them fungible.

As a result, it became possible for anyone to create their own “Bitcoin-based” tokens with relative ease. Due to the recent memecoin mania in the Ethereum network, BRC-20 inspired crypto enthusiasts to mint their own memecoins in the Bitcoin network. Since their first launch in March 2023, over 14,000 BRC-20 tokens have been created, with a total market cap of around $580 million. A few days ago, this number approached $1 billion, meaning most BRC-20 tokens have already lost nearly half of their value.

Furthermore, in order to trade these tokens, users may need to make 20 inscriptions, which could cost more than $400. However, since some BRC-20 tokens recently surged by more than 2,000% in a few days, people were ready to do this to become early adopters.&

Eventually, BRC-20 hype started to dominate the Bitcoin network, affecting transaction fees. According to Glassnode, on May 7, over 75% of BTC transactions used Taproot. This technology is what made the implementation of Ordinals, and, hence, BRC-20, possible within the Bitcoin network. In January 2023, Taproot was responsible only for 1,5% of BTC transactions.

Despite the network overflow, the BTC price didn’t experience significant volatility. The asset slightly moved down, reaching the lower border of the ascending channel. This line could act as a neckline of a potential Head and Shoulders pattern, which is arguably forming within the channel. Its breakout with increased volume could hint at the continuation of bearish movement. The $24,600 level is viewed as the pattern’s potential price target.

Daily RSI moved to the neutral zone, while MACD crossed the zero point. In addition, the 20-day EMA started to look down. This suggests that the path of least resistance could be a downside. However, if the asset manages to move above $31,600, this could invalidate the bearish view.&

Litecoin brought attention due to Bitcoin transaction issues

While Bitcoin struggled from massive queues in the mempool, some blockchains, which are typically viewed as Bitcoin alternatives, managed to take advantage of it. Bitcoin Cash and Bitcoin SV saw a temporary price increase, but Litecoin was one of the largest beneficiaries of this situation.&

According to BitInfoCharts, beginning on May 1, LTC transactions increased by almost six times in a week, reaching a new all-time high. Despite this, average Litecoin transaction fees remained at nearly $0.003. Litecoin Foundation even reported that new addresses created on its network exceeded those on Bitcoin.

However, the LTC price continued to experience downside movement, and dropped below the 200-day SMA, which is considered a major support level. Daily MACD moved below the zero point, while RSI bounced off the oversold level. The asset is currently retesting the $80 level, which corresponds to the 0.618 Fibonacci point. The following price movement could be defined depending on whether or not the price manages to sustain above this level.

LDO is preparing for a new protocol release

After a three-day vote on the proposal, the liquid staking platform Lido Finance announced that the second version of its protocol will be deployed on May 15. Lido v2 will open the possibility of redeeming stETH.

Initially, about 270,000 ETH will be available in the platform’s storage, offering withdrawal requests without the lengthy process of validators going off the network. The project team will also launch a staking router, a modular architecture that empowers market participants, including solo stakers, to become node operators.

Despite this, the LDO price broke the $2.03 support level, after a series of failed attempts over the last few months. The asset bounced off the 0.618 Fibonacci level, which could hint at a potential completion of a price correction.&

Daily Stochastic indicates that there is room for upward movement. If the price manages to gain a foothold above $2.03, it may test the descending resistance line (white line). But if bears continue to put pressure on the market, and break the $1.76 level, it can open the gate to the $1.25 support area.

The CAKE price reached its two-year low

The CAKE price has been witnessing a steady decline, losing almost half of its value after breaking the ascending support line (white line). With a 25% weekly price drop, it became one of the worst performing assets among the top 100 by market cap.&

However, CAKE moved into the oversold zone, hinting that it could be difficult for bears to continue driving the price downward. In addition, MACD started to form a bullish divergence on lower timeframes, hinting that a price rebound could follow.&

The immediate target for the bulls could be $2.08, which corresponds to the 1.618 Fibonacci point. If the asset sustains above this level, this could push it to the 20-day EMA.

Tune in next week, and every week, for the latest CEX.IO crypto highlights. For more information, head over to the Exchange to check current prices, or stop by CEX.IO University to continue expanding your crypto knowledge.

Disclaimer: For information purposes only. Not investment or financial advice. Seek professional advice. Digital assets involve risk. Do your own research.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments