Assumption 1: Bitcoin will continue to function and operate

Assumption 2: Bitcoin is very hard to ban.

Let's say the probability of Bitcoin continuing to operate and not being banned is >66% which is a conservative assumption.

If the above is true, it stands to reason that Bitcoin will likely continue to demonetize gold due to lower inflation rates, high portability and lower storage costs.

If Bitcoin continues to demonetize gold, every gold holder assuming they are rational would want to hedge themselves by selling some of their gold and buying at least some Bitcoin. Not doing so would be a foolish move.

Central banks are the biggest gold holders on earth so the above also applies to them.

Central banks also have a strong incentive to not buy/support Bitcoin because it competes with their own product. The ones with the biggest disincentive are large central banks like the Fed because they have the most to lose. Smaller central banks have much less to lose and much to gain if they buy Bitcoin before other central banks do. So the first one that would buy Bitcoin would be smaller players. Once the first smaller central banks start buying Bitcoin, you will sooner or later see a mid-sized more credible player step in. This could be an arab nation, an asian nation or switzerland.

Once a credible central bank entity holds Bitcoin, it's more less game over and everyone else will consider stepping in. Central banks like the ECB, China or the Fed will be the last ones to buy and they won't have a choice.

[link] [comments]

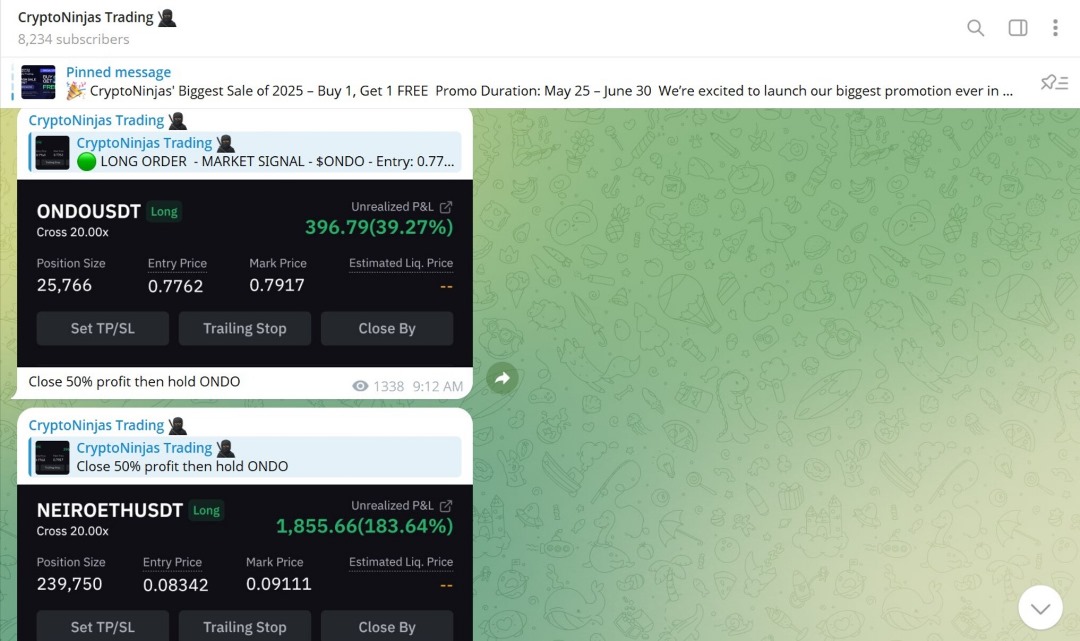

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments