The 2022 U.S. tax season is upon us and cryptocurrency traders need all the help they can get. Here are five common crypto tax misconceptions you should look out for, courtesy of crypto tax software provider, Cointelli.

“You don’t have to pay taxes on crypto”

One very common mistake that people make is thinking they don’t have to pay tax on cryptocurrency transactions. However, crypto transactions are taxable, and the IRS is very capable of coming after you and your assets if you don’t comply. The IRS refers to cryptocurrency as virtual currency, and any transactions on exchanges, income from mining or staking, crypto received from hard forks and airdrops, and even DeFi transactions – basically the majority of profits and losses resulting from crypto activity – are subject to tax.

According to the IRS’s guidelines from 2014, cryptocurrency is treated as property for taxation purposes. This means that any capital gain or loss generated from selling your assets is taxable, while assets that you simply hold or possess are not taxable until you sell them. The IRS hasn’t yet provided clear guidelines for areas that include staking, NFTs, and DeFi transactions.

So, what happens if you don’t report crypto transactions to the IRS? The crypto market has grown rapidly in recent years, and the IRS’s enforcement efforts have grown with it. If you don’t report your crypto transactions on your tax returns, you could land yourself in big trouble. As you may have already seen, the IRS has been asking the following question on the first page of Form 1040:

“At any time during [the tax year], did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

Trying to avoid paying taxes on your crypto is no longer a feasible option. Thankfully, Cointelli is here to save you from stress and frustration this tax season and help you stay compliant with the most recent tax laws.

“Reporting my crypto transactions will just lead to me paying more in taxes”

Another common misconception is that reporting your crypto transactions can only lead to you paying more in taxes. This is not necessarily true, however. In fact, there is actually a way to reduce your taxes by using a strategy called tax-loss harvesting. But how exactly does this work?

Basically, harvesting is an investing strategy where you sell assets at a loss to offset your other capital gains. For instance, if your crypto was tanking, your natural instinct might be to hold onto it until it recovers its value. But if you decide to sell your crypto and accept the loss, you could instead “harvest” it. Because the loss you take can be used to offset your capital gains from other investments, you could thus end up reducing or even eliminating your capital gains tax.

You must keep four things in mind before harvesting losses though:

- Be wary of the wash sale rule: A proposal to apply the wash sale rule to cryptocurrency may take effect in 2022. If this rule takes effect you will not be able to deduct a loss from the sale of crypto if you purchase the same crypto 30 days before or after the sale.

- It is advisable to harvest your losses year-round.

- Remember that offsetting your short-term gains comes first.

- Don’t forget about exchange fees.

In order to claim your losses for the tax year, you must report your losses on crypto to the IRS and finish your tax-loss harvesting before the end of the year. Capital losses from crypto are reported on Form 8949. After entering the details, you must calculate the total sum of proceeds, choose the best cost basis for you, and input your net capital gains and losses at the bottom of Form 8949. For more, check out this guide.

As may be clear from the above, calculating your capital gains and losses manually can prove complicated. This is why many crypto traders are already using crypto tax software like Cointelli to quickly and accurately calculate their net crypto gains and losses from short-term and long-term crypto transactions.

“You only need to pay taxes when converting crypto into fiat currency”

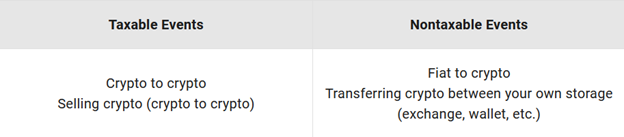

A third common misconception is that you only need to pay taxes when converting crypto into fiat currency. However, this is likewise not the case. Many different scenarios and situations are taxable. For example, did you mine any cryptocurrencies? You may be surprised to learn that traders need to pay taxes on crypto mining. The IRS classifies gaining income from generating blocks in a blockchain as earned income, which means you owe income tax on any cryptocurrency you may have mined

Another scenario to consider is if you have received “free” crypto from an airdrop. This is considered income as well, which means you owe taxes on it! The IRS’s cryptocurrency tax guidelines from 2019 state that all crypto received from airdrops is subject to income tax. Regardless of whether you intended to receive it or not, “free” crypto that enters your wallet or exchange account is considered ordinary income.

To determine if a crypto event is taxable, you should first understand that the IRS classifies cryptocurrency as property, not currency. Therefore, many forms of crypto-related income are classified as capital gains and are subject to capital gains or income tax.

It is also important to understand the tax implications of a crypto hard fork. But what exactly is a hard fork? After a cryptocurrency has been out for a while, it is very common for developers to issue updates or to upgrade its programming. When a cryptocurrency program or “protocol” gets a significant upgrade or coding modification, we call this a “hard fork.”

If your cryptocurrency went through a hard fork but there was not a new cryptocurrency issued to you, whether through an airdrop or any other kind of distribution, you do not have taxable income. However, if your cryptocurrency went through a hard fork upgrade and the developers issued new cryptocurrency to you, this is a taxable transaction.

“Crypto profits are always taxed at the same rate”

A fourth misapprehension that many people have is that crypto profits are always taxed at the same rate. Don’t be fooled; the rate at which crypto profits are taxed varies, which can make calculating how much you owe very complicated. Three factors affect the rate at which crypto gains are taxed.

The first is the holding period, or how long a person held their crypto before selling it. Crypto gains are categorized into short-term and long-term gains and are taxed according to their holding period. Short-term capital gains can be taxed at up to 37%, while long-term capital gains can be taxed at up to 20%.

The second is your income bracket. High income taxpayers must pay a 3.8% net investment income tax (NIIT) on investments such as crypto, which will affect their taxation rate.

The third factor is your location. You may have to pay state and/or local taxes depending on where you live. If you are preparing to sell, make sure you understand your local tax laws before calculating your profits and losses.

Cointelli understands that this can all get confusing, and that not everyone is a tax-expert. That’s why it takes care of the hardest parts of preparing crypto tax reports for you.

“Doing my crypto taxes is too complicated”

Filling out your crypto tax report doesn’t have to be hard! Cointelli boils it down to the below three steps:

- Figure out your crypto gains and losses

- Complete Form 8948 and Schedule D

- Add your other crypto income to the tax report

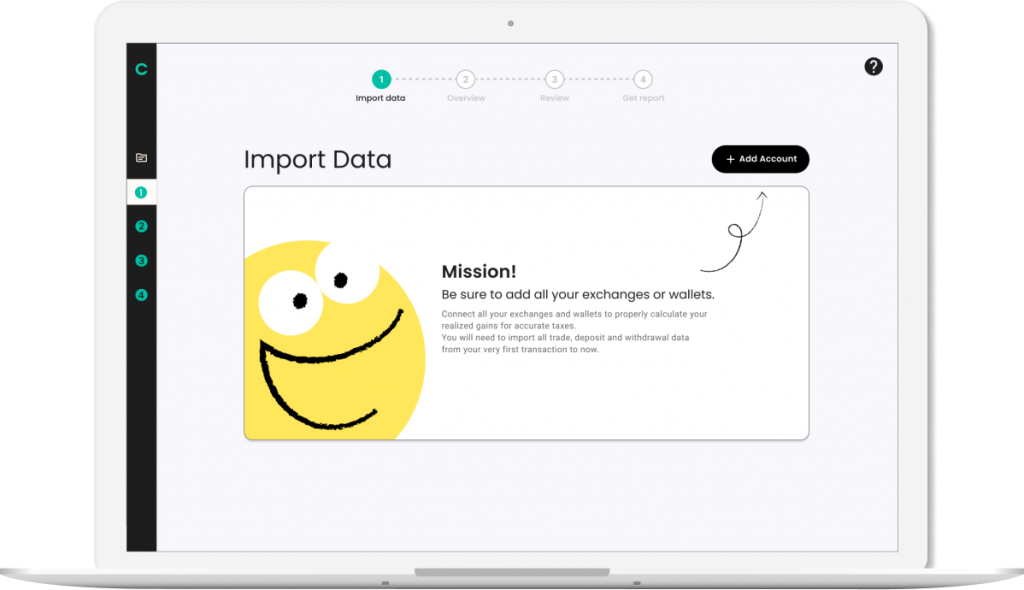

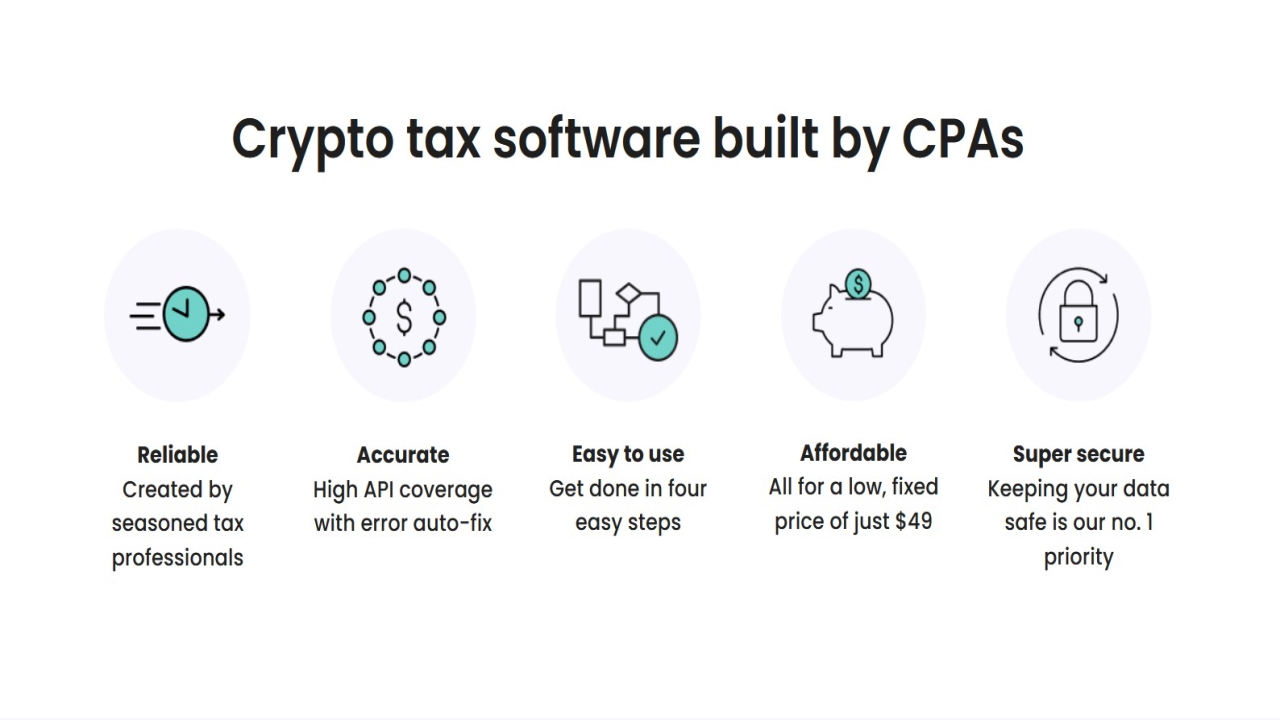

Cointelli is software created by a team of CPAs who specialize in cryptocurrency and want to help you report your crypto taxes accurately. The amount you pay in tax can vary broadly depending on how you calculate your capital gains, which makes it critical that you use reliable crypto tax software. Featuring broad compatibility with exchanges, wallets, and blockchains and functions like error auto-fix, Cointelli is crypto tax software that you can count on. What’s more, it also makes the whole process quick and easy!

Simply import your crypto transactions from your exchanges into the software, and Cointelli will automatically organize your purchase costs, purchase dates, selling costs, selling dates, holding periods, transaction fees, and more.

Struggling with crypto taxes this tax season? Click here to let Cointelli handle it all for you, so you can sit back and relax!

- This article is intended to provide general financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always consult with your own professional tax advisor for advice on taxes, your investments, the law, or any other business and professional matters that affect yourself or your business.

- Cointelli is currently only available in the US. The above financial and tax information pertains to the US market.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments