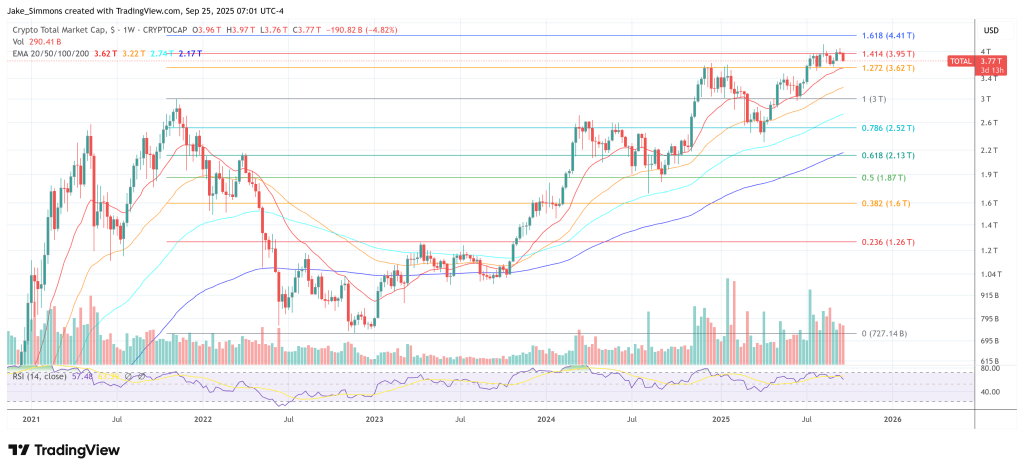

![How to buy Crypto like Smart Money [NOMOONS] [SERIOUS2] How to buy Crypto like Smart Money [NOMOONS] [SERIOUS2]](https://a.thumbs.redditmedia.com/Xz6iFdzGIydXyzslfVIQjQ4IPdFT4-S_e2OKLJB1ui0.jpg) | First of all a quick disclaimer for the feds: I never owned any crypto, never traded any, this isn't a financial advice and only for entertainment reasons only. Unfortunately to share all knowledge a reddit post would be way too long ( and boring ) so I'll try to keep it as simple as possible with real use cases for you to accumulate and possible add to your plans. I will also include many key elements that you can do your own research on if interested Spot the AccumulationSomething that REALLY helped me on my journey to understand all this:free knowledge Link Usually what the average Crypto Enthusiast or Investor refers to accumulation is a longer consolidation phase ahead of a rising market. However consolidation can also be distribution at a key ressistance in a downtrend and lead to a further dump as likely as a pump ( in hindsight ) In this post I want to help you identifying the differences and the strategies used by institutional money and experienced traders to properly time their accumulation. This comes very handy as a proven far more effecient strategy than Dollar Cost Average ( DCA ) in a volatile market such as crypto since your average price won't take a hit by accumulating in a downtrend. Let me explain it with a chart: This is the BTC/USDT Chart since ATH. The orange squares are multiple consilidation zones followed by new significant trends - sometimes to the downside but also recently ( thankfully ) to the upside.While some are definetly Event driven such as Luna, Institutional Liquidation, FTX, Stock Market & Macro Events there's yet a clear difference to seperate between a buying opportunity afterwards or not. ( Theorie skip this if you already know the basics ) larger players play a different gameBefore we get into how they accumulate a Key information is that larger players don't buy like retail investors. They can't simply perform a market order on an illiquid volatile asset and call it a day. If they buy on the open market with a larger order they would heavily increase the price and therefore decrease their potential returns in the long run. They need Liquidity and therefore a longer period of time to accumulate. They don't time the bottomSmart money doesn't care about Support, Trendlines, Resisstance, wedges or flags simply because they are too subjective to define and as well suffer in performance and tend to have lots of fake moves they can't afford to rely on. Instead, they care about long term outlook, Liquidity in the broader markets & Supply and demand. Macro economic factorsI'll be honest, if I explain how Macro Economic factors impact the accumulation this post will become a novel, nobody will read it, most won't simply care nor understand it so I'll keep it summarized that major macro economic factors are way more important to Smart Money than anything crypto related. Joe Biden could declare Bitcoin the major currency for his ice cream shop in fron of the white house and smart money wouldn't care. It's short term price action and as mentioned above they can't get proper returns of the investment on such news due lack of supply. The only likely case here would be accumulation ahead of it during rumors. Important macro economic factors for you to look up if interested:GDP Growth rate, market Liquidity, Inflation / interest rate, Labour market & unemployment rate, DXY ( Dollar strength ), obviously the Stock Markets ( crypto is a high risk volatile asset. Smart money would trade their ATH Bitcoin all day for a cheap bluechip stock ) Housing market, Bond Yields, Retail Sales and especially for crypto: commodities ( gold ... ) Alright now with the theory behind us let's get into charts and let me give you some easy simplfied examples that might help you out in the future :What you should look out on the chart Can you spot a difference? Throughout the entire downwards price action there were either asymetric dynamic demand or steep angles. High FUD hit the market. Uncertainy between traders & investors lead to heavy selling but also buying & trading intraday in hopes to catch "the bottom" as many did last year. Reality is, Smart Money never cared about those zones on the left side. The Macro outlook wasn't promising and there was a clear distribution to the upside everytime a rally vanished. When does this change? After the June lows. Bitcoin reached a absolute low of 17,600 USDT. Smart money got interested and started accumulating slowly. Clearly visible by the chart with steady upwards movement only suppresed & declined with awful macro economic news : Inflation was not under control as expected. The Stock Market declined heavily throughout the next months. Most of you probably remember the months after August of major stocks hitting incredible new lows. But Bitcoin... diddn't? In fact, it was going sideways for a really long time. Everyone who was around in the sub back then remembers the "boring" endless crabbing. That was another sign of accumulation. Smart money entered the market and was happily accumulating Bitcoin around $17,000 - 20,000. To help you understand the difference and to illustrate how the bottoms were cut off with large supply I've added a few whales eating the retail panic: Smart money accumulated almost similar to the DCA strategy around these areas. They just frequently bought and entered at the lows supporting the price to hold back to back the levels. They don't care about support lines ( that are btw often broken during these times to grab even more liquidity but that's another topic look up the term "liquidity clearout" if you are interested how larger players grab liquidity at lows. ) Smart money isn't always right to time the market and they also don't try. They want to buy cheap and sell high - that's all that matters. Not a perfect 100x. A 2-3x is totally enough. Nobody expected the downtrend after Inflation news nor FTX. Yet everyone buying before or after is in profit at current prices. As shown in the chart the small difference between the average early accumulation in July & August compared to after FTX barely matters. They took a hit of -18% on their average entry. On the other hand, from that average, they are now up 54% at CURRENT prices. This is the beauty of not timing the bottom, but timing the accumulation entry. Another super easy & simplified method is buying the trendPull up the chart, turn on the "Moving average" on a daily chart and put the number to 200. I know this looks silly but you would be suprised how many larger institutions keep it this simple and use such trend identification to estimate their accumulation & liquidity zones. And ... it works! That person simply dodged the entire downtrend and accumulated right at the reversal into uptrend + the lows. TIMESomething to keep in mind and where Smart Money always wins is time in the market. It's a marathon, not a race. If you try to time the bottom or any reversal inbetween or overinvest expecting short term results you most likely WILL miss out. Nobody perfectly times the market, ever. If you have currently the mindset looking at this post to learn whether buying crypto now with your entire budget is a good idea you already lost. Unless you get lucky and it is indeed the absolute perfect timing it won't work. Markets move irrational, months ahead of future news and price in 6-8 months outlook. Thinking now is a good timing because now a BTC ETF filing hits the market is an absolute wrong mindset and only matters to trades that make money intraday of price action. ALT COINS I'll be straight honest with you - majority of smart money investors don't really care about Alt coins except Ethereum. That's also clearly visible with how the TOTAL3 Chart looks so much worse ( Crypto market cap excluding BTC & ETH ) although heavy retail bag holding & dip buying. Smart Money usually funds projects and join presales. They rarely accumulate alt coins in sizes even close similar to BTC & ETH. Although they definetly diversify the risk & uncertainity is usually way too high to accumulate during bear markets. You can expect them to join as soon as we enter a bullrun again. BUT there's also something positive about this. Why not copy them? Accumulate Bitcoin ( maybe Ethereum ) during the Bear market and start accumulating ahead or start of the Bullrun in smaller caps. That being said all this is almost horrible simplified but my goal is to help you understand the basics, possible already help you with entries but mostly motivate to do your own research with the given information and improve for the future! There is plenty of time in the market and almost all people get wealthy overtime. The last years was just another cycle and there will be plenty of more. Best time to learn for the future is always now TL;DR : It's a TL;DR of a TL;DR to accumulate & learn how smart money is winning the markets. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments