The crypto markets have been in turmoil lately since it reached its all-time high in 2021. Due to the bear market of 2022, Bitcoin price is down 70% from its November 2021 all-time high price of $69,000, and crypto investors worldwide have faced massive losses this year. Altcoins are no better, with Cardano (ADA) and Solana (SOL) shedding more than 70% and 55% of their value. Moreover, the crypto market cap is below $1 trillion, down about 55% from $2.2 trillion at the beginning of the year.&

However, if you’re a crypto veteran or have studied the limited but wild history of crypto, you probably know that with max pain in the industry comes an opportunity to bounce back higher.

AMP token is down by over 90% since its all-time high. If you're among investors whose portfolio is down heavily, you might consider generating passive income by AMP token staking and weathering the storm while waiting for the next bull run rather than selling them at a loss.

The AMP token and staking platform were launched as the brainchild of the Flexa network, one of the leaders in digital-only payments, which claims to be the fastest and "most fraud-proof payments network in the world." AMP is an open-source digital collateral and asset token that allows instant, efficient, and irreversible collateralization of any type of value transfer.

Read on to learn everything you need to know about the AMP token, how AMP staking works, and where and how to stake the AMP token to make the most of your crypto holdings.

Let's get right to it!&

Key Takeaways

- If you're among investors whose portfolio is down heavily, you might consider generating passive income by AMP token staking and weathering the storm while waiting for the next bull run rather than selling them at a loss.

- AMP is an open-source digital collateral and asset token that allows instant, efficient, and irreversible collateralization of any type of value transfer.

- AMP can secure any type of asset users want to transfer, ranging from digital payments, fiat currency, cryptocurrency, loan distributions, and proceeds from actual and virtual property sales.

- Staking AMP on the Flexa Network via the authorized Flexa Capacity App is the most popular and most straightforward way to generate passive income by AMP token staking.

What Is the AMP Token?

The AMP tokens were created by the Flexa Network, one of the world's fastest and fraud-proof networks, that enables secure and speedy crypto payments with its Flexa app.& AMP is an open-source ERC-20 token used as a collateral token to facilitate the immediate settlement of payment transactions by implementing conditional rights using smart contracts along with a partition scheme. Collateral token partitions can collateralize any account, application, or transaction whose balances can be directly verified on the Ethereum blockchain. Token partitions can be managed separately with AMP token contracts allowing different collateral managers to enforce unique sets of rules that allow for special functions and capabilities. This way, users can stake tokens without any asset transfers to another smart contract, thereby preserving asset custody while increasing the safety of staking collateral.

The AMP collateral partition strategy is designed to facilitate interoperability in staking contracts.

According to the Amp website, AMP can secure any type of asset users want to transfer, ranging from digital payments, fiat currency, cryptocurrency, loan distributions, and proceeds from actual and virtual property sales.

AMP Tokenomics

Launched in September 2020, the AMP token total supply is 99 billion, and its circulating supply is 77.05 billion tokens. You can check the AMP token current price and other metrics at AMP Price on CoinStats.

The total staked volume of the AMP token offers a precise metric of the Network's health; more staked AMP implies fewer tokens are available in the market, boosting the scarcity attribute that can drive the AMP tokens' value.

What Is Staking?

Blockchains use a consensus mechanism to verify data and transactions on the blockchain network. Proof-of-Work (PoW) and Proof-of-Stake (PoS) are two of the most prevalent consensus mechanism algorithms, each of which works on different principles.

In a Proof-of-Work blockchain, transactions and data are verified using a method called mining, in which miners have to solve complex mathematical problems to verify and process transactions and add them as a new block in the blockchain. The PoW mechanism of verifying transactions on the blockchain is robust and secure but also energy inefficient and causes scalability issues by hindering the number of transactions that can be processed by a blockchain simultaneously.

On the other hand, in a PoS consensus, a participant node is allocated the responsibility of maintaining the public Ledger in proportion to the number of virtual currency tokens it holds. On a Proof-of-Stake blockchain, the right to verify transactions is assigned to users randomly based on the number of tokens they have staked. So, holders of a required number of coins can earn staking rewards and participate in validation, i.e., verify transactions as needed. Participants staking their crypto in a PoS blockchain for an agreed-upon 'staking period' to provide value to the Network and earn rewards in return are called validators.

A Proof-of-Stake blockchain is less power-consuming and, therefore, solves scalability issues faced by a Proof-of-Work blockchain. This is why the Ethereum blockchain recently shifted from PoW to PoS consensus mechanism through "The Merge."

You can learn about staking in detail with our detailed guide, What Is Staking.&

Staking only applies to blockchains that utilize the Proof-of-Stake (PoS) consensus mechanism to validate transactions. Users can stake cryptocurrency tokens on any staking platform of their choice. Most staking platforms are user-friendly and easy to use, so you can start staking on almost all major crypto exchanges, like Coinbase, Binance, etc., without prior experience.

How Does AMP Staking Work?

Amp is designed as a platform for collateralizing asset transfers and staking AMP guarantees any form of value exchange, including digital payments, fiat currency exchange, loans, etc. Once staked to a partition, Amp is ready to collateralize a transfer. With the use of collateral pools, Amp effectively decentralizes the risk of asset transfer, especially for fraud-proof networks and real-world applications.

Staking AMP on the Flexa Network via the authorized Flexa Capacity App is the most popular and most straightforward way to generate passive income by AMP token staking. AMP stakers supply Flexa Network with the collateral to conduct merchant transactions and become a vital component of the Network's security infrastructure.

Flexa requires each wallet app to have its own collateral pool that will not be limited or closed, enabling you to purchase and stake Amp in any pool.

In return for staking their AMP tokens, users are given out AMP rewards in proportion to their staked AMP tokens. The annual percentage yield (APY) guaranteed by staking is determined by the number of operations in a particular wallet and the amount of AMP staked in that same wallet. Therefore, by providing 10% of the total staked AMP for a particular wallet, you'll get 10% of the total fees generated on Flexa by the wallet's users. The more staked AMP users have and the longer they stake them, the higher the return on staking rewards will be. Wallet apps performances contribute to the AMP token value, which contributes to the Network's value. The staking rewards come from the network fees on the Flexa network and are distributed amongst the AMP holders.&

Now that we've provided an answer to the question "how does AMP staking work," let's get into a quick guide on where and how to stake AMP tokens to start earning on your crypto.

Fast Fact

The more staked AMP users have and the longer they stake them, the higher the return on staking rewards will be.

How to Stake AMP on Flexa?

As the issuer of the AMP tokens, the Flexa network is the best place to stake AMP through the Flexa Capacity DApp and earn AMP staking rewards. In so doing, you'll not only earn passive income but also contribute to the Network's security.

Follow the steps highlighted below to get your AMP staked in no time.&

- Go to https://app.flexa.network/ and connect your cryptocurrency wallet like MetaMask or another available hardware wallet.

- Select one of the staking options displayed.

- Select the app to stake AMP and how many AMP tokens you wish to stake, then click continue.

- Once the transaction goes through, you'll see staked AMP balance and the rewards appearing.

Congratulations on staking AMP on Flexa!

You can also easily unstake the AMP tokens through the steps described below.&

- Connect your wallet and click Move.

- Choose the number of AMP tokens you want to unstake and click Continue.

- Wait for your collateral to unstake; timing depends on network conditions.

- Select Move to Wallet to withdraw the tokens to your wallet, and click Continue.

- The transaction will go through, and the AMP tokens will be back in your wallet.

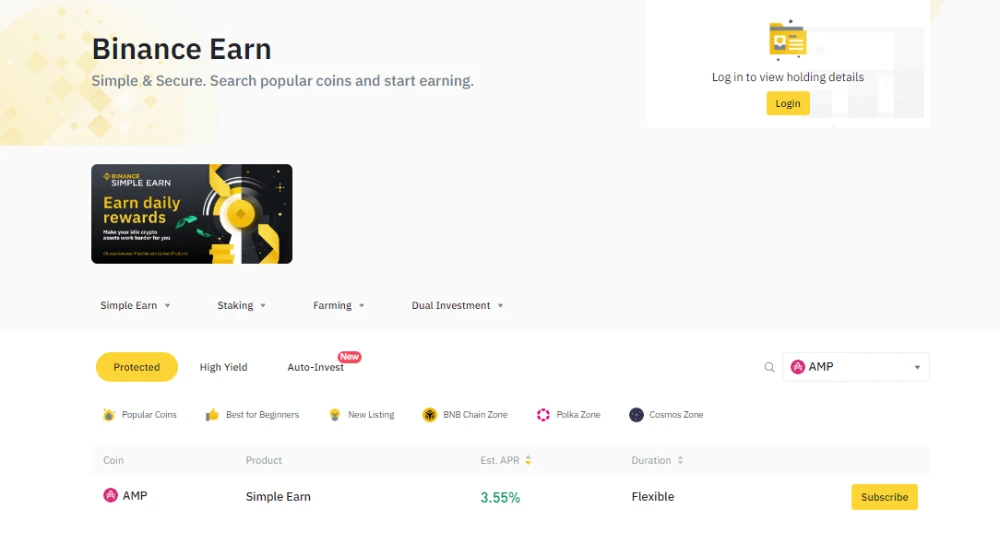

How to Stake AMP On Binance?

While staking AMP on Binance won’t contribute to the security and functionality of the Flexa network, it allows AMP holders to earn passive income, especially during a bear market. Moreover, staking on Binance is very easy, and you can also buy AMP coins to stake. Follow the steps described below to stake AMP on Binance.&

Create a Binance Account

If you don't have a Binance account, then the first step is creating an account on Binance. Binance, like many other cryptocurrency exchanges, offers a hassle-free registration with only an email address or valid mobile number. A link will be sent to your address or mobile phone, and you must click it to verify your account. Once the account is activated, you must create an elaborate password, and you’re good to go.

While Binance doesn't have mandatory KYC and AML requirements, users must complete the KYC verification process to gain full access and increase higher deposits and withdrawal limits. You must provide personal information and a government-issued identity card to verify your account.

Once your identity verification is complete, it’s recommended to activate two-factor authentication (2FA) for an extra layer of security.

Buy or Deposit AMP Tokens

After setting up your account, the next step is to deposit AMP into your Binance account. You must send AMP coins from your cryptocurrency wallet to your Binance account. On the other hand, if you don't own AMP tokens, you can easily buy them on Binance using fiat currencies, credit or debit cards, bank transfers, or peer-to-peer transactions.

Stake AMP

Once you have the required amount of AMP tokens in your Binance wallet, you're all set to start your AMP staking. Go to Binance Earn and search for AMP. Choose among the options depending on the type of staking products, how much you're willing to stake, and the lock-up period. Enter the amount of AMP you wish to stake, agree to the terms and conditions, and confirm the transaction. You'll see the staked tokens and the rewards you receive in your Binance Earn wallet.

AMP Staking Benefits

As an AMP token holder, staking can be one of the best ways to earn on your holdings because of the reasons described below:

- Staking AMP is one of the best ways to receive rewards, especially in a bear market when cryptocurrency prices are down historically.

- As the number of people staking AMP increases, the Network becomes more secure and processes more transactions. Similarly, the rewards given out from the transaction fees also increase.&

- As more people stake their tokens and earn AMP rewards, crypto's real-world adoption will become a reality.&

- The more AMP tokens are staked, the fewer tokens are in circulation. This would create scarcity and push the price higher, enabling you to earn profits on your investment.&

AMP Staking Downsides

Like with any investment, staking AMP carries the following risks described below:

- The AMP price has been descending, and since the tokens' supply is high, the chances of its price rising significantly are low.&

- To earn significant returns on staking, you must stake large amounts of AMP, which might not be possible for all.&

- Significant risks are associated with all cryptocurrencies, as they are an extremely volatile asset class, and& many aspects of cryptocurrency remain unregulated.

Final Thoughts

AMP is one of the most innovative tokens in the crypto market, aiming to solve scalability and speed issues that have plagued the blockchain industry for a while. When using AMP as collateral, users benefit from the security, transparency, and efficiency of an immutable ledger. Staking AMP allows you to earn passive income on your holdings and contribute to the project's security and development.

Disclaimer: This article is for educational purposes only, and nothing in this article is a piece of investment or financial advice. Users should do their research before investing in cryptocurrencies, as they are highly volatile and unregulated.&

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments