| EXPERIMENT – Tracking 2018 Top Ten Cryptocurrencies – Month Forty-Four – UP +71% Find the full blog post with all the tables is here. Welcome to your monthly no-shill data dump: the Top Ten Cryptocurrency Index Fund Portfolio updates are out! Here's the report for the 2018 Top Ten Experiment featuring BTC, XRP, ETH, BCH, ADA, LTC, NEM, DASH, IOTA, and Stellar. tl;dr

Month Forty-Four – UP 71%The 2018 Top Ten Crypto Index Fund Portfolio is BTC, XRP, ETH, BCH, ADA, LTC, IOTA, NEM, Dash, and Stellar. August highlights for the 2018 Top Ten Portfolio:

August Movement Report, Ranking, and DropoutsDespite a strong month for the 2018 Portfolio, there was more downward than upward movement: Ups:

Downs:

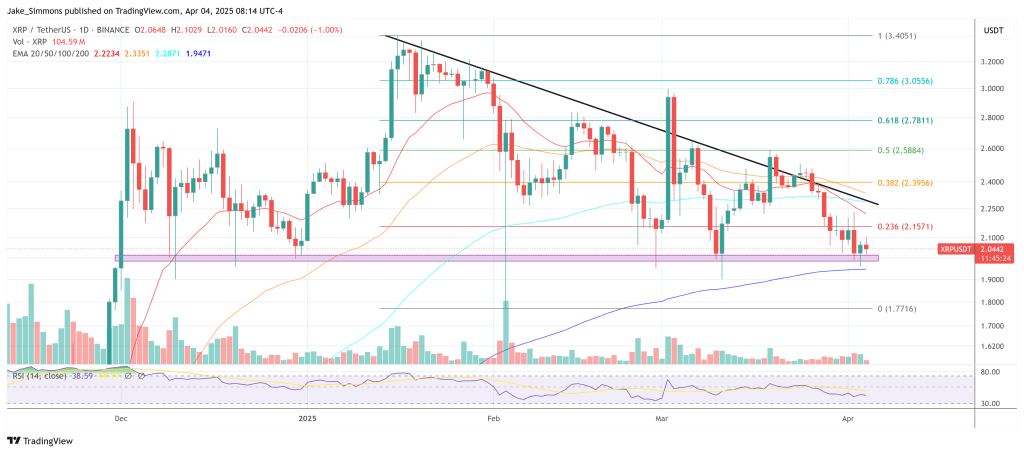

And here’s a look at the movement in rank since January 2018: Top Ten dropouts since January 2018: After forty-four months of the 2018 Top Ten Experiment, only 40% of the cryptos that started in the Top Ten have remained. NEM, Dash, Stellar, Bitcoin Cash, IOTA, and Litecoin have been replaced by Binance Coin, Tether, DOT, SOL, Doge, and USDC. August Winners and LosersAugust Winners – Cardano easily outperformed the field, +130% in August. Second place this month goes to Ethereum, up +70% August Losers – NEM gained +19% making it the worst performer of August followed by BCH’s +24% this month. Tally of Monthly Winners and LosersAfter forty-four months, here’s a tally of the monthly winners and losers over the life of the 2018 Top Ten Experiment. With 11, Bitcoin has two more monthly wins than second place Cardano. NEM notched yet another monthly loss in August: it has finished last place most often (12 months out of 44). Bitcoin is still the only cryptocurrency that hasn’t yet lost a month since January 2018 (although it has come very close a couple of times). Overall Update – Portfolio at all time high, 40% of cryptos in the green, ETH still in lead, NEM worst performer.Even though only 4 out of the 10 cryptos are in positive territory (BTC, ETH, ADA, and XLM), their strength in August propelled the entire portfolio to a 2018 Top Ten All Time High. Green is still very unfamiliar territory for the 2018 Top Ten Portfolio. Over the first 44 months of the 2018 Index Fund Experiment, thirty-eight months have been in the red, with only six months of green. And all six of the green months have come in 2021. Check out the table below to see the monthly ROI summary. ETH (+421%) is ahead of ADA (+352%) which flipped third place BTC (+277%) this month. XLM (+12%) joined the green club this month. LTC looks poised to be next. The initial $100 invested in first place ETH forty-four months ago? It’s worth $523 today. NEM is back at the bottom, down -79% since the Experiment began. The initial $100 invested forty-four months ago is worth $21 today. Total Market Cap for the entire cryptocurrency sector:The total market finished August at $2.2T, picking up about $623B during the month. Comparison point: it was at $2.2T just four months ago. Crypto as a sector is up +358% since January 2018. If you were able to capture the entire crypto market since New Year’s Day 2018, you’d be doing better than both the Experiment’s Top Ten approach (+71%) and the return of the S&P (+69%) over the same period of time. Noice. Crypto Market Cap Low Point in the 2018 Top Ten Crypto Index Experiment: $114B in February 2019. Crypto Market Cap Low Point in the 2018 Top Ten Crypto Index Experiment: $2.2T in May 2021 and now. Bitcoin dominance:BitDom dropped to 42% in August. It was at 46.6% just last month. Record low BitDom was 33% back in the very first month of the 2018 Experiment. Low Point in the 2018 Top Ten Crypto Index Experiment: 33% in January 2018. High Point in the 2018 Top Ten Crypto Index Experiment: 70.5% in August 2019. Overall return on $1,000 investment since January 1st, 2018:The 2018 Top Ten Portfolio gained $592 in August. If I decided to cash out the 2018 Top Ten Experiment today, the $1000 initial investment would be worth $1708, up 71% from January 2018. This is an all time 2018 Experiment high. Here’s a look at the ROI over the life of the experiment, month by month, since the beginning of the 2018 Experiment forty-four months ago: ATH this month at +71%. The absolute lowest point was in January 2019 when the 2018 Top Ten Portfolio was down -88%. Remember: no one knows where the price will be in a year. I was down -88% after one year, -80% after two years, -25% after three years. Be careful out there. Combining the 2018, 2019, 2020, and 2021 Top Ten Crypto PortfoliosAlright, that’s that for the 2018 Top Ten Crypto Index Fund Experiment recap. But I didn’t stop the party in 2018: I invested another $1000 in the 2019, 2020, and 2021 Top Ten Cryptos as well. How are the other Crypto Index Fund Experiments doing?

So overall? Taking the four portfolios together, here’s the bottom bottom bottom bottom line: After a $4,000 investment in the 2018, 2019, 2020, and 2021 Top Ten Cryptocurrencies, the combined portfolios are worth $23,249 ($1,708 + $6,846 + $9,471 + $5,224). That’s up +481% on the combined portfolios. Here’s the combined monthly ROI since I started tracking it in January 2020: That’s a +481% gain by investing $1k on whichever cryptos happened to be in the Top Ten on January 1st for four straight years. Comparison to S&P 500:I’m also tracking the S&P 500 as part of the Experiment to have a comparison point with other popular investments options. Another month, yet another all time high for the S&P Index: The S&P 500 is up +69% since January 2018, so the initial $1k investment into crypto on January 1st, 2018 would be worth $1690 had it been redirected to the S&P. At long last, this is less than the +71% return of the 2018 Top Ten Crypto Portfolio. To reiterate: THIS IS A 2018 TOP TEN CRYPTO INDEX FUND FIRST! When I combine the four Top Ten Crypto portfolios (taking the same invest-$1,000-on-January-1st-of-each-year approach with the S&P 500 that I’ve been documenting through the Top Ten Crypto Experiments) the yields are the following:

Taken together, here’s the bottom bottom bottom bottom line for a similar approach with the S&P: After four $1,000 investments into an S&P 500 index fund in January 2018, 2019, 2020, and 2021, my portfolio would be worth $6,100 ($1,690 + $1,810 + $1,400 + $1,200) That is up +50% since January 2018 compared to a +481% gain of the combined Top Ten Crypto Experiment Portfolios, a difference of over 430 percentage points in favor of crypto. Here’s a table summarizing the four year ROI comparison between a Top Ten Crypto approach and the S&P as per the rules of the Top Ten Experiments. Conclusion:Massive milestone for the 2018 Top Ten Portfolio in August: after forty-four often painful months, the investment in a homemade crypto index fund has better returns than the mighty S&P. Cue the balloon drop, Mission Accomplished banner, and the confetti guns: the weakest of the four Top Ten Crypto Index funds is finally performing better than the S&P…for now at least. Many thanks to the long-time Experiment followers, appreciate you taking the time to follow along over the years. For those just getting into crypto, welcome! I hope these reports can somehow give you a taste of what you may be in for as you begin your crypto adventures. Buckle up, think long term, don’t invest what you can’t afford to lose, and try to enjoy the ride! Feel free to reach out with any questions and stay tuned for monthly progress reports. Keep an eye out for my parallel projects where I repeat the experiment, purchasing another $1000 ($100 each) of new sets of Top Ten cryptos as of January 1st, 2019, January 1st, 2020, and most recently, January 1st, 2021. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments