I'm not new to bitcoin or crypto and have been DCA'ing since 2021. I had a realization in February of this year that it might be a good time to sell some of my portfolio and reinvest in a stronger asset.

I invest strictly for cashflow in LC/LCOL areas (low crime, low cost of living), so my thought was trading an asset like a low income rental property for a high quality asset like BTC isnt such a horrible idea, even if it cash flows.

It took from middle of February until just the end of last month for me to liquidate roughly 50% of my REI portfolio. I picked the properties I was leased thrilled with holding rather than the ones that had the highest value. This had an unintentional effect of making me appreciate those assets I held onto even more.

I think I did it at just the right time too because the last property was on the market for 5 months and I was worried it was not going to sell.

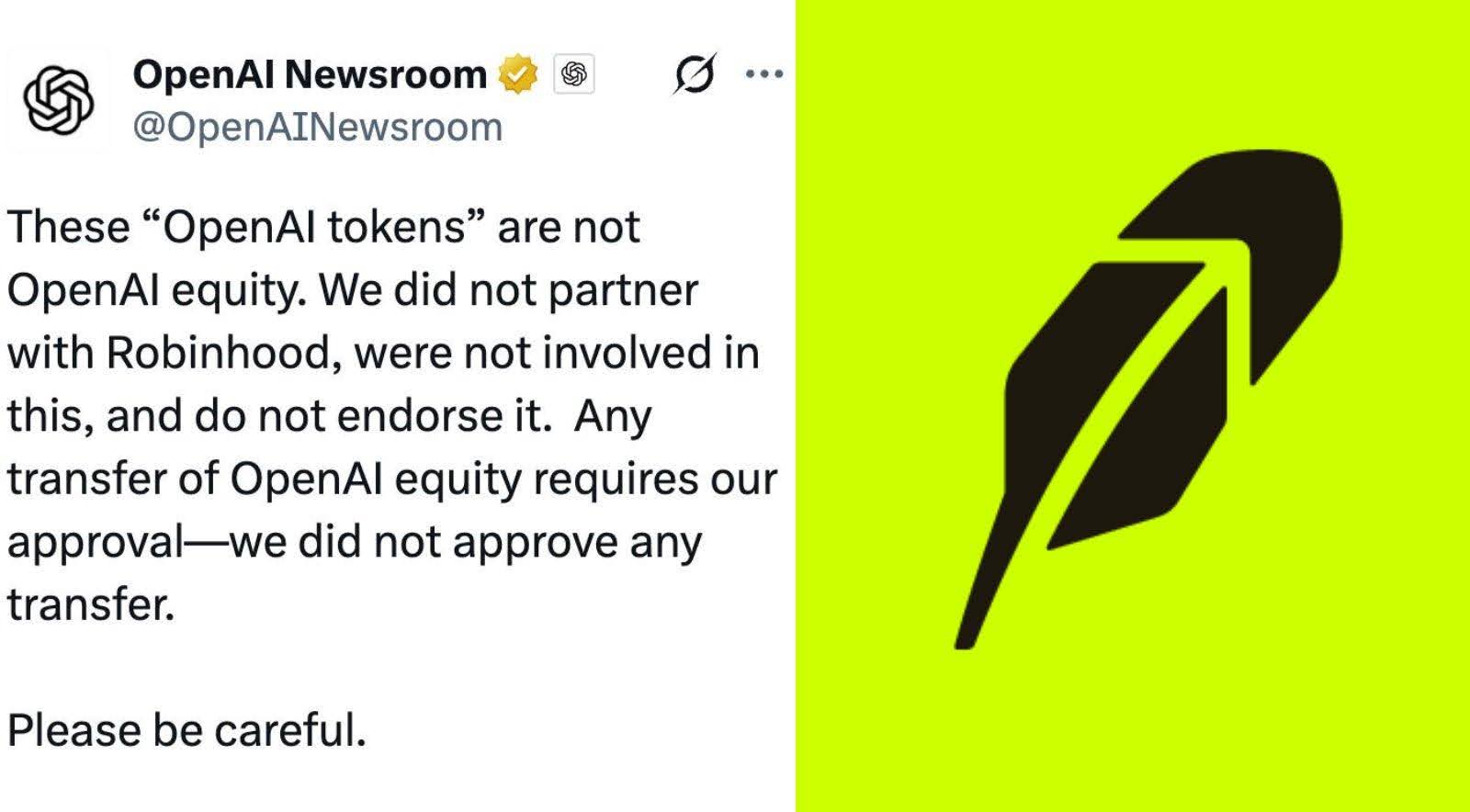

One of the really frustrating parts was dealing with the transfer of funds. It really makes you appreciate how fast final settlement occurs on the blockchain when in the traditional finance world it takes anywhere between 3 to 7 business days before the proceeds from a sale clear and you're able to move them, then another 7 to 14 days to be able to withdraw your Bitcoin from an exchange after you've purchased it.

Currently I have 30% of the proceeds from the sales sitting on exchanges as limit orders waiting for a spike down (even though it might not happen), 20% is put aside for uncle sam and the remaining 50% is currently in cold storage.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments