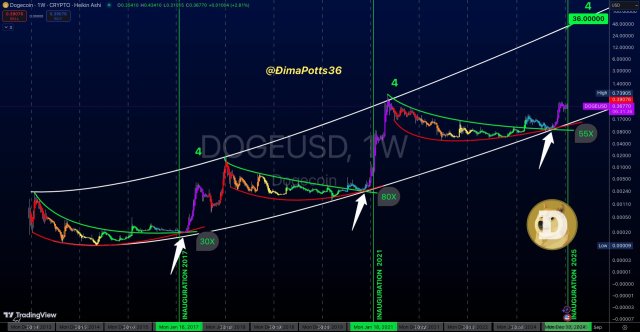

| I have been in crypto since 2018. Many ups and downs along the way, but if anyone asks me what would be the biggest lesson I learned from those years, I'd say "patience". 1. Patience with buying We are all familiar with the term "buy high sell low". Sounds absurd, but it is actually happening every time. Everyone is a genius in a bull run, as the prices shoot up every hour, FOMO comes into play. This chart sums it up nicely: From my personal experience, I successfully defended the FOMO phase of 2017. In 2018, I bought the first Bitcoin at $7,000 and ETH at $600, thinking they couldn't possibly go any lower. Hundred of posts back then say the same thing, $6k-7k is "the floor". Another aspect of patience with buying, is not to fomo into shitcoins. Many people have the mindset of "get rich quick" and jumped into many shitcoins, which turned out to be terrible investment. Again, I was lucky not to fomo into Waltonchain, Dragonchain, Ark, Verge, ICX, Lambda, Komodo, Bitmax, OMG. The ICO boom in 2017 left many broken. The only not-so-good purchases for me were NEO, DASH and Raiblock (now NANO). I sold NEO and NANO last year, making a small profit and not looking back. Time in the market is more important than timing the market, however it would be better to combine both factors. This is because we as retail investors don't have a lot of money to play with, so buying now would be surely better than buying in Nov-2021. A wide range of tools can be deployed to strengthen the DCA plan. I prefer an adjusted DCA (buying regularly, but not regardless of any price). My favorite tools: RSI, MA50, MA200, Mayer Multiplier and Bitcoin rainbow. You can't time the top or the bottom, but getting 10% close to the range would surely help. 2. Patience with hodling This one is also very important. Crypto is volatile and you normally see people making 1000%, 10000% or even more in a particular project. The OG who bought in early and almost never consider selling, is a different breed. For us, even holding for 4 years would be a commitment. So again, don't invest more than what you can afford to lose. You would not want to sell something urgently because the rent payment is due and now you have no cash left. Hodling is hard. Very hard. When you see your portfolio value go down 10% a month or even worse. But the power of holding is huge. DCA returns for selected coins https://www.blockchaincenter.net/dollar-cost-averaging/ Right now we are in the red, and one of the worst time to sell in my opinion. However, it should be noted that not everything is worth holding forever. There are a lot of coins from 2016/2017/2018 that could be considered "dead coins" by now. But if you believe in a particular project and support it, you can reduce your cost basis in a hard time like this. Another good thing with holding now is that you can stake and earn passive income. This can lower your cost basis and get you airdrops for some specific coins. 3. Patience with selling Many retail investors lost interest with crypto and can't bear the fact that their portfolio is now in the red. Hence, many sell low, in the possibly worst time to do so. In a hard time, if you can't buy more, at least keep hodling the position. No one ever goes broke by taking profits, however. It's always a good idea to DCA out near the top. If the price drops later, you can buy back for cheaper price. I sold some portion of BTC at $60k and bought back at $39k. Not the perfect top or bottom, but at least quite close. I made some bad selling transactions as well. For example, I bought BNB at $92 just last year, and sold at $270. Now even in a downturn, BNB is still $390. Again, the tools above can help with the short-term as well. And for you, what would be the biggest lesson from crypto investing? [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments