These are some of my personal rules to painting the full picture of the market. This market, mostly compromised of projects without unique utility has a trillion dollars up for grabs without a bank required (libertarian-born, immutable and trust-less).

Think penny stocks, but bigger, built on a superior system, more money, less regulation, more risk and an equally scammy reputation, as a whole. Open 24/7 365, unlike the government.

The first rule is accepting this is both a lucrative/trillion dollar industry, whilst being compromised of a lot of crap.

Accept the crypto bro reputation (shilling a token w/o unique utility for personal gain, while knowing it’s not unique is going to be your average crypto person you meet, and who people think you are. Ignore the noise. They have a point, but there is money to be made.) “Both can be true” is an accurate response for a lot of criticisms in the space.

This reputation turns off traders, but if you can move past it and learn, there is a lot of opportunity (and risk!).

We’ve separated the individual from the industry.

Remove all emotion and trust your gut, which will take YEARS to trust (observing patterns, macro reactions, industry sentiment, it is more predictable than it is unpredictable.)

All roads lead to understanding Bitcoin is the S&P (store of value/digital gold) to everything else, even Ethereum, which is essentially a private company.

Bitcoin is unique. You may not like the speeds outside of lightning or its TPS, but it is the longest-standing most secure digital store of value in the world. It is not meant to be spent, but it was an invention, decades in the making by a PHD Comp Sci OG cryptographer genius and visionary. (Quantum watching closely).

(Unpopular, but true!) Industry “secret” Adam Back, CEO of Blockstream is unequivocally and 100% Satoshi, if you look deeply into circumstantial evidence.

Again, you can disagree with my points. I just want to provide this insight of my tested and experienced beliefs. Anything I say can be researched and proven without a reasonable doubt.

Satoshi is alive and according to the incredibly detailed, “Patoshi” mining research, Back/Satoshi has about 750,000 BTC. A deserved fortune.

Dispelling the mystery is the first step to trusting Bitcoin. Adam Back being Satoshi removes speculation of Satoshi rug-pulling or being dead. He is literally holding (and having a conflict of interest with Tether / BitFinex, but I don’t want Satoshi to be judged.) The point is we won’t be rugged.

The above DD builds a small foundation of understanding and trust in the ever-mysterious (not really!) crypto industry. The answers to all your Satoshi questions are in archived cryptopunk emails on Google from Back. He purposely did not cover his tracks very well.

Now that we’ve separated the S-tier (Bitcoin aka the S&P of crypto) let’s try to understand the rest of the human psychology driving retail traders.

I would estimate about 30% of traders do not understand the price of a token is IRRELEVANT when determining its ATH potential/value - market cap only.

Not all non-Bitcoins are built equally.

Although Bitcoin is a unicorn, secure invention with the longest uptime of any coin and fully decentralized team (unless most), which near guarantees a profit if held - some people want bigger returns!

We don’t discriminate on dreams of massive ROI, we discriminate on unique utility, or lack there of.

Add up as many positive attributes to a token you can - renounced contract, tokenomics of the rich list, sale/buy tax?, vision (just NFTs and memes, probably best to avoid. this is a high risk gamble, low utility coin = you can find a better investment.

Buy the rumor (even though you are uncertain, you need to develop your gut instinct in the market and trust it.) and sell the news.

Personally, I find the biggest tip for Bitcoin is time in the market not timing the market, but for the other half of the industry, timing is everything and don’t hold too long.

The majority of coins I made 10x, 20x returns were gambling, but my best informed and experienced gut instinct. With a strong enough thesis, there IS a such thing as a sure-fire return.

Get in early for the memecoins that have a lot of hype. For example, l made a 5x in October from TokenFI. Factors include, my perceived rally in market and thus alt coin surge, Floki, a rising a top 100 token announced TokenFI as their sister-token. I bought at under a $0.01 at 5am iirc (very early) and I am not smart. I just followed what would have to be a 10-20 M Mcap if it’s sole, primary project is a top 100 coin. Human psychology, people will ape in. I am not smart, in fact, that was one of my, how was it that easy moments? How can I get rugpulled by a top 100 token’s sister-coin if I got in under $1M Mcap. Early, early buy-ins and actually having an exit strategy is huge.

Learn how to use a DEX and understand the many different chains. If you don’t, you will have to be twice as lucky.

If it’s on a CEX, it’s usually too late for these types of 5x-10x+ gains in under a week. The CEX listing is usually an immediate all-time high and then massive sell off (easily accessible liquidity for retailers).

I use Coinbase to instantly deposit my memecoin earnings to my bank. Liquidity is rarely an issue when exiting IMO, but fees, slippage and volatility is.

I didn’t really organize this well, but I’ll add more. I made a 690% return in under a week by being really early, taking a risk, and picking a project that seemed at least sort of interesting (a meme coin on 15 chains under 1M Mcap seemed EZ as I predicted many would ape in). It was called AnyINU and I sold all of mine and I have proof of my page.

If you are making a post asking people for their opinion on a coin, you are guessing. Convince yourself, don’t trust, verify (the tokenomics, risk factor, vision, utility, etc)

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

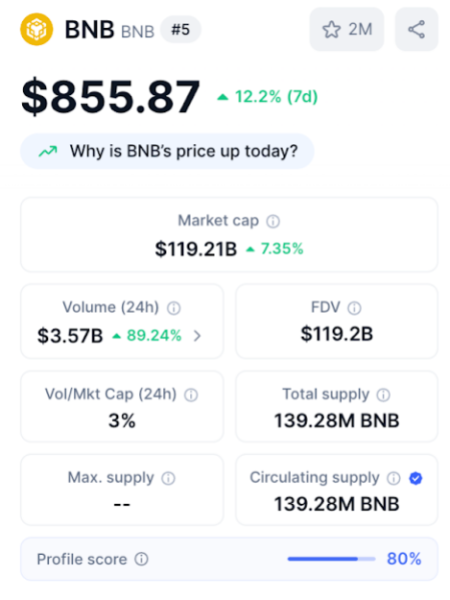

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments