The biggest crypto market is still the US (hopefully that will be more balanced in the future). And right now, one of the many concerns in this market is US inflation.

CPI is up 1.3%, hitting a high of 9.1%.

That's 9.1% over the last 12 months.

Core CPI is up 5.9% (it was 6% in May).

CPI is a lagging metric, so it really measured the June outcome of the effect inflation has previously had.

The breakdown:

Here's the more detailed data:

https://www.bls.gov/news.release/cpi.nr0.htm

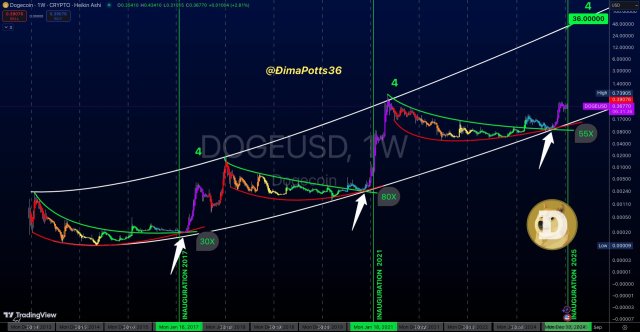

This prediction nicely illustrates the problematic areas. Credit: u/danielhanchen

Energy, housing, and food have been the most problematic.

Energy is the biggest culprit. Accounting for over 26% increase.

The energy problem:

The gasoline part alone of the energy section rose by 11%.

Energy commodities (fuel oil and gasoline), accounted for 21.6%.

Core CPI, a different story:

Core CPI doesn't take into account food and energy.

So it can give us a clue how things would do, if it wasn't for the energy problem.

Core CPI has actually peaked back in April, and has been in decline.

Core CPI

The bad news:

Higher CPI means higher Fed rates. Potentially 100 bps. But definitely at least 75 bps.

That's a very fast increase, and could put a lot of stress on the market.

All the while we have some other bad news like the Chinese economy slowly collapsing.

The target is still only around 3%. So the cost of borrowing will still be cheap, just not near 0. To put things into perspective, between 2005 and 2007, rates were over 3%. And the economy and stocks were in a bull market.

The issue is more how fast they increase, and that the market got used to near 0 rates.

The good news:

-OPEC has been increasing its output. And we can already see the price of oil drop from $122 down to $95.

That's important as energy (mainly oil) is the biggest culprit.

The problem is they aren't able to operate at full capacity yet. Renewed unrest in Libya and Nigeria has made OPEC miss its targeted outputs.

Along with still limitations in refinery capacity, and supply chain. But OPEC is still aiming to increase output.

-Supply chain, one of the problems that can also help improve the oil and energy situation, as well as the food situation, has been slowly improving.

China and Europe have had setbacks, but ports and shipments in the US have been improving.

The current drop in oil prices will also help transportation.

-The housing market is cooling off.

Median sales price are still high, but are slowing down to a grinding halt. Sales on the other hand are beginning to drop while inventory is beginning to increase again as the supply chain of lumber is recovering.

A correction seems imminent.

Unfortunately, it will be a while before we see any improvement on housing cost, especially if price drops are too slow to outpace mortgage rates.

-Markets price in the future, not the current situation.

For markets like stocks and crypto, it's more the future outlook that matters.

While the current situation is dire for main street, and will likely be for several months, markets are speculative, and speculate on future value.

The market will buy ahead of the news, and buy a recovery prematurely when there's the first hint and rumors that the worse is over, or that the wheels are already in motion.

Where to look to stay ahead?

Considering how big of a factor energy has been, it makes it a little easier to simplify that process.

Keep an eye on the energy market first, then supply chain.

And it all boils down to what happens in Libya, Nigeria, and with the oil refineries and transportation of oil.

Those will tell you where, when, and how far along the recovery will be.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments