The production price affected by the rise in commodity prices is a manifestation of the beginning of inflation. The inflation rate in developed countries accounts for 7.1%, and it is now in the 90th percentile of historical data.

During the epidemic, non-agricultural wages increased due to the dismissal of low-paid workers. As these workers return to employment, wages are more likely to fall rather than rise in the coming months.

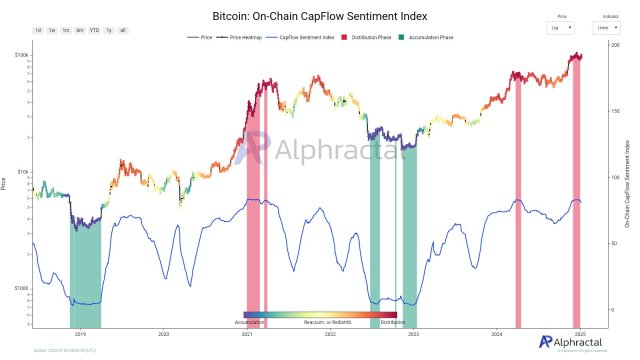

The data shows that BTC has begun to play a role in hedging inflation. Observing the changes in BTC prices relative to inflation, we can find that this relationship is becoming more and more important statistically.

We are still not sure what will happen to inflation in the next 5 years, but we believe that increasing real assets is a prudent measure to protect the investment portfolio from the tail risk of out-of-control inflation.

- Inflation is beginning to show up

Signs of potential inflation problems are beginning to appear, the most obvious being the tightening of employment conditions (and the consequent rise in wages) and the rise in global production prices. However, there are still differences among investors. The outlook for inflation is divided into two schools of thought: one believes that the impact of inflation is more short-lived in nature, and the other believes that inflation has risen to a level that threatens economic stability.

The data shows that from a historical point of view, the current global inflation rate is not that high. The current level of inflation is similar to that observed after the 2008 financial crisis, and since 1970, it has only been placed at the 55th percentile. This is because production prices are affected by rising commodity prices, and inflation is beginning to rise. 7.1% in developed countries, the current figure is in the 90th percentile.

In the era of inflation, only BTC is the real asset

During the recovery phase of the new crown epidemic, the unemployment rate has fallen much faster than during the global financial crisis, which means that the labor market has begun to heat up, and it also means that wages may increase with it, as we have seen in the United States this year. Although wage growth has intensified during the epidemic, the unemployment of low-income workers has reversed this situation. As these workers are re-employed, wage growth in the coming months is likely to decline, rather than increase.

Therefore, it is difficult to determine whether a higher inflation rate is just around the corner. Global shipping disruptions, wider supply chain issues, and inventory challenges have exacerbated short-term inflation, which has led to some supply bottlenecks, but this does not necessarily mean that it will lead to longer-term inflation problems. Therefore, it is difficult for us to say exactly what will happen to inflation. This issue is in the hands of central bank officials, and history shows that they will be more passive rather than proactive.

- The dilemma of the central bank

Reducing currency issuance after unprecedented easing policies is likely to cause a dislocation in the bond market, which will result in greater market volatility. Speeding up liquidity in order to alleviate market pressure has left the US Federal Reserve and other central banks stuck in this dilemma, so it is difficult to eliminate its negative impact.

This is why the market pays so much attention to the recent June FOMC (Federal Oversight and Monetary Commission) statement. The minutes of the FOMC meeting highlight that the Fed maintains a very moderate attitude in general (even if the minutes are unexpectedly tough). At the same time, they are considering the danger of inflation by raising the inflation forecast rate and sending out a signal to predict a rise in interest rates in 2023. The FOMC still believes that inflation is temporary in nature and is therefore happy to see inflation "heat up" over a period of time.

The problem is that the Fed’s “result-based” approach, which is the so-called “wait until inflation arrives before taking action”, is risky. Especially considering the rapid changes in the world economy and technology, some traditional indicators of inflation may be unreliable.

Investor behavior also shows that many people do not believe in results-based methods. Due to a series of capital inflows since mid-2020, the assets managed by trading products in the trading platforms protected by inflation have increased by 74% in the past year.

In the era of inflation, only BTC is the real asset

These record capital inflows also highlight that perhaps concerns about inflation are becoming a consensus rather than an isolated view. It also implies that many investors believe that the Fed and other central banks may be behind the curve in the chart.

Regardless of the outcome of inflation, the central bank may lose control of inflation, and there is still considerable tail risk. Therefore, as highlighted by the above-mentioned capital flow events, inflation hedging is becoming more and more popular. During inflation, there is a small part of hard assets that should perform well, and we think BTC is one of them.

- BTC as an inflation hedge asset

Conceptually, BTC makes sense as an inflation hedge asset. This is what economists call "real assets"-an asset with a limited and predictable supply. Therefore, if the supply of U.S. dollars or any other fiat currencies increases, the price at which BTC can be exchanged for these fiat currencies may appreciate, even if its purchasing power remains stagnant.

The data shows that BTC is beginning to play the role of this inflation hedge. Since its creation in 2009, observing its price changes relative to inflation during the two-year period highlights that this relationship is improving, and the current R2 is 0.30 (since 2019). And the relationship between BTC and inflation is currently better than the relationship between inflation and gold.

In the era of inflation, only BTC is the real asset

Citigroup compiled an index to track unexpected inflation by measuring inflation forecasts and delivery results.

At a level above zero, inflation is higher than expected. BTC also has an early but possibly convincing relationship with unexpected inflation. Our analysis emphasizes that BTC does respond to unexpected inflation and will rise when the inflation data is higher than expected.

In the era of inflation, only BTC is the real asset

We realize that the relationship between BTC and inflation is likely to be uncertain at this moment, because the sample size is small. In other words, this relationship has been steadily improving over time, which has also increased the credibility of the concept of BTC as a real asset.

Fourth, BTC as an asset is maturing

More and more evidences show that BTC as an asset is constantly maturing. After the recent FOMC statement (June 16) expressed an unexpectedly tough tone, the price movement is very similar to that of gold. This highlights that BTC's behavior is in line with investors' expectations of physical assets, which will appreciate when the U.S. dollar depreciates, and vice versa.

In the era of inflation, only BTC is the real asset

We are still not sure what exactly will happen to inflation in the next 5 years, but we believe that adding BTC and other physical assets as a prudent measure is to protect the portfolio from the tail risk of out-of-control inflation. BTC originally had the concept of an inflation protection certificate, and it is now proven by increasing investor participation, as evidenced by the improvement in its relationship with consumer prices.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments