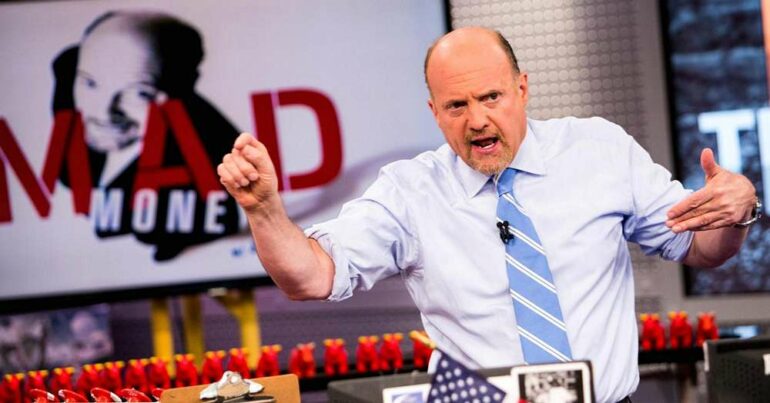

- Two exchange-traded funds tracking the stock recommendations of Jim Cramer have gone live.&

- One of them is an inverse ETF which shorts the stock picks made by the Mad Money star.&

- The Long Cramer Tracker ETF backs the stock recommended by Cramer.

- Jim Cramer welcomed criticism for his stock picks last year when the inverse ETF was first announced.&

A pair of rather interesting exchange-traded funds (ETFs) tracking the stock recommendations of Jim Cramer have made their debut. The Inverse Cramer Tracker ETF ($SJIM) and the Long Cramer Tracker ETF ($LJIM) are now available for U.S. investors that are looking to bet against or in favor of the stock picks made by the Wall Street pundit. The Cramer-themed ETFs have managed to get approval from regulators before the much-awaited spot Bitcoin ETF.

Jim Cramer welcomes criticism for his stock picks

Jim Cramer has historically been a controversial figure in the world of finance. From his iconic “Bear Stearns is fine” claim right before the investment bank’s collapse back in 2008, to some of his more recent picks including Tesla, which has since tanked more than 10%, Cramer has often been ridiculed for his stock picks. When the Inverse Cramer ETF was first announced in October last year, the Mad Money star welcomed those who were looking to bet against him.

According to a report by Bloomberg, the Inverse Cramer ETF will either buy the stocks that the CNBC Mad Money star recommends against or short-sell the ones that he actively promotes on his show, to deliver returns to investors. The Long Cramer ETF on the other hand will buy the companies that the financial pundit favors, and drop the ones that he doesn’t like. $SJIM is currently trading at $25.03, while $LJIM is trading at $25.46.

If he tells you he hates a stock or sell, sell, sell or something like that, then we’re gonna go long that name again at the next kind of practical entry point.”

Matthew Tuttle, CEO of Tuttle Capital Management

The Cramer-themed ETFs were launched by Tuttle Capital Management, the firm behind the $551 million AXS Short Innovation Daily ETF ($SARK). SARK is an anti-ARK ETF that bets against Cathie Wood’s investment strategy. CEO Matthew Tuttle told Bloomberg that the portfolio for both ETFs was equal weight, with an expense ratio of 1.2%. Tuttle’s team reportedly watch Cramer’s appearance on Mad Money and other interviews to determine which stocks go into the ETFs which hold anywhere between 20 to 50 of his stock picks.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments