| Ethereum2021 was a fantastic year for crypto, in particular Ethereum. Ethereum reigns as the second-largest blockchain despite the slew of competition from Binance SC, Solana, Avalanche. But it remains far ahead showcased by various metrics, and there are no signs of slowing down. Total Value LockedEthereum ended 2021 with a Total Value Locked (TVL) of $153 billion and contains nearly 60% of TVL in crypto. Its nearest competitor Terra (LUNA) TVL, sits at $13.3b with 7% of the market. Despite the hype following emerging L1s they remain far from the king. RevenueEthereum showcased impressive revenue in 2021 totaling $10.9b. The nearest L1 was BSC, which edged on $1.0b of revenue. There are four projects on Ethereum that post larger revenue than BSC. (Filecoin, Axie, Opensea, Uniswap) Opensea, an NFT marketplace on Ethereum, saw a revenue of $1.5b in 2021 with the emergence of NFTs. Layer 2s on EthereumLayer 2 protocols are taking traction, benefitting from Ethereum’s reliability and security. In the future, Ethereum may be a consensus layer for an extensive array of layer 2s that inherit low gas fees and fast TPS speeds. Some top names are Polygon (MATIC), Optimism, Arbitrum, Loopring (LRC), and ZkSync. Creator EarningsTypically, creators on centralized networks like YouTube, Spotify, Etsy, and OnlyFans, only capture a portion of the revenue they create. As the creator economy on Ethereum begins to evolve, many creators will start to see the benefits of capturing a larger percentage of value utilizing a decentralized network. NFTs for artists is a prime example. Ethereum, as a whole, competes with prominent names in creator economies. Eth Burning and Deflationary PressuresEIP — 1559 upgrade has been burned 1.7 million ETH at a valuation of $4.6 billion since early Aug 2021. Before EIP-1559, all ETH would remain on the network. Now, supply decreases with every transaction. Even though Ethereum remains inflationary, the increasing demand sees days of negative issuance. With ETH continuously being locked away, bought for speculation, and utilized for gas fees, Ethereum’s deflationary pressures will exceed new supply. ConclusionEthereum remains far ahead of its competition in almost all metrics. Moreover, it attracted the highest number of developers in 2021 that continue to build the ecosystem. There are a few negatives for Ethereum, no doubt. Ethereum is slow, and gas fees are incredibly high. In addition, environmental mandates are beginning to add pressure to the “proof of work” consensus. But, Ethereum contains scheduled upgrades that will improve speed, lower gas fees, and see a switch to an eco-friendly “proof of stake.” Ethereum Consensus Network (formerly Eth 2.0) will be near completion in approximately one year. So, what are we left with?

It’s no wonder Cathie Wood and her team of quants forecast an ETH price of 180k by 2030. 2022 will be an important year for Ethereum upgrades. In the past, upgrades are often delayed and I expect no different this time. But, the process seldom detriments the network. So… At its current price of $2680, Ethereum could be a complete steal, and far as the risk/reward ratio, it remains one of the best crypto investments. GabiFollow me on Medium or subscribe to this FREE daily newsletter on Substack to receive it first! [link] [comments] |

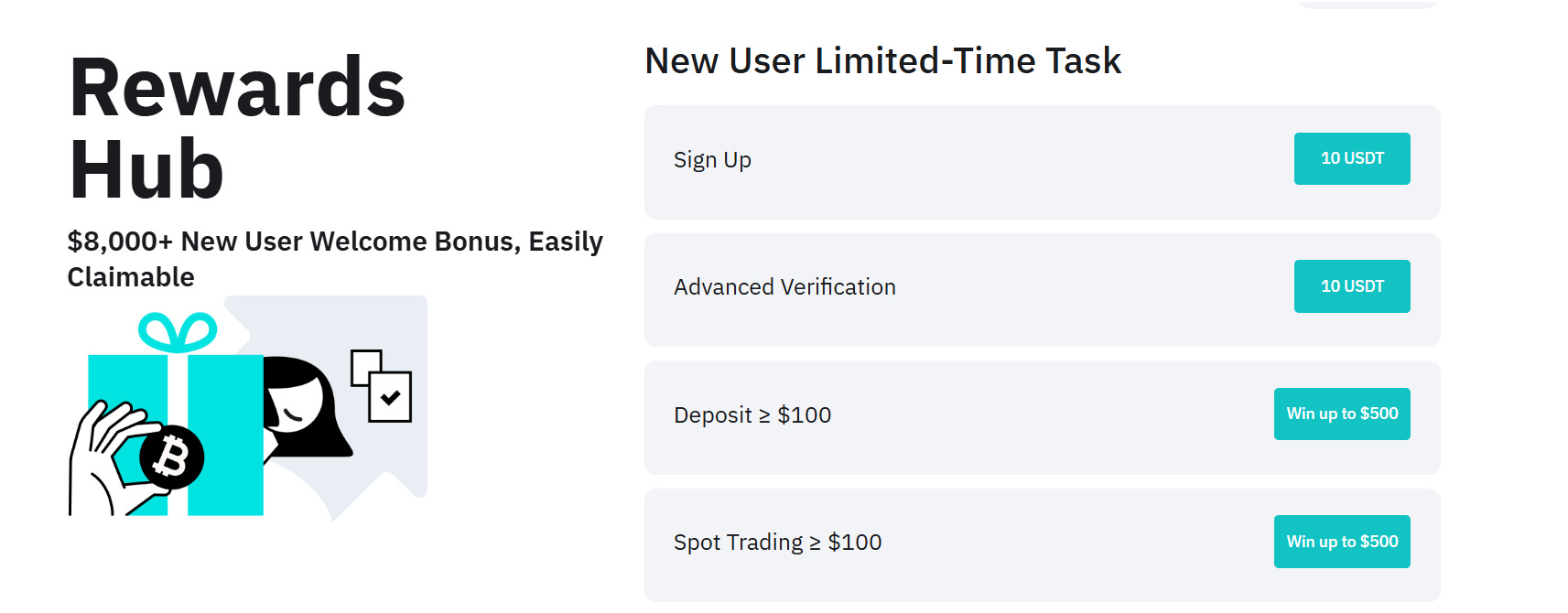

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments