A Reminder:

What are the Pandora Papers?

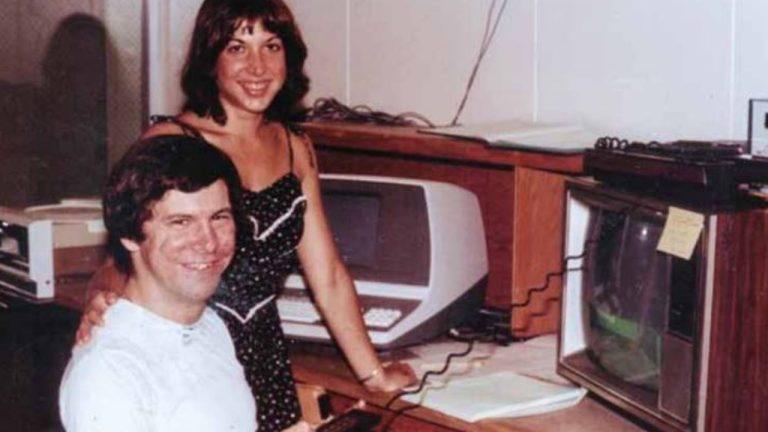

The Pandora Papers is an investigation into the shadowy offshore financial system that reveals the workings of a secret economy that benefits the wealthy and well-connected at the expense of everyone else.

The “papers” are the more than 11.9 million confidential records obtained by the International Consortium of Investigative Journalists that form the backbone of the investigation.

Where did the Pandora Papers leak come from?

The records come from 14 offshore service providers — law firms, wealth management advisors and corporate formation agencies — that help those with money set up companies in low- or no-tax jurisdictions. You can find out more about the firms here.

What’s the difference between Pandora Papers and Panama Papers?

Size, scale, scope. While the Panama Papers was based on the files of a single offshore services provider, the Pandora Papers records come from 14. The new investigation includes data on more than 27,000 companies and 29,000 so-called ultimate beneficial owners — the real owners of shell companies — or more than twice the number of beneficial owners identified in the Panama Papers. The Pandora Papers also connected offshore activity to more than twice as many politicians and public officials as did the Panama Papers.

Why does the Pandora Papers investigation matter?

The offshore system allows elites and multinationals to shift taxable wealth to paper-only companies in low-tax jurisdictions, without requiring them to live or actually earn profits there. They can shelter their assets— yachts, airplanes, artwork, mansions, cash and even company shares — by paying financial services providers to set up companies to hold those items. It also offers secrecy, which provides an opportunity to hide assets from authorities, creditors and other claimants as well as from public scrutiny.

The offshore financial system can drain trillions of dollars from treasuries, worsen wealth disparities and protect those who cheat and steal while depriving their victims of recourse. Studies have estimated that the world’s ultra-wealthy own the bulk of the $11 trillion realm of offshore companies.

$11 Trillion Dollars ! That's a lot of doe.

And now the relatively new US Treasury Secretary Yellen has the audacity to claim: “I think many (cryptocurrencies) are used, at least in a transaction sense, mainly for illicit financing. And I think we really need to examine ways in which we can curtail their use, and make sure that anti-money laundering (sic) doesn't occur through those channels.”

I am at loss for words, the pandora papers confirm what we all knew all along, but instead of doing something about those tax havens, they go after crypto, which is pushing a completely false narrative:

"The majority of cryptocurrency is not used for criminal activity. According to an excerpt from Chainalysis’ 2021 report, in 2019, criminal activity represented 2.1% of all cryptocurrency transaction volume (roughly $21.4 billion worth of transfers). In 2020, the criminal share of all cryptocurrency activity fell to just 0.34% ($10.0 billion in transaction volume)."

and that's the exact reason why we need more of crypto and to push on with idea of decentralizing financial markets. Only way out.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments