Once known as a hub for crypto verse, specifically in the first decade of Bitcoin’s inception, Japan started to put regulations around the crypto sphere in 2018. Not eager to stifle innovation in the emerging sector, the country’s authorities placed tight trading laws on cryptos. The theft of 850,000 Bitcoins worth $500 million on Japan’s Coincheck in 2018 was one of many reasons behind this move.

In recent times, state policymakers made a U-turn and have taken multiple initiatives to strengthen the country’s economic growth and to support and nurture local blockchain startups. To encourage Japanese residents to invest their savings in the country’s Web3 ventures and equities, FSA, the Financial Service Agency of Japan, announced tax cuts for crypto investors in august this year.

Lawmaker Urges Government To Introduce More Relaxed Rules

While speaking on the government’s move to implement refined regulations for crypto exchanges, Masaaki Taira, Head of the Web3 project of Japan’s ruling Liberal Democratic Party, added in an interview that “it’s still not enough.” Taira said that the government must work on easing the rules to a significant extent to rejuvenate the country’s crypto market.

The Japan Virtual and Crypto assets Exchange Association (JVCEA), the country’s self-regulatory body which monitors the crypto exchanges within its border, was reported to focus on easing the tedious process of screening tokens before getting listed on crypto exchanges.

Masaaki Taira, popularly known as the brains behind virtual currency policy, published a whitepaper for the crypto sphere in March together with his team.

It is also common knowledge that the ruling party’s lawmaker is the one behind persuading his country premier Fumio Kishida to include “boost the web3 market” as a priority in his tenure’s annual policy released in June.

The whitepaper entails the importance of the rapid emergence of the Web 3.0 era. For instance, utilizing NFTs(non-fungible tokens) can enormously boost the country’s economy, already the third largest economic player in the world. Taira’s team also posed concerns in the whitepaper about the slow progress in the industry. It reads:

The arrival of the Web 3.0 era is a great opportunity for Japan. But if we continue as we are now, we will surely miss the boat.

Another White Paper To Come On Japan Crypto Regulation

Taira, the former state minister in the Cabinet Office, further revealed that his team is working on publishing the second whitepaper. It will focus on improving the tokens listing, accounting guidelines, crypto tax, and a comprehensive regulatory framework for the DOAs (decentralized autonomous organizations), a type of establishment for crypto verse. Hoping to file its interim report by this year’s end, he believes that “The momentum is building.”

Masaaki Taira’s recent comments about the latest shift in crypto policy suggest that Japan is gradually increasing its efforts to energize the crypto atmosphere in the vicinity. The move has already been rumored to attract the giant digital currency exchange, Binance, which is seeking legal clearance to return to the regime after four years.

Besides Binance, Amber Group is another foreign cryptocurrency exchange that recently acquired DeCurret exchange to swim into the Japanese crypto water.

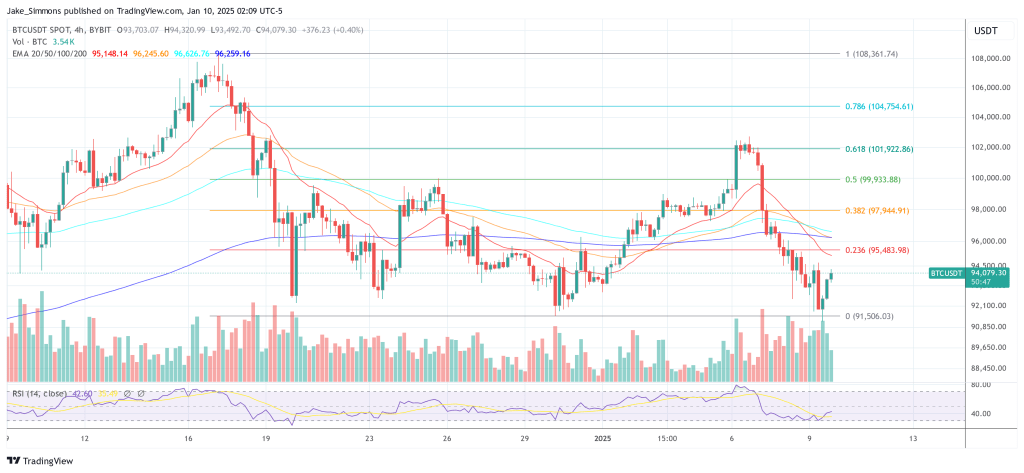

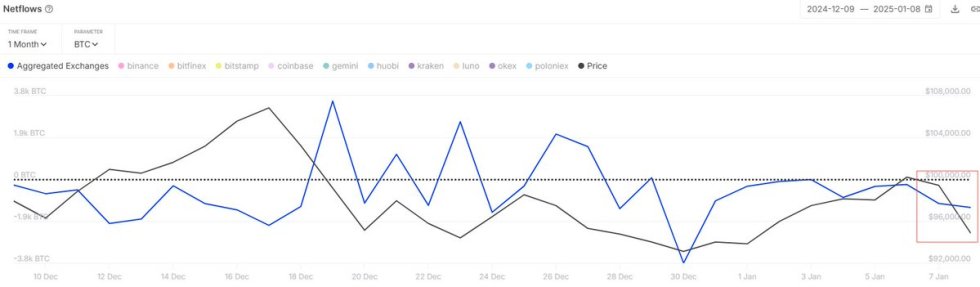

Featured image from Pixabay and chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments