In the last month, Japan’s official currency has dipped slightly more than 1% in comparison to the U.S. dollar. Then, on Tuesday, the Japanese yen plummeted to its weakest position against the greenback in over 20 years, a shift that came after the Bank of Japan opted to keep its extremely loose monetary policy unchanged, despite the mounting pressures of inflation and a depreciating currency.

Yen’s Steepest Dive in 20 Years as BOJ Stands Firm on Loose Monetary Strategy

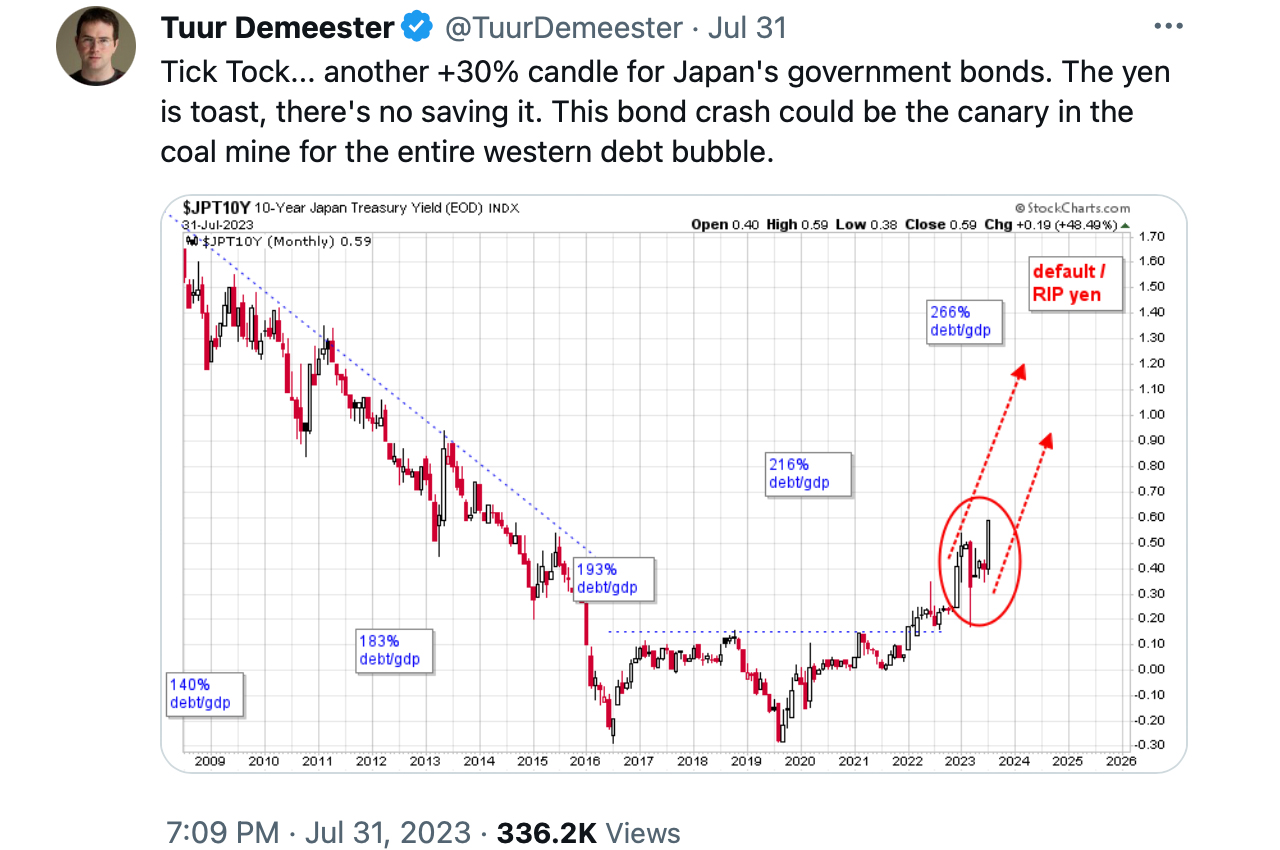

The yen weakened past 143 to the dollar on Tuesday, down more than 5 yen from Friday when the Bank of Japan (BOJ) announced it would allow long-term yields to rise to 1% from 0.5%. The BOJ kept its key interest rate at -0.1% and said the 1% cap on 10-year bond yields was not a fixed target but a loose guideline.

Economists had speculated the BOJ would start normalizing policy to combat rising prices, but it cited wage-driven rather than cost-push inflation as the key factor in any changes. This disappointed currency traders who sold the yen aggressively, reversing an initial 2% gain Friday.

BOJ governor Kazuo Ueda suggested that it’s possible to start normalizing monetary policy if the BOJ becomes confident that inflation will pick up next year. However, Ueda also mentioned that for now, underlying inflation remains below 2% and the BOJ’s outlook is for price increases to slow toward the end of the year.

Wondering why the USDJPY is crushing the ceilings? Look no further than the spreads between Japanese and US bonds. The carry trade is earning 5.531% on 1-yr and 3.388% on 10-yr spreads. pic.twitter.com/IORN1bXOri

— Rufas Kamau

(@RufasKe) August 1, 2023

The widening yield spread between Japan and the U.S. reduces incentives for the “yen carry trade” where investors borrow cheaply in yen to purchase higher-yielding U.S. assets. As carry trades unwind, dollars are repaid and the yen strengthens. Six-month statistics against the U.S. dollar show the yen is up more than 11%.

“All these markets are linked together in terms of global liquidity flows. People borrow in yen to buy dollars, dollars sit around looking for something to do, people say we might buy Treasuries or Apple,” the global equities fund manager at Artemis, Simon Edelsten, told Reuters on July 27.

At the moment current bond market volatility suggests yields will remain elevated. The benchmark 10-year Japanese government bond rose to 0.6%, up just 0.15 points since Thursday. Markets expect further BOJ intervention if yields spike too fast. The Federal Reserve has supported measures to provide U.S. dollars to Japan in a crisis after setting up swap lines last year. But uncertainty reigns over whether dollar strength or yen weakness will dominate.

What do you think about the Japanese yen’s recent performance and the BOJ’s unwavering stance? Share your thoughts and opinions about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments