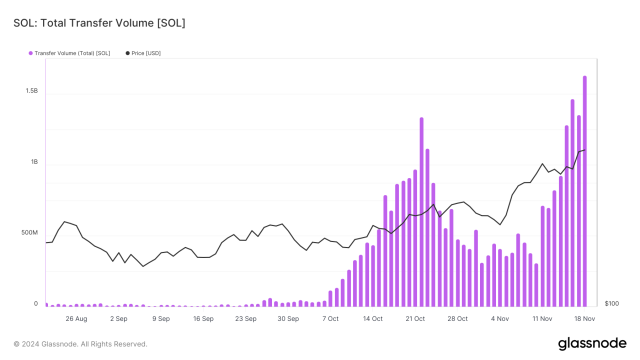

JPMorgan’s analysts consider Bitcoin’s declining open interest a sign that the current price trend may weaken.

The cryptocurrency market’s recent downtrend appears to be coming to an end, with JPMorgan’s latest research suggesting that most long position liquidations have been completed.

According to a Bloomberg report, analysts for the United States-based bank estimate that the liquidations are “largely behind us.” The prediction is based on the open interest in Bitcoin (BTC) futures contracts on the Chicago Mercantile Exchange (CME), indicating that the selling trend might soon decelerate. Open interest, which refers to active futures contracts, serves as an indicator of market sentiment and the strength of price trends.

Bitcoin’s open interest decline is seen as a sign that the current price trend could be weakening, according to analysts: “As a result, we see limited downside for crypto markets over the near term.”

Crypto prices have been on a downtrend in recent weeks due to declining optimism around regulatory developments in the U.S., states the report. On Aug. 26, Bitcoin traded close to $26,000, down 11.27% over the past 30 days, according to Cointelegraph Markets.

Positive developments in the previous months boosted Bitcoin’s price. Among them were a series of applications for the first U.S. exchange-traded funds (ETFs) linked to Bitcoin’s spot price. The list of players waiting for regulatory approval includes BlackRock, Fidelity, ARK Invest and 21Shares, among others.

Ripple Labs’ partial victory against the U.S. Securities and Exchange Commission (SEC) was another positive development. However, this optimism is gradually fading, notes the analysis, as traders await Bitcoin ETF decisions and the SEC’s appeal against Ripple brings renewed uncertainty.

The scenario contributes to a “new round of legal uncertainty” for crypto markets, making them sensitive to future developments, according to JPMorgan’s team. External market conditions also played a role in the crypto market’s decline, including the rising U.S. real yields and concerns about China’s economic growth.

Magazine: Should you ‘orange pill’ children? The case for Bitcoin kids books

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments