Bipartisan lawmakers from the U.S. House and Senate Agriculture Committees have requested clear information from the chair of the Commodities Futures Trading Commission (CFTC) about the crypto industry and their role in monitoring it and taking enforcement actions.

The CFTC chair Rostin Behnam intends to expand the regulator’s authority over the crypto market. Democrats and Republicans from the Senate and House Agriculture Committees agreed that the agency plays a “critical role“.

In a letter that Bloomberg described as “a rare show of bipartisanship in a divided Congress”, the lawmakers asked chair Benham to answer several questions in order “To understand the scope and size of digital asset markets, the benefits and risks presented by these emerging technologies” and “the role of the Commission with respect to these markets”.

“The CFTC has a critical role to play to ensure the integrity of digital asset markets. While some of these technologies have the potential to modernize the financial system, it is imperative that customers are protected from fraud and abuse and that these markets are fair and transparent.”

The lawmakers approached the risks of the crypto industry and called for the CFTC to widen their engagement to protect consumers from losses and scams.

The letter details alleged risks from the industry and reiterated that the CFTC is enabled by the Commodity Exchange Act to take enforcement actions for violations coming from digital asset marketplaces.

“Despite the CFTC’s responsible engagement, this industry is still subject to risks of abuse, including consumer fraud and cybercrime. Consumers reported losing nearly $82 million to 2 cryptocurrency scams between the fourth quarter of 2020 and first quarter of 2021, more than 10 times the amount from the same six-month period a year earlier.”

The lawmakers are also concerned about risks in the DeFi space and “any DeFi protocols offering derivatives contracts on unregistered exchanges”. However, they noted that “there are still questions about who is responsible for monitoring DeFi markets for fraud and manipulation, safeguarding customer funds, and ensuring parties meet their obligations to one another.”

Related Reading | Did US Regulators Began Offensive Against Crypto Platforms? CFTC Fines Kraken

Authority Of The CFTCIn October 2021, during chair Rostin Behnam’s confirmation hearing, he appealed to Congress looking to expand the CFTC’s regulatory authority and stated that the entity is ready to be the “primary cop on the beat”

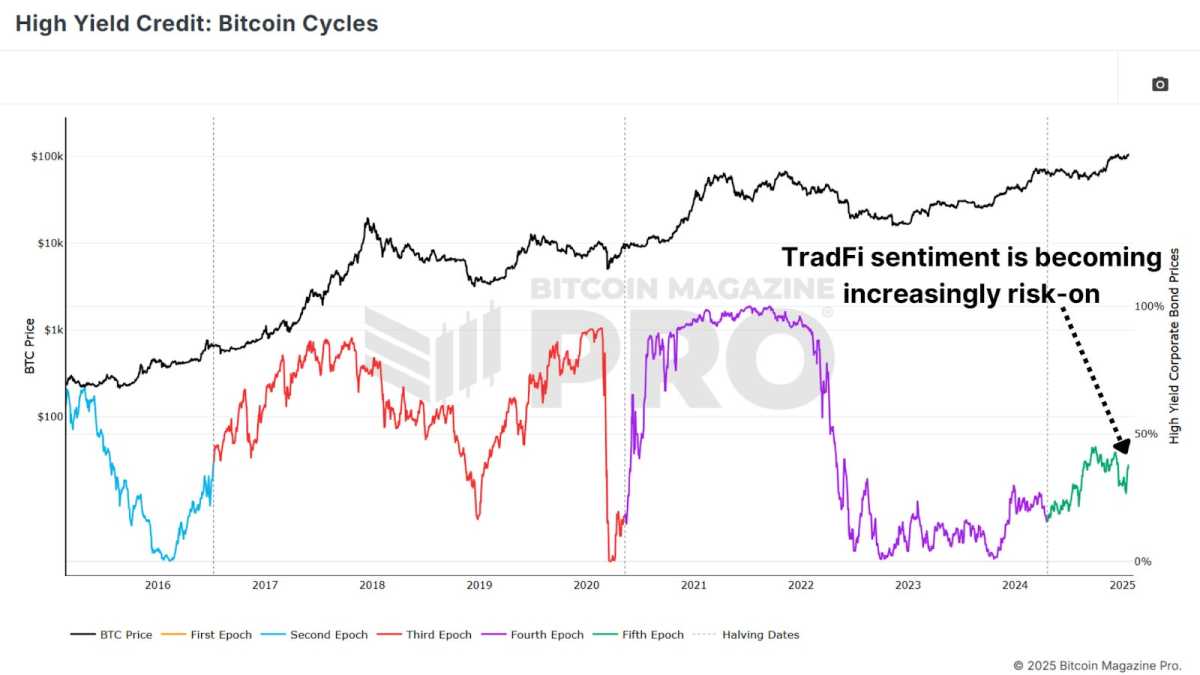

“the total size of the digital asset market was US$2.7 trillion and among that $2.7 trillion, nearly 60% were commodities. So with that in mind, I think it’s important for this committee to reconsider and consider expanding authority for the CFTC,”

Behnam’s statement seemed to contradict Gary Gensler’s, chair of the Securities and Exchange Commission (SEC), who sees most cryptocurrencies as equity. This has seemingly turned into a race amongst regulators to gain more authority.

The SEC’s view on how to define Ether has become unclear. If the two largest cryptocurrencies by market cap (BTC and ETH) are not securities, then the SEC has a large size of the market out of regulatory reach.

However, the lawmaker’s letter defined both Bitcoin and Ether as commodities, which would mean that both of these assets fall under the CFTC’s jurisdiction.

“The CFTC has long considered certain digital assets to be commodities and courts have agreed. In fact, the two largest digital assets by market capitalization are commodities: Bitcoin and Ether. These two digital assets alone make up approximately 60% of the $2.7 trillion market. Futures contracts on Bitcoin and Ether are currently traded on CFTC-registered derivatives exchanges.”

Related Reading | How the CFTC fine on Coinbase could affect future crypto company listing

Crypto total market cap at $2.0 trillion in the daily chart | Source: TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments