It's the effect of having been in a bear market for a period of time that can push you too deep into cynicism, and affects your decisions.

It changes both how you perceive the market, and your expectations of the market

Because like Pavlov's dog, every time there was any hope or rally, or any market movement, you got a collar shock of red candles and decline. It makes people increasingly cynical. And some people start getting trapped in that mindset.

We can get conditioned into a perma-bear.

It also didn't help that at the same time, we kept getting bombarded with negative macro news in the media for more than a year. And even though the worst of it is already behind us, and reached a boiling point last year, there is still enough lingering bad macros to reinforce the perma-bear's mindset.

We see the same thing happen during a bull market.

If you go for prolonged periods where prices keep trending up, green candles dominate, bears get burned, etc...It will skew your perception of the market. Which at the time would be correct. But you don't want to be trapped in that mindset if the market changes.

Some people turned into lambo boys with a perma-bull attitude "price only goes up", "you aren't buying? Enjoy being poor".

If you enter a bear market with that same mindset, you're gonna get scorched.

If we enter a bull market at some point, and we enter it with the mindset of a bear market still plaguing us, we're gonna make a lot of mistakes. From opportunity costs, to betting against the market, and getting burned.

Adaptability.

Just like you have to be quick on your feet, and adapt to a bear market when a bull market crumbles, you'll have to be quick on your feet and adapt to an exit from a bear market to an in-between market, and potentially to a bull market.

Those who can adapt quickly, will thrive.

And the easiest way to adapt quickly, is to be aware of possible scenarios, what could happen, and have a plan already in place for various scenarios. Being open minded to any potential cards you might be dealt, and enter a situation with a strategy.

But aren't we still in a bear market?

By most definitions, no.

Keep in mind that we don't have to be in a bull run to stop being in a bear market. There is such a thing as something in between.

Also, some people think that to be out of a bear market, you need to reach a new ATH.

A perfect example is that while we're still down from the ATH, we went for a period of several months of general upward trend from $15K to around $30K, without any new lows.

The pure definition of a bull market is a prolonged period of general upward trend, higher highs and higher lows. You would usually see people mention at least a couple months, to define a prolonged period.

And a bear market is just the opposite. A period of decline in trend, with lower highs, and lower lows.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

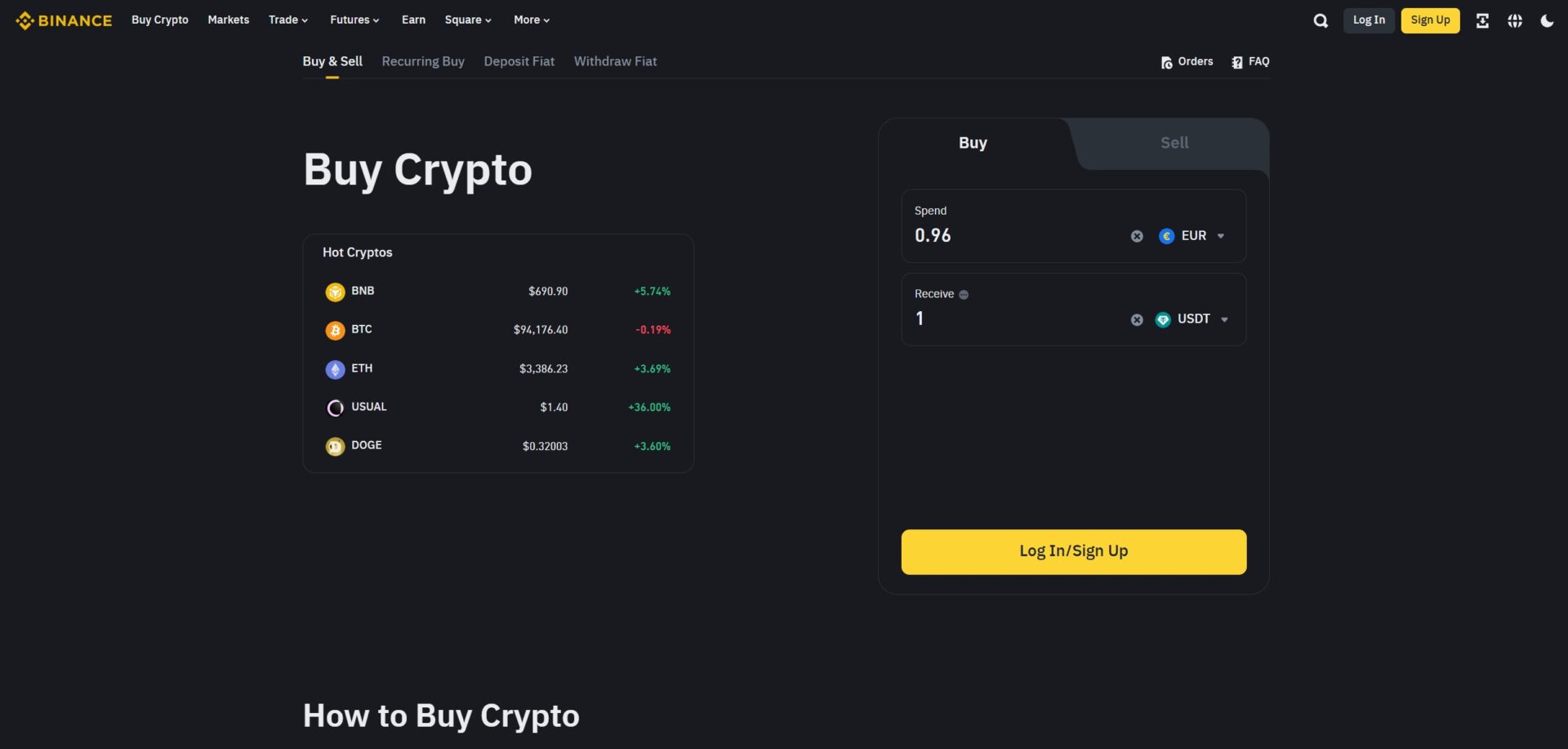

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments