Hi, I'm Jimmy He, here to take you through the day's crypto market highlights and news.

Bitcoin (BTC) saw price fluctuations in Wednesday morning trading after the U.S. consumer price index (CPI) showed June inflation hitting a 40-year high of 9.1%, overshooting expectations of 8.8%.

The largest cryptocurrency by market capitalization fell 4.5% in the minutes after the CPI was released, dropping to a 10-day low of $18,919. BTC has since climbed back, up 2% over the past 24 hours and trading at around $19,700.

Core inflation, which removes the CPI’s more volatile food and energy components, slowed for the third straight month, dipping to 5.9% in June from 6% in May.

AAVE, the token of decentralized finance (DeFi) lending protocol Aave, led market gains and rose 13% over the past 24 hours. On Tuesday, the struggling crypto lender Celsius Network paid off its full debt to Aave, freeing up $26 million in tokens of collateral.

Ethereum (ETH) rose 4.4% over the past 24 hours.

The S&P 500 was down 0.1% and the NASDAQ was up 0.1%.

Latest prices

●Bitcoin (BTC): $19,717 +1.2%

●Ether (ETH): $1,079 +3.2%

●S&P 500 daily close: 3,801.59 −0.5%

●Gold: $1,731 per troy ounce +0.5%

●Ten-year Treasury yield daily close: 2.90% −0.05

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Fed Futures Traders Now Betting on 100 Basis Point Interest Rate Hike After CPI Release

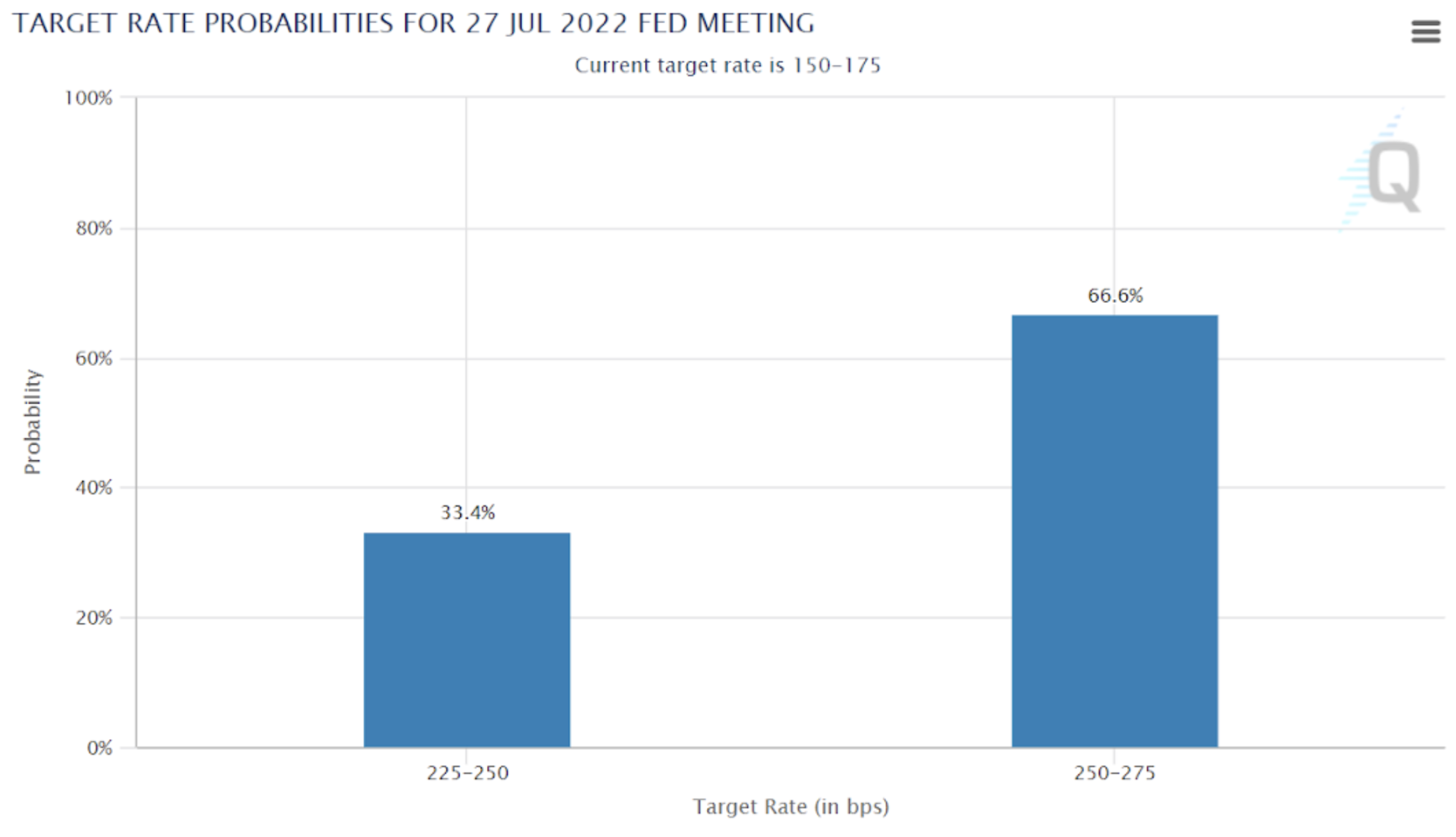

Futures traders are now seeing more than a 50% chance that the Fed will raise the target rate to 250-275 basis points at its meeting later this month. (CME)

Traders of Federal funds on the CME exchange now see a 67% likelihood that the Federal Reserve will raise the target interest rate by 100 basis points, or one full percentage point, to 250-275 basis points this month, up from only 7.6% a day prior and 0% a week prior.

The odds of the Fed reprising June’s 75 basis point hike to a target rate of 225-250 is down to 33% from 92.4% a day ago.

On Wednesday, the Labor Department released the CPI, the most widely tracked measure of inflation, showing the highest inflation gauge in four decades.

“The fresh inflation high could give central bankers the green light for another aggressive rate hike. The Fed has prioritized the battle to stabilize prices over any push for economic growth at this point in time,” Helene Braun reported.

The Federal Open Market Committee (FOMC) is scheduled to meet on July 26-27 to discuss further monetary tightening.

Altcoin roundup

- StarkWare confirms StarkNet token: The crypto firm, which created the StarkNet blockchain scalability product, confirmed the creation of the long-rumored StarkNet token to help maintain, secure and evolve the ecosystem. The token will go on Ethereum as an ERC-20 token in September. Read more here.

- Over $400M in BNB burned in quarterly move: Over 1.9 million of crypto exchange Binance’s BNB tokens worth roughly $405 million were burned as part of a quarterly burn program, data shows. The action is part of an automatic system to reduce the total supply of BNB to 100 million. Read more here.

- UK court allows serving legal documents via NFTs: The High Court of England and Wales has allowed Fabrizio D'Aloia, founder of Italy-based online gambling company Microgame, to file a lawsuit against anonymous people through a non-fungible token (NFT) drop. The ruling will allow legal proceedings against otherwise anonymous persons through their wallet addresses. Read more here.

Relevant insight

Other markets

Biggest Gainers

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments