Hi, I'm Glenn Williams Jr., here to take you through the day's crypto market highlights and news.

Bitcoin (BTC) declined 4.3% on Monday to trade below $22,000 on Monday. The price decrease is a retracement following last week’s 14% advance. The largest cryptocurrency by market capitalization is down 54% year to date.

Bitcoin has dropped five of the last six days on volume that aligns with its 20-period exponential moving average (EMA). In Sunday trading BTC prices advanced 0.6% on below average volume. The tepid move higher following the recent declines, implies profit taking by traders at the $23,000 mark.

In traditional equity markets, the S&P 500 was up 0.34% while the Nasdaq declined 0.26%. West Texas Intermediate (WTI) crude oil is up 1.8%, while gold declined by 0.6%.

Ether's (ETH) price declined 5.28% on Monday, on average volume.

Other altcoins were in decline in Monday trading activity as well, with Avalanche’s AVAX falling 8.4% while XRP decreased by 5.84%

Today’s edition of "Market Wrap" was produced by Sage D. Young.

Latest prices

●Bitcoin (BTC): $22,201 −2.4%

●Ether (ETH): $1,529 −5.2%

●S&P 500 daily close: 3,966.84 +0.1%

●Gold: $1,718 per troy ounce −0.6%

●Ten-year Treasury yield daily close: 2.82% +0.04

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

BTC Retraces in Monday Trading, Pares Gains From Last Week

By Glenn Williams Jr.

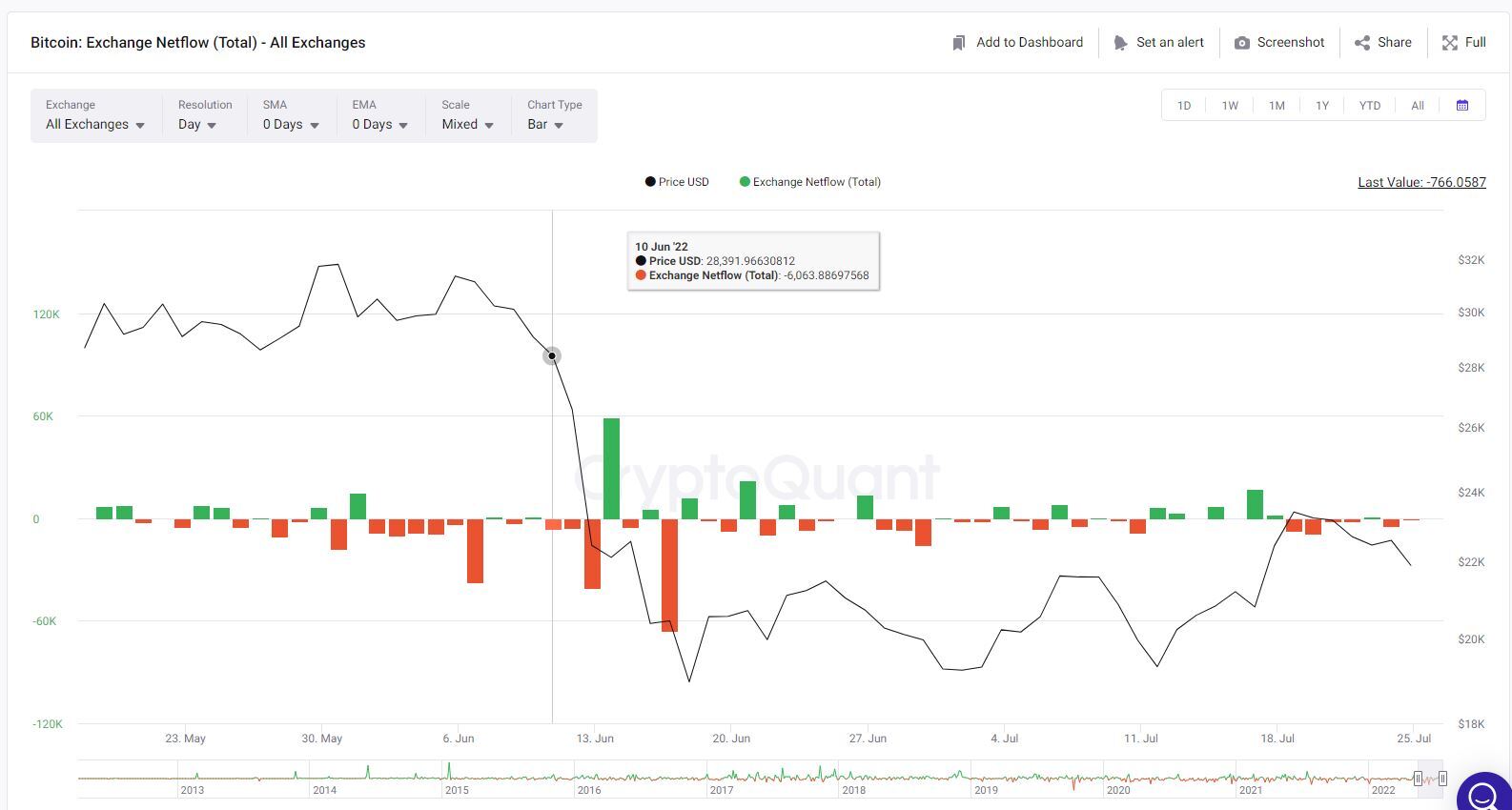

Recent on-chain activity showed an increase in BTC being sent to exchanges over the last 24 hours. Investors should note that the Exchange Netflow Total (pictured below), is an indicator that tracks net deposits on exchanges and compares the current figure to the average of net deposits over the prior seven days.

An increase in net deposits is often interpreted as traders sending BTC to exchanges, from which they can more readily exit their BTC position. We suspect that following last week’s 14% increase in BTC’s price traders began to take profits, sending BTC to exchanges to ultimately be sold.

Bitcoin's total exchange net flow (CryptoQuant)

From a technical vantage point, BTC’s price has fallen into a window between its 10- and 20- day EMAs. Given that the 10-period EMA crossed above the 20-period EMA on July 14, we expect that some traders may interpret this as a buying window.

However, it should be noted that in July, daily trading volume for BTC has surpassed its average 20-period volume on just nine days out of 25. In our view, there does not appear to be significant conviction among long or short traders at the moment. We expect that BTC prices will continue to be range-bound in the short term, with short-term support at $20,500 and resistance at approximately $23K.

Readers should note that our expectations for support coincide with the “point of control” value indicated (below) in the Visible Range Volume Profile tool. For context, the VRVP displays trading activity over a period of time, across specific price levels (via histogram). The point of control represents the price level with the highest amount of activity, and gives an indication of where a substantial amount of agreement on price exists.

Bitcoin/U.S. dollar (TradingView)

On the macroeconomic front, we expect most investors will be looking forward to Federal Reserve Chair Jerome Powell’s comments this week following the Federal Open Market Committee’s (FOMC) interest rate decision. As we’ve mentioned previously, our expectations are that the rate will be increased 75 basis points. More important, in our view, will be the tone of Powell’s speech, particularly as it relates to upcoming FOMC decisions.

Additionally, we will be paying attention to Thursday’s GDP growth figures, where the consensus of analyst estimates is for an increase of 0.5%. A GDP figure below 0.5% will likely be interpreted as bearish across both traditional and digital asset markets. A negative figure would suggest that the economy is soon headed for recession, which is defined as two consecutive quarters of negative growth.

Altcoin roundup

- How Attackers Stole Around $1.1M of Tokens From Audius: The sophisticated exploit involved attackers passing a malicious governance proposal by exploiting smart contracts. About $1.1 million worth of the decentralized music project’s AUDIO tokens were stolen. Read more here.

- Meme Coin Teddy Doge 'Soft' Rug Pulls $4.5M Worth of Tokens: Wallets connected to developers of BNB Chain-based Teddy Doge sold over $4.5 million worth of its TEDDY tokens for other cryptocurrencies over the weekend. TEDDY prices fell some 99.7% in the past 24 hours. Read more here.

Relevant insight

- Listen ???? : Today’s "CoinDesk Markets Daily" podcast discusses the latest crypto market movements and what to know about the Ethereum Merge.

Other markets

Biggest Gainers

There are no gainers in CoinDesk 20 today.

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments