Marco Bello/Getty Images News

The relentless selling that took place in risk assets earlier this year saw the prices of growth-oriented assets plummet. That certainly created some pain for investors, but as I've made clear in my posts in the past month or so, the worst, I believe, is a long way behind us. That has me looking forward to assets that I think are great buys, and back in mid-June, that led me to MicroStrategy (NASDAQ:MSTR).

MicroStrategy is an enterprise software company, but I dare say no one cares that it has a software business any longer. About two years ago, the company began buying Bitcoin (BTC-USD) to add to its balance sheet, and it has become one of the largest Bitcoin holders in the world. That has made MicroStrategy simply a leveraged play on the price of Bitcoin, because the software business is far too small to matter in the context of the company's Bitcoin holdings.

Now, I said on June 21st that I thought Bitcoin was bottoming, and so far, so good; I haven't seen anything occur in the past month that has put me off of this position. Should we get a further breakdown, I will come off of it, but the facts are the facts and to my eye, they support a sustainable bottom. With that in mind, if you're bullish on Bitcoin, you should be very bullish on MicroStrategy.

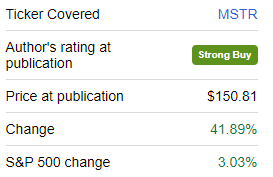

Also in mid-June, I published a bullish piece on MicroStrategy that said if you're looking for Bitcoin exposure, you want to own MicroStrategy.

Seeking Alpha

The stock is up 42% since then, against +3% for the S&P 500. I had several reasons for liking MicroStrategy then, and in this article, I intend to provide an update given we've seen such an enormous move in the past five weeks or so.

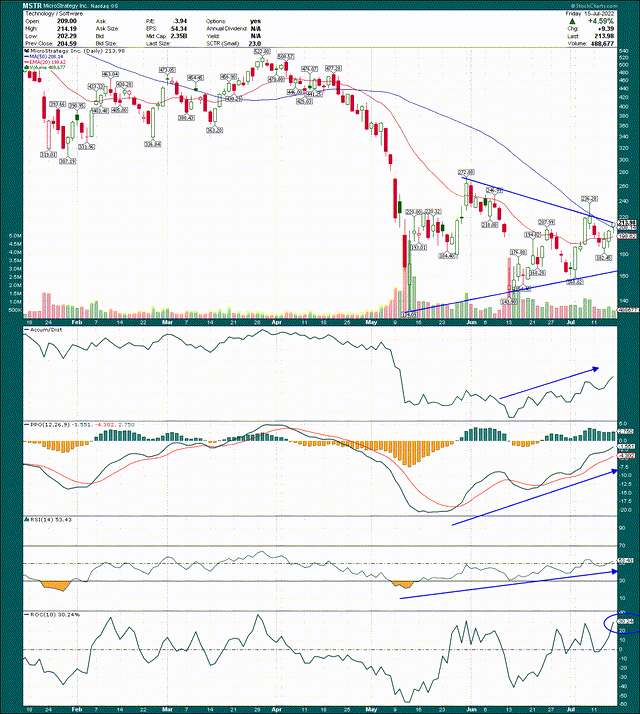

Now that we have some context, let's begin with a daily chart.

StockCharts

MicroStrategy has produced some very bullish price action in the past few weeks, which is hardly surprising given the 40%+ gain. However, this is building a more bullish case for me, rather than it looking like the move is over. Has the easy money been made already? Certainly. Are we done? I don't think so.

I've drawn in a symmetrical triangle on the price chart with higher lows and lower highs. That triangle is converging on itself, so we'll get resolution one way or the other shortly, probably within less than two weeks. The direction this triangle breaks will determine the next big move of the stock, so watch that carefully. Obviously, you can tell which way I'm leaning.

Note also that the stock has closed above the 20-day exponential moving average several times, which is indicative of the start of a new uptrend. In addition, the 20-day EMA is about to cross over the 50-day simple moving average in a bullish way, which is yet another indicator the worst is behind us. The next step after the crossover will be getting the 50-day SMA to turn higher, which I expect will happen over the course of the next few weeks.

Next, the accumulation/distribution line is moving up for the first time in months, which means big money is buying dips rather than selling rips. The A/D line on its own is never a reason to buy or sell, but in the context of what else we can see, it's one more reason to be bullish.

The PPO looks very bullish at this point, having made what should be a significant bottom, and very nearly getting all the way back to the centerline from -20 on this rally. When we pull back next, I expect a much higher low on the PPO, which again, suggests a sustainable bottom.

The 14-day RSI is making similar moves to the PPO, showing improving momentum as the stock rallies.

One note on the 10-day rate of change in the bottom panel is that we're up ~30% in the space of two weeks, so don't be surprised to see some consolidation and/or selling to work that off. This stock moves in huge magnitudes all the time, so rallies like this happen. Selloffs in similar magnitudes happen too, so I just wanted to point out we're overbought on very short time frames. That favors one more rejection inside the triangle before the final push out, but we'll see. Just something to keep in mind.

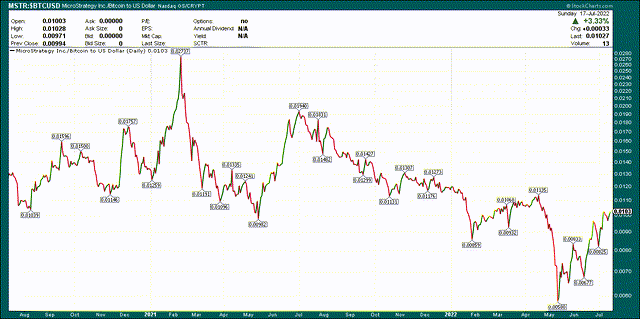

Now, let's take a look at the price of MicroStrategy relative to Bitcoin itself. This is a measure of relative value, which is highly relevant given MicroStrategy is simply a proxy for Bitcoin at this point. In the chart below, the relative value of MicroStrategy to Bitcoin improves as the line moves down, and deteriorates (or becomes more expensive) as the line moves up. This is a two-year chart, roughly corresponding to when the company began stockpiling Bitcoin.

StockCharts

We can see here the value of MicroStrategy relative to Bitcoin was extremely strong two months ago. It was still quite good a month ago, and even today is well towards the bottom end of the historical range. I'm not suggesting we'll see a return to the dizzying heights of when MicroStrategy's share price was 6X what it is today, but on a relative basis, the stock is still very cheap against the asset with which it shares its fate. That means that when/if Bitcoin rallies, we could get a two-fold tailwind on MicroStrategy of 1) rising underlying Bitcoin value and 2) multiple expansion back to historical levels.

Other considerations

While I'm painting a bullish picture, there are, of course, immense risks in owning any cryptocurrency, or related stock. MicroStrategy has placed massive bets on the future price action of Bitcoin, and if it doesn't work, the company could be forced to liquidate at very low prices, destroying enormous amounts of money in the process. That's a risk, and something you want to keep in mind if you decide to take a position. This is about as far from a buy-and-forget stock as I can think of.

The first half of 2022 has been a stark reminder to us all about how quickly things can unravel in the world of risk assets, and we have no guarantees that Bitcoin has actually made a bottom. I cannot count how many forecasts I've seen in recent weeks about how Bitcoin is doomed and going to $10k or $12k before it bottoms. That's the kind of sentiment I love because it means pessimism is very high. It's difficult to buy in the face of a constant drum of negative news, but that's exactly the time you want to buy. Another reason I love technical analysis is that it takes all of that noise away and just focuses on facts of price action. Let others generate fear and moaning while we focus instead on making money.

The failures we've seen in the world of cryptos have been alarming, but remember that any industry going through a downturn sees failures. How many banks went under during the financial crisis? How many consumer discretionary companies fail during recessions? The list goes on, but those industries don't die out; we simply lose the weakest players. So long as you don't spend your capital on the weakest players, the risk of a total blowup should be manageable. That's a choice each investor must make for themselves, but crypto haters trumpeting a handful of failures as indicative of cryptos being a doomed venture is ridiculous.

I'll mention again something I talked about in my last piece on MicroStrategy, and that is the risk of a margin call. The level of $21k on Bitcoin was said to be critical for the loans the company has taken out to buy Bitcoin. This is one of the additional risks of MicroStrategy; the company is leveraged using ~$2.4 billion in long-term debt for some of its Bitcoin purchases. However, the company had over 90,000 unencumbered Bitcoin last month as well, meaning it would simply contribute more Bitcoin to the collateral of the debt, thereby avoiding a margin call. The margin call ended up being fear for no reason, given the price of Bitcoin went well below $21k for a brief period of time. If Bitcoin falls below $21k again, just keep in mind the company owns almost $2 billion worth of unencumbered Bitcoin.

One final point I will make is that MicroStrategy's short interest is up to 38%, according to Seeking Alpha. When two in five shares are shorted, volatility tends to be enormous, but there's another important thing to remember. Short squeezes are a real phenomenon, but remember that they are very rare. Certain conditions must be met, including a very high percentage of the float being shorted, but we also need a high-volume breakout. If I'm right about the current consolidation resolving higher, we could see a short squeeze. To be clear, I'm not saying we need a short squeeze for the bull case to work, but I am saying that it's a possibility. Once price reaches a point where a majority of shorts are underwater, that's when the panic buying could set in. It's impossible to know that exact point because we don't know when the 38% of the float was shorted. However, high-volume breakouts tend to produce squeezes if they're going to happen. We shall see.

Final thoughts

I haven't seen anything in the past month or so that has put me off the bull case for Bitcoin. That's key for the bull case for MicroStrategy, and I'm certainly still bullish. The 40%+ move we've seen since my last article was really nice, but I also think there's a lot more left on this one in the coming months. Volatility will remain epic on this one, so if you're risk-averse, this isn't for you. But by using technical analysis, we can remove the fear and emotion and put the odds in our favor. The bottom line is that I think MicroStrategy's current consolidation will resolve higher in the weeks to come, and if you're bullish on Bitcoin, this is one to keep on your watchlist.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments