The articles and videos I've come across about restaking only left me more confused, or made sense of some parts but others were clear as mud. So, I wanted to give a more simple and straight forward explanation on what restaking is and what is provides.

To understand what restaking is, it's first important to lay the groundwork with traditional staking first.

Traditional Staking

This part is obvious to most here, but staked tokens does two things...

- It helps secure the network. The more tokens staked, the harder it becomes for a malicious actor to overtake the network, and the more disincentives there are for validators to misbehave since tokens are at stake.

This is called crypto-economic security (this term is important).

- You earn yield for providing crypto-economic security.

Staking Does Not Secure Off-chain Apps

The crypto-economic security provided by staked tokens are extended to dapps on that network. On-chain applications don't need to bootstrap their own security because they inherit it from the underlying chain.

However, off-chain applications like oracles and bridges don't inherit crypto-economic security... they have to bootstrap their own security which is expensive and time consuming (launch a token, incentivize validators, attract retail investors, etc.), and often times that security they bootstrapped is no comparison to the security of more high-profiles off-chain competitors.

So... how can off-chain applications benefit from the crypto-economic security of staked tokens without having to bootstrap their own?

This is where restaking comes into the picture.

Restaking

Restaking platforms like EigenLayer, Babylon, Exocore, and others create a solution that extends the crypto-economic security of a blockchain to off-chain applications. In the restaking world, the off-chain applications are called AVSs, and operators (a fancy word for validators) opt into securing these AVSs.

An AVS launches on a restaking platform, it defines the slashing and reward mechanics, and operators can decide to help secure it with the crypto-economic security they bring from their native network. In return, the operators earn commission from the AVS in whatever denomination that AVS determined in advance, and that commission is shared by restakers (retail holders) as restaking yield.

So when you restake your tokens, you're providing crypto-economic security to the operators who then secure the AVS (off-chain applications).

With restaking, AVSs can rent their security instead of building it themselves.

Why's it Called Restaking?

It's called "restaking" because you're taking your **existing** staked tokens (staked to their native network) and staking them a second time to secure AVSs. Basically, you're staking twice... this of course increases your risk since your tokens can be slashed by two different entities (the native network and the restaking network), and it increases your yield.

Single Chain Restaking vs Omnichain Restaking

There's two types of restaking solutions - single chain and omnichain restaking.

Single chain restaking extends the crypto-economic security from one network to AVSs. So, in the case of EigenLayer, the crypto-economic security of Ethereum can be extended to secure these off-chain applications. But this places a burden on that single chain and doesn't scale too well since crypto-economic security is still fragmented into each network.

Then you have omnichain restaking, which aggregates crypto-economic security from multiple chains and extends them to AVSs. Basically, AVSs can be secured by operators who come Ethereum, Polygon, Avalanche, and others *simultaneously*. This approach pools the crypto-economic security that's fragmented in traditional staking and single chain restaking.

TLDR

- Traditional staking secures blockchain networks and the on-chain dapps deployed on them.

- Off-chain apps like oracles and bridges do not inherit this security so they have to bootstrap their own.

- Restaking provides a solution that extends security from blockchain networks to off-chain apps.

- Off-chain apps can now rent their security instead of building it from scratch.

- These off-chain apps, called AVSs, define the slashing and reward mechanics.

- Operators (fancy word for validators) opt into security AVSs and in return get rewarded by them.

- These rewards are shared by restakers.

- Restakers increase their risk but also increase their reward.

Of course the rabbit hole goes deeper, and there are other risks of restaking I didn't go into like smart contract risk or social consensus risk (AHEMeigenlayer) of some solutions and how that's being solved by others.

Anyway... hope you find this helpful. Even if you don't like the concept of restaking, I'm hoping you at least have a better understand of the value it provided to off-chain applications.

Cheers!

[link] [comments]

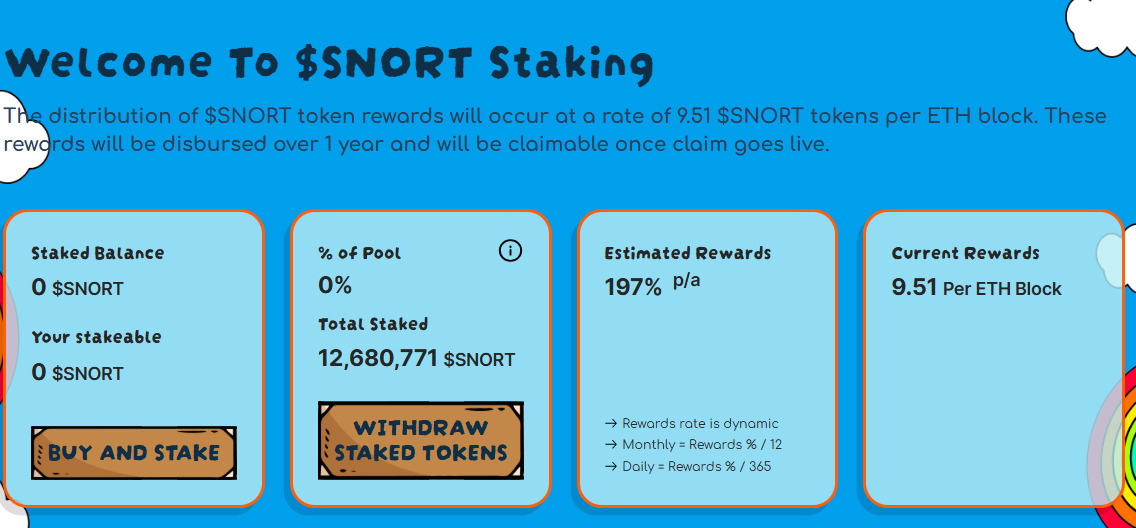

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments