Short Term

Liquidations: Mess from previous cycles will pass. FTX, Genesis, mtgox, etc sell offs will pass and coins will shift to harder hands. Future rugs and scams are still possible but the market will mature over time.

The halving: I don't think the pump will be as significant as previous halving cycles, but this is far from priced in. Supply shock is possible.

Mid term

ETFs: The ETFs open up so much capital potential inflows from retirement accounts, small business, SMEs, as well as people who simply prefer to hold without the hassle of self custody. The ETFs break existing models - BTC hasn't seen capital potential like this before.

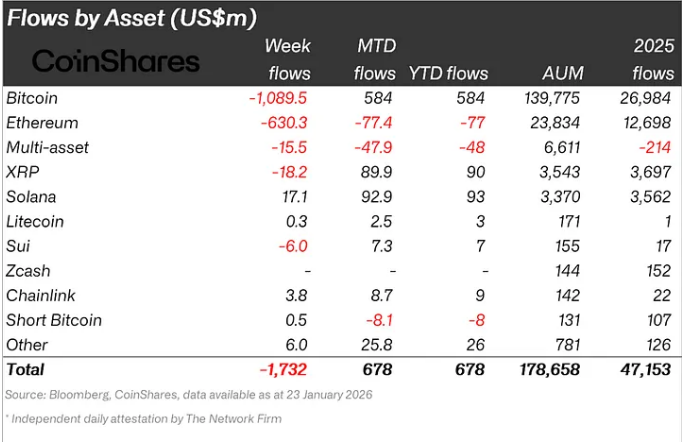

You can already do the napkin math on ETFs: we have seen inflows of up to $500M per day, so at $50,000 ETFs are buying up to 10,000 bitcoin a day while 900 are being issued to miners.

Layer 2s: L2s will continue to advance on top of the base layer.

Clean energy: This will continue to improve. Methane mitigation, stranded energy, grid stabilization, clean energy expansion. Just look at the stuff Daniel Batten is doing - it is truly amazing and I don't think anyone could have envisioned it. Opposing journalists will continue to be fact-checked and community noted.

Long Term

Supply: 93% of bitcoin supply has been already issued, some of this 93% will be traded around, of course every coin has its price, but long term holders and players like Saylor will just keep locking up more and more over time, leaving just 6% issuance to fight over for the next 14 years. After that, only 0.5% supply remains.

Deflation vs Inflation: As taught by Jeff Booth, exponential efficiency is deflationary, if the true deflation rate is 5% per year and inflation rate is 5% per year, these will compound and diverge over time. The gap between the 'natural' price level based on technological deflation and the 'artificial' price level maintained by monetary policy widens progressively. Where do you think this is heading?

Real estate: I don't see how it is possible for real estate to repeat the gains it has enjoyed in the past 10-20 years. Upcoming generations would be priced out of homes and rental returns would diminish. Yes, there is value in owning your home and a roof over your head, but RE as an investment will not repeat the same pattern we've seen. Governments will not allow it through fear of revolt.

Gold: I don't think I need to say much here, utility will remain but SOV returns will diminish. Interestingly, the April halving is when the stock to flow ratio of BTC overtakes that of gold.

Overall, in 4 years when the block reward is reduced to 1.5625, how much more fiat will have been printed? How many more people will have figured this all out? We already know supply will be less, will there be more demand? I believe so.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments