Nigeria’s Securities and Exchange Commission has proposed to raise the registration fees for virtual asset service providers (VASP) seeking an operational license. This development is accompanied by other changes in the regulations governing the key aspects of the crypto industry in the West African country.

VASP Registration Fees In Nigeria To Rise By 400%

On March 15, the Nigerian SEC released a set of proposed amendments to its Rules on Digital Assets Issuance, Offering Platforms, Exchange, and Custody. According to the securities regulator, the suggested changes are aimed at providing more regulatory clarity to a rapidly developing crypto market as well as implementing feedback from industry players following recent discussions with the Central Bank of Nigeria (CBN).

Of all the updated regulations, a quintupling increase in VASP registration fees from 30 million ($18,841.75) to 150 million ($94,208.76) has been a major talking point as such policies are usually viewed as a means of discouraging business participation, in this case, the emergence of new crypto exchanges. Meanwhile, it could also function as a protective mechanism, thus ensuring that only sturdy and well-funded parties are able to operate as VASPs.

Furthermore, crypto exchanges and trading platforms would now be expected to pay an application fee and processing fee of 300,000 naira ($188.42) and 1,000,000 naira ($628.06) as opposed to previous values of 100,000 ($62.81) and 300,000 ($188.42) respectively.

In addition, the country’s regulator has also raised the minimum paid-up capital for these businesses to 1,000,000,000 naira ($628,058.40) which must be set in bank balances, fixed assets, or as an investment in certain securities. Meanwhile, there will be a fidelity bond covering up to 25% of this minimum paid-up capital in line with the Commission’s existing rules and regulations.

The Nigerian Crypto Space And Its Troubles

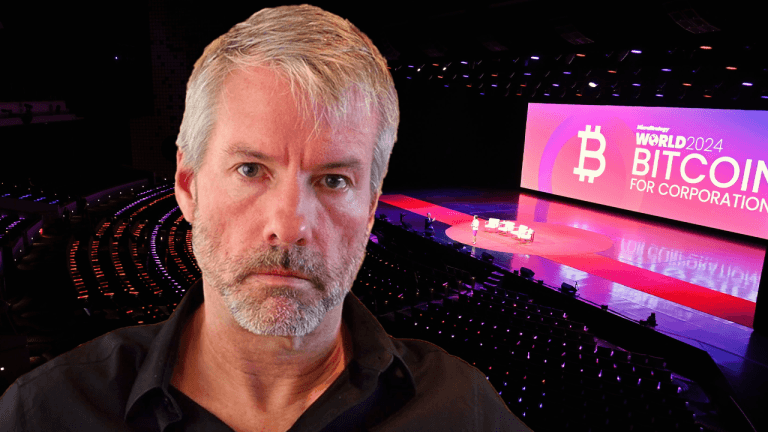

Lately, Nigeria has been among major crypto headlines due to an ongoing squabble with prominent crypto exchange Binance. The government of the West African nation has accused Binance of playing a significant role in the devaluation of Nigerian Naira, demanding compensation to the tune of $10 billion.

This accusation has been accompanied by the Nigerian government making other demands of Binance in terms of user data and reportedly detaining two of the exchange’s top executives. In response, Binance has shut down all Nigerian Naira (NGN) services as well as delisted Naira trading pairs on its platform. However, there are still no indications the exchange will pull out of the African nation.

At the time of writing, the total crypto market cap is valued at $2.52 trillion, following a 4.23% decline in the last day. Meanwhile, Bitcoin, the market leader, now trades at $66,275.63 due to an ongoing price correction.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments