There are a lot of young people on this subreddit becoming financially literate for the first time, so I'd like to share a few not so obvious things I've learned in the last 5 years that I really really wish someone had told me when I was 20.

Everyone Invests, Some Just Don't Know It

You don't get a choice whether to "invest" or "not invest" your money. If you "haven't invested" your money, you've just invested in cash. In the United States, that means you've invested your money in the United States Dollar (USD).

For an ideal currency, leaving your money in the currency means that it doesn't gain value, and it doesn't lose value. It just remains there, with its same value, until you purchase with it. That's why, traditionally, people have thought of leaving money in cash as "non-investment."

There is supposed to be no risk to lose your value, and no upside to gain value. Key phrase: supposed to be.

When your Grandparents or older folks tell you things like "cash is king" or "you should always have some cash on hand," they are giving advice which is drawn from their experience of a far different monetary environment than the one in which we currently live. Theirs was closer to the ideal, where cash really was risk-free, reward-free investment.

So "only invest what you can afford to lose" is quite misleading. Typically, the person telling you this is telling you to invest more of your money in cash, and less in other traditional "investments." This is an awful idea, because when investing in cash, you are guaranteed to lose.

There is no investment strategy in the world that is immune to losing money, even cash. There is simply risk-reward for each investment. And in the current environment, cash is a particularly bad one.

Cash is Trash

Today, cash is a high-risk, no-reward investment. Central banks are increasing the money supply at an astounding rate. In the United States, the money supply increased by about 25%, or $5 trillion (a little more actually) in just 2020.

Money supply increase devalues the currency with respect to economic output:

- If economic output is stable, then a 25% increase in money supply means that 1 unit of money gets you 20% less than what it used to.

- Let's say the economy grew 25% with the money supply. Your 1 unit of money can now buy the same as it could before, except that you were entitled to have that money go farther as the economy grew, and that was taken away from you.

The point is to communicate to all young people that if you are holding cash, you are hemorrhaging money. A conservative estimate for the cost of holding cash over the next decade is 10% a year.

Living Expenses

Old wisdom is to always keep at least 6 months living expenses on hand in cash. It's referred to, tongue-in-cheek, as "fuck you money," the idea being that if you have to tell your boss to go fuck himself, you won't starve.

In the current monetary environment, you're paying a solid premium on those living expenses, about 5% / 6 months, in order to hold it in cash. Because of this, dropping down to 3 months, or even 1 month isn't so unreasonable. It's really, really expensive to hold money in cash, so decide how big the risk of needing fuck you money is in your current job.

If you're happy, save some money and ditch the cash. Also, the best investment today is quite liquid, which brings us to...

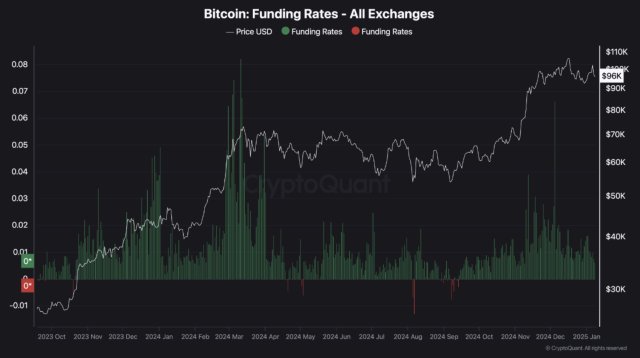

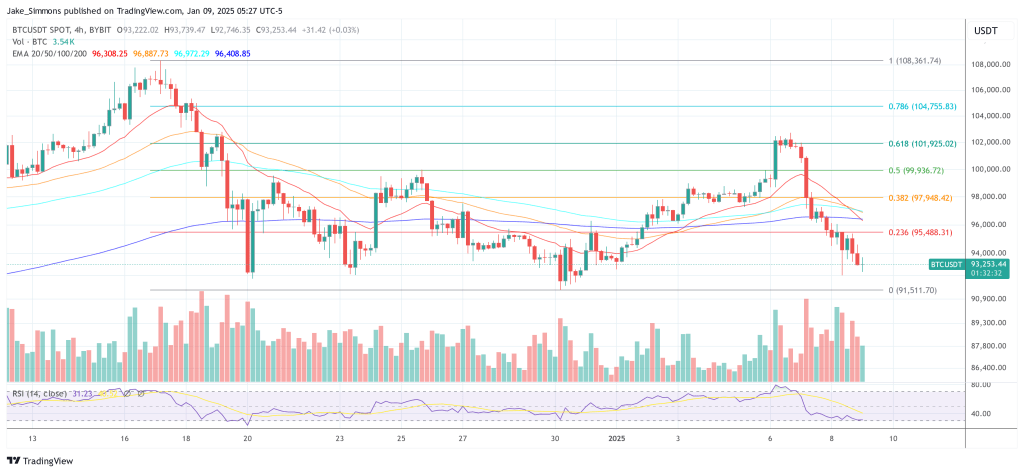

Bitcoin

Bitcoin is designed as the ideal money we talked about above. Eventually (we're probably 2 decades away from this), Bitcoin won't lose value, and it won't gain value. It will just be. If you have 1 BTC and you hold it for 10 years, it'll entitle you to the same amount of value when you spend it as you provided to the economy when you earned it.

Now, if economic output doubled in that time, your 1 BTC will buy twice as much, but that's still just the 1 BTC of value your initial labor entitled you to, because your labor contributed to that doubling.

Currently, only a very small fraction of the world understands that BTC is the store-of-value asset layer of the future, and so only $1 Trillion of the likely $200 Trillion that will end up there is already there. That's why BTC, today is an investment, and not merely money.

But BTC, fundamentally, is not designed to be an "investment" in the traditional risk-return sense of the word. It's designed to simply hold value over the long term, the way USD and other cash does not (because governments can print more of those at will).

As such, BTC is quite liquid. Even today, you can sell BTC on an exchange like Gemini and withdraw the corresponding currency in less than a day. That means that it would be totally reasonable to hold your 6 months living expenses in Bitcoin instead of USD, and simply sell the BTC if an emergency strikes and you need cash. That way, you capture the upside of BTC, and avoid bleeding 10%/year on your living expenses money.

Debt and Inflation

The worse cash gets, the better debt gets, and vice versa. When the value of the currency denominating your debt is collapsing at 10% a year, that means that the real value of the debt you must repay is also collapsing at 10% a year.

I'm just going to say this outright: in the currently monetary environment, paying off something like a 6% fixed rate mortgage is a terrible idea. It's throwing away at least 4% of your money every year for no reason.

People don't seem to realize that all financial instruments also exist as their mirror, because of opportunity cost.

Paying off a loan to the bank is effectively the same thing as giving a loan to the bank. If you have a $100 loan, and you're paying $1 interest/year, after one year, you have -1$, then -2$, then -3$. The bank is gaining $1/year from you over the long term.

All you're doing when you pay that off is reversing who gets the $1/year. If you pay that off, and now you have $0, $0, $0, instead of -$1, -$2, -$3. You are now earning $1/year, with respect to the loan option, instead of the bank.

When you pay off a loan, you are loaning the bank. Would you rather you have $100 and the bank gets $1/year, or the bank has $100 and you get $1/year.

Ask yourself - in the current inflationary environment, do you really want to be loaning the bank your hard earned money for a paltry 6%? And the lower the interest rate, the worse that is.

Summary - Opportunity Cost is Everything

Money doesn't exist in a vacuum. All uses of money must be compared with all other possible uses for that same money.

Cash is trash. You want to avoid holding it if at all possible.

Bitcoin is very liquid, it will probably appreciate, and it's engineered to maintain its value across time. It's a better vehicle than fiat (government created and printed) cash in every way.

In an inflationary environment, paying of debt is a bad idea. You'd much rather take a loan from the bank than give the bank a loan. Interest rates matter for this. If the interest on the debt is high enough, it still may be correct to pay it off.

Any interest rate under the rate of monetary expansion is essentially free money, as long as that money is placed in an asset that will hold its real value.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments