What is a moving average?

A moving average is a widely used indicator in technical analysis that helps smoothing out price action by filtering out the “noise” from random price fluctuations.

They are calculated by taking the average closing price of a currency pair for the last ‘X’ number of periods. It is a trend-following, or lagging, indicator because it is based on past prices.

Moving averages are a simple way to see overall price behavior for an asset, and are also used as variables for a number of more complicated technical analysis charts and tools.

The highest the number the smoothest the moving average and because moving average is an indicator used to forecast future prices the highest the number of the moving average the smaller number of signals you get.

There are many types of moving averages. The two most common types are the simple moving average and the exponential moving average.

Simple moving average or (MA or SMA) are the simplest form of moving averages, but they are susceptible to spikes and this can trigger false signals. By other hand exponential moving average (EMA) puts more weight to the recent price, which means they place more emphasis on what traders are doing recently.

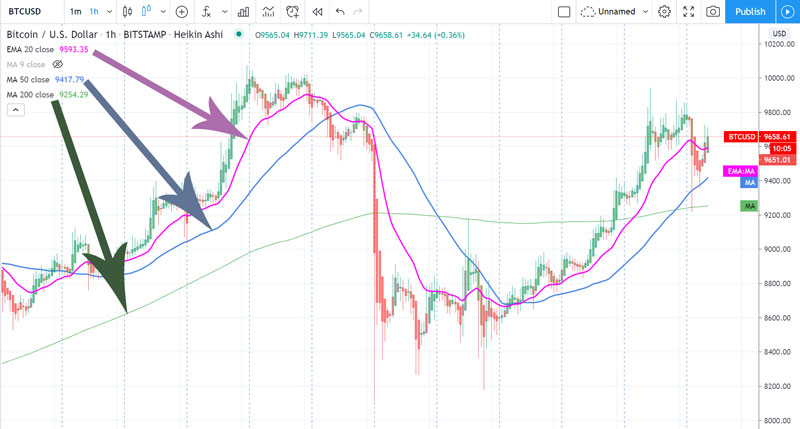

The most used are 3 moving averages:

EMA20 (pink) - it pays more attention to recent prices,

MA50 (blue)

MA200 (green) - they work well at longer time frames and also give good ideas about what the overall trend is doing.

The Best Strategy System

We are buyers when moving averages are moving up, we exit when they are flattening out and we sell when they turn down. Like any other trading system we got our own rules so in the following examples we will show you how to apply this rules to.

Entry strategies

When EMA20 is above the MA50 which is above MA200, we are in an uptrend. We buy dips against the moving averages following these rules:

- Green candle after reds.

- Price test 20 ema.

- CCI turns green.

- And as long as we are above 200 MA, we can buy dips

- When we get above the 200 MA (bullish reversal), there is almost always a pullback. Which is a good risk: reward entry point. Some traders buy on the cross of the 200, while some others will buy as soon as they spot a bullish reversal.

Exit strategies

When the EMA20 (pink) goes below the MA50 (blue) or when moving averages are flattening out we get out following the next rules:

- When a candle breaks the lows of the previous candle. take half profits and wait for the buy signals and add on to your position.

- If price breaks the EMA20, MA50 and/or CCI turns red.

- If you are very far from the MA50 (more than the average of the chart), get out on the first red candle

- if you close below the EMA20 and you couldn't get out, exit definitely if you close below the MA50.

- If you are really stretched (price very high from 200 ma), you should go down to 15 min and get out on a reversal this means when the MAs cross each other

- In a downtrend when EMA20 is below the MA50 which is below MA200, every rally to EMA20 is a sell. Sell pullbacks to the EMA20

Long-Term & Short-Term Trades

Whenever you want to trade with a short-term target on the daily chart, it would be helpful to take countertrend entries on smaller time frames (15 minutes or 1 hour).

If you are getting long on a counter-trend signal and the price is above the 20 EMA, your exit should be when the price closes below the 50 MA. You will buy back if the price crosses and pullbacks to the moving averages.

Timeframes

a) In Crypto the 4-hour charts are good for trend trading but If you have more time on your hands, trade in an hourly. It will give you tighter entries and stops.

b) Sometimes is useful to transpose a known moving average (MA) from a bigger time frame to a smaller and vice-versa, this multi timeframe moving average calculation can be done by applying the next cross-multiplication:

Required ma = (given time frame * known ma) / (time frame where we want to import the ma)

For example, the MA200 MA (known ma) on a 15 min chart (given timeframe) is the hourly (60 mins) MA%) (required ma).

Required ma = (15*200)/60= 50

c) When trading on an hourly timeframe during pullbacks, most of the time in crypto, the price doesn't come all the way back to the MA20. When this happens, you go to a lower time frame for a tighter entry.

d) Crypto market moves really fast, therefore it's difficult to find an entry on the hourly. Most of the time you'll need to go down to a 15 min to get an entry.

How to spot a sharp reversal?

a) The distance between the MA200 and the price, is an indicator of a sharp reversal. If the price stretches too far, more than the average, it is bound to be a correction or reversal.

In such case, take your exit on the first red candle or in the first close back to the EMA20.

In case you miss the earlier ones, take your exits on the MA50 or the MA200.

b) In a bearish setup, EMA20 ema is below MA50 which is below MA200, we draw trend lines to connect the lows, and when we break down from there, it is a perfect sell setup.

Trend Reversal Strategy

- You can spot the first signs of a reversal on a 15 min, then an hourly and then 4 hourly timeframe and so on.

- It's important to recognize bullish reversal in a downtrend before the trend becomes bullish because you get in at a better position.

- In a downtrend, we need to see at least a double bottom or a lower bottom than the pre- vious one to make sure that the price has bottomed out.

- Therefore, to spot a reversal we go down to smaller timeframes (15 mins) and watch for a breakout. When the moving averages become bullish (20 ema above the 50 ma) we will get a cross which should consolidate and hold against the 20 ema and continue higher.

Golden Rules

- If we are trending, we should keep making higher lows higher highs (bull market) / lower lows and lower highs (bear market), otherwise we are just consolidating (not going anywhere).

- previous highs are always the new resistances after a correction.

- the MA20 is our best friend we use it to get it and out of trades all the time, on smaller timeframes it’s our trigger and on bigger timeframes is our trend system most important signal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments