In stocks during a bear market the downtrend is punctuated by brief but heavy rallies to the upside, this is caused by shorts temporarily closing their positions. Once a big short starts to exit nobody wants to be the last guy out the door so other shorts pile in and since shorts close by buying suddenly you see big buying volume coming in. This is where people get in trouble because if you are not experienced with a bear market you may see this heavy buying and think “oh no I missed the bottom” and fomo in. Meanwhile the following week the short gets back from his tropical vacation and sees a nice 20% uptick on the back of dumb money retail and gets back to business. If the market suddenly rallies always ask yourself “has something fundamentally changed that would cause everyone to suddenly pile in here?”

[link] [comments]

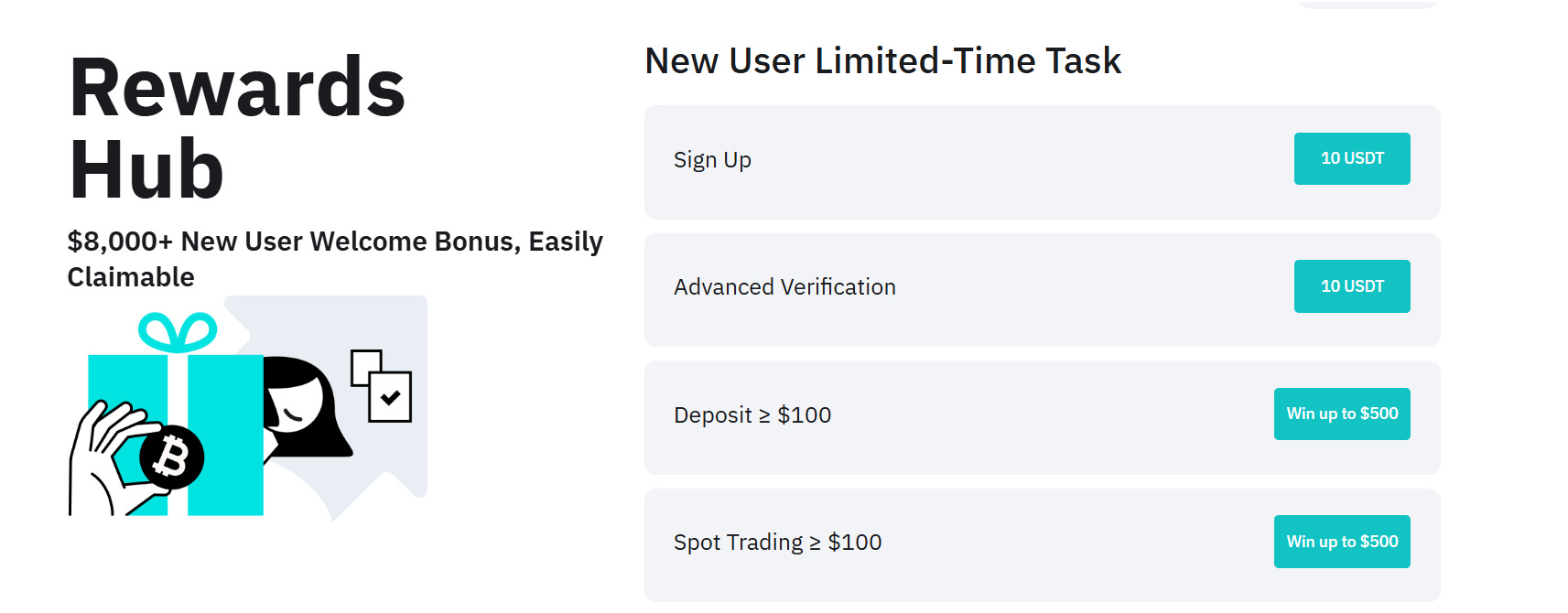

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments