Hello everyone,

I have been involved in crypto since 2017 and thought I would share my two cents about how to choose coins using a value-investing approach.

I believe that crypto investors fall into two categories: speculators and value investors. Speculators are people who try and anticipate future price movement using specific data/tools (i.e. TA, predicting the psychological effect of certain announcements, etc.). As a general matter, they are unconcerned with fundamentals. As you have probably guessed from the title of this post, I do not subscribe to this approach. Although I am sure that many people can make that work for them, it just isn't for me.

Value investing dates back to the late 1920s and was first conceptualized by Benjamin Graham and David Dodd in their 1934 book "Security Analysis." In a nutshell, a value investor (1) looks at the fundamentals of a business (i.e. assets, liabilities, free cash flow, projected growth, etc.), (2) uses that information to calculate the fair value of the business, and (3) purchases stock of the business where the stock price reflects a valuation that is significantly below the value investor's assessed value. For example, if I calculate that business X should be worth around one billion dollars and business x has one million shares of stock representing the entire business, then the fair market value of each share would be one thousand dollars a share (one billion divided by one million). I would therefore buy stock of business x if it were listed at say, 300 but not at 1100.

Over the course of the last century, people have studied how to do value investing ad nauseum and have developed several very sophisticated theories on how to calculate the fair market value of a company. Unfortunately for them (and great for us), those approaches do not work with cryptocurrencies because cryptos are not structured like traditional companies. Because of this, we aren't yet competing with expert value investors.

MY APPROACH:

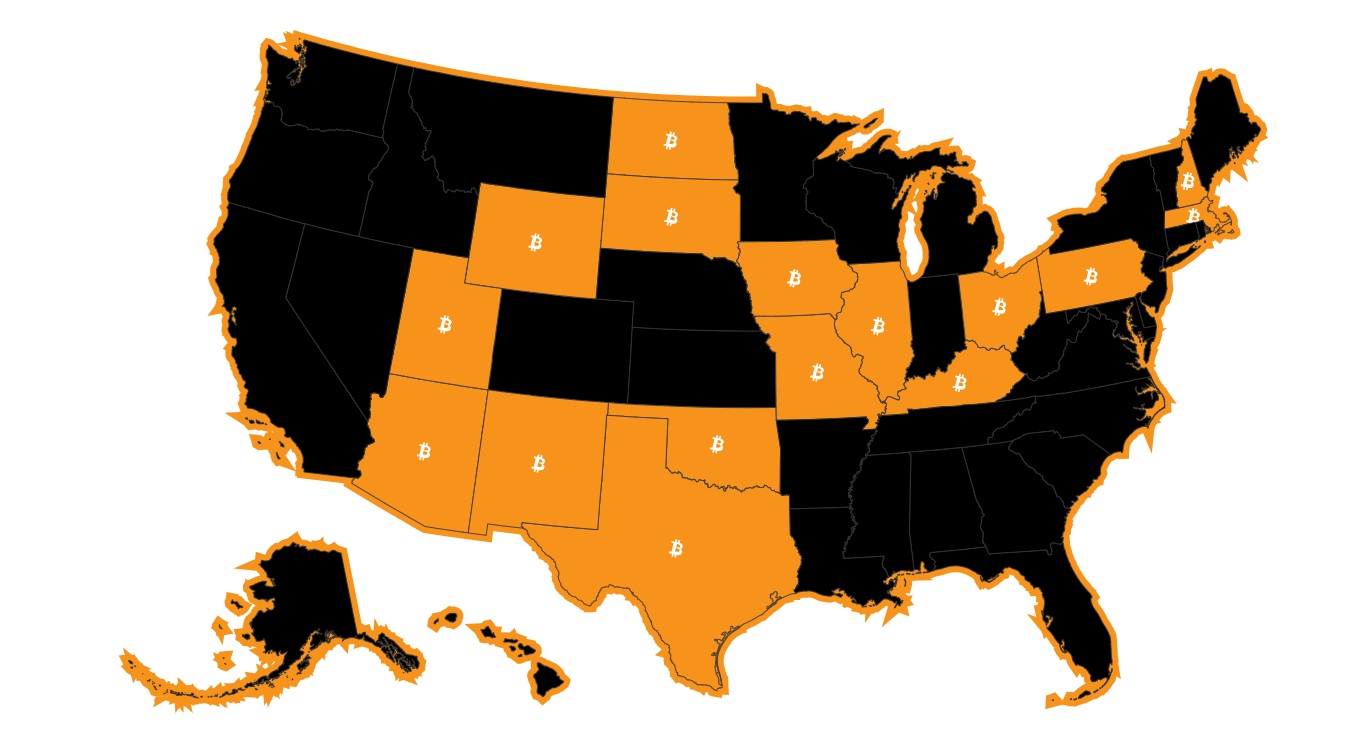

Only look at Business-like Cryptos: For value investing to work, we can only look at cryptos that have features that make them somewhat like traditional businesses. For this reason, I only consider cryptos that have a discrete product or service they provide. For example I would consider cryptos like Siacoin/Storj/Filecoin (decentralized storage), Golem/IExec (cloud computing), Theta (video streaming), Powerledger/Wepower/SunContract (decentralized energy marketplace), but not bitcoin/nano/other currencies. Platforms like Ethereum, Cardano, Iota, Neo, etc. fall somewhere in between and have to be assessed for their unique value added.

Decentralization Adds Value: Once we have a list of candidate investments, I discount any cryptos that do not have a value added proposition due to decentralization. Believe it or not, not everything needs to be decentralized. If I can't answer why decentralization adds value, then I throw out the coin.

Working Product: Assuming the coin has a good value added from decentralization, I look to see if they have a working product, product in beta, etc. I can't stress enough how important this step is. Anyone can say their product will do anything, but the proof is in the pudding. If they have a working product, I test the product to see how it works.

Governance/Funding Structure for Development: Although governance and funding for developers do not necessarily go together, they often do. In a nutshell, I want to make sure that the coin has a method to maintain funding to the developers of the product/service even if the price of the coin goes down. Normally, solid projects will have non-profit foundations with an ongoing revenue stream for developers. This ensures that the project will continue to mature/grow even during a bear market. I am sometimes willing to be laxer with the revenue requirement if I have solid evidence that the foundation has a huge stockpile of funds that can maintain their burn rate for long periods of time.

Tokenomics: I prioritize to see (1) how many tokens/coins are in circulation vs. the future, (2) what percentage of the tokens/coins are controlled by a small number of people, (3) understanding the way the tokens/coins operate re. inflation/staking. There are other red flags that can pop up, so I suggest everyone spend some time reading about tokenomics generally.

The Market Size: I always try to look at the current market size in the space that the coin is competing. For example, for Storj/Filecoin/Siacoin, the decentralized storage market is projected to be around 150 billion by 2022.

Market Cap of Traditional Competitors: I find it useful to try and find traditional companies in the space and look at their market caps. For example, Dropbox has a market cap around 10.5 billion dollars.

Competitors in Crypto Space: It is always a good idea to look at the crypto competitors for several reasons. First, you might find a better investment! Second, competitors will always be the best sources of useful criticism of your chosen coin. If there is something wrong with Siacoin, you can be sure that the people over at Storj are going to tell you all about it in their reddit/discord/telegram.

Telegram/reddit/Discord: Dovetailing off of #8, I always go to the telegram/reddit/discord servers of the target coin and of the competitors. It is amazing how often I learn something unexpected and useful.

Putting it all together: Once I have the information above, I try to make a reasonable/conservative judgement about what the coin's current value is and what its potential value could be in terms of market cap. This is the hard part, and I don't even know if I am any good at it, so I can't say that I can provide any help on this front. Regardless of whether or not I am right, after I come up with those figures, I take a look at the coin's current market cap and buy if it is significantly below what I think it is worth. I try to be conservative and only buy things that seem really undervalued. Luckily, a lot of cryptos are very undervalued!

I hope that some of you find this useful. Obviously these are just my thoughts, so take them with a grain of salt.

EDIT: I want to clarify that just because I mention certain coins here, that does not mean I think they are good purchases. I only mentioned them to make very specific and narrow points.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments