| In todays TA I'm going to be continuing a series of analyses. I'll recap some important terms here but for a full recap please see this post going over why the MA 1000 is a useful indicator for baselines. I'd like to emphasize that the MA 1000 is not "the" baseline but rather a baseline.

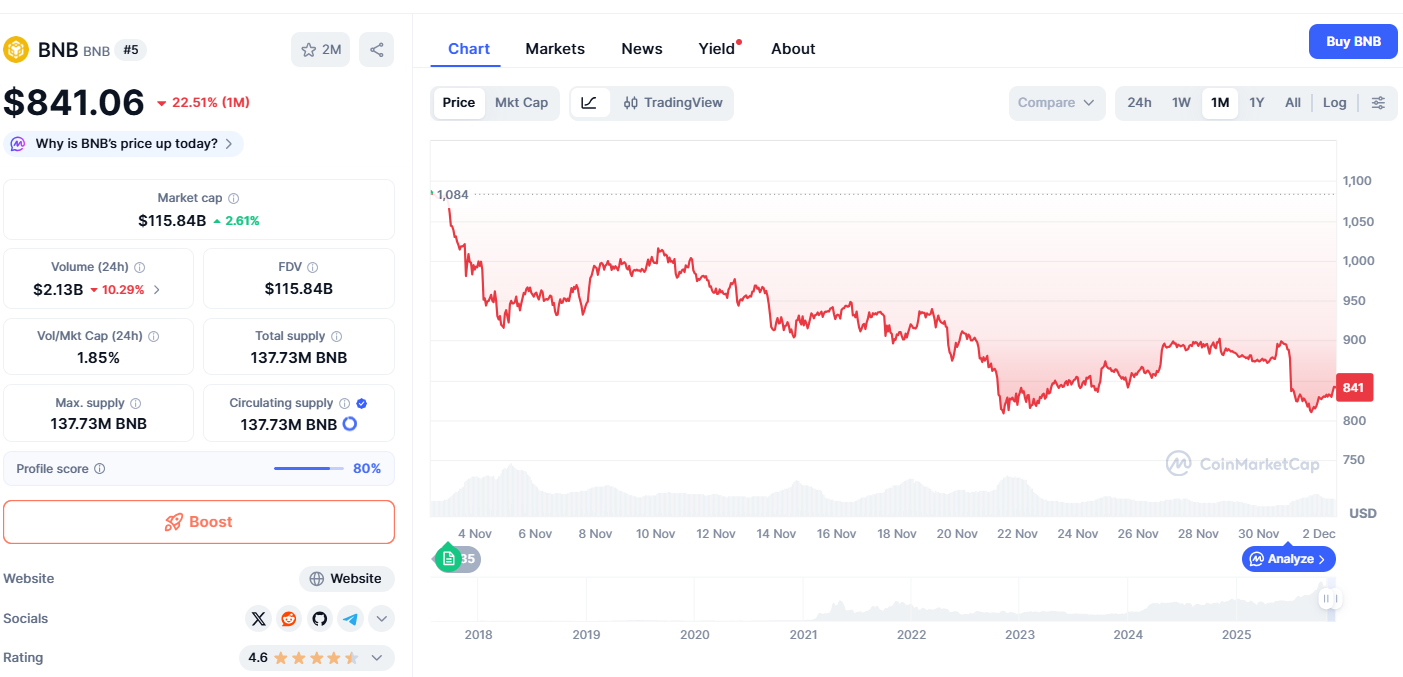

Ok so on with the show! BTC's MA 1000 on the daily chart ETH's MA 1000 on the daily chart What we're seeing are that both BTC and ETH are behaving similarly at the moment. In my last post, I mentioned how ETH had crossed the MA 1000 threshold and quickly corrected back below it. What we're seeing now is that both BTC and ETH are remaining below that threshold however are near it nonetheless. They have also maintained a similar distance from the MA 1000 since my last update. It's tough to say right now, but they also look as though they're oscillating in the short term along both their MA 50, and on a longer horizon as though they're beginning to oscillate along their MA 200. We won't know for sure until more data is collected/more time has passed. To emphasize the point from the intro, the MA 1000 is not the only baseline, but rather a baseline. Other MA's offer insight into shorter time frame baselines and that's what we may be seeing with the MA 50 and 200 discussed in this short paragraph here. This post will *not\* be making any predictions about where prices will go. Instead, this post is emphasizing that prices in crypto seem to follow statistical concepts such as regression to the mean. From what we can see, prices do not like to deviate too far from their mean for too long, and that any drastic deviations from the mean are eventually met with correcting back towards it. I hope you enjoyed! [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments