Decentralized exchange (dex) volumes have become very prominent this year and some dex applications have been dealing with volumes that are sizable to large centralized crypto exchanges. During the last seven days, Ethereum-based dex platforms processed $21 billion with Uniswap capturing 71% of all the Ethereum-based dex applications today. Statistics from a report published by The Block Research and recently updated metrics, show dex platforms saw $1 trillion in volume during the course of the year.

Dex Volumes in 2021 Reach New Highs According to Digital Asset Report

Decentralized finance (defi) has grown a great deal this year and as the end of 2021 approaches, there’s more than $250 billion of value locked in defi protocols, according to defillama.com. Metrics further indicate that out of all the blockchain platform dex applications, Uniswap commands the most 24-hour volume with $1.45 billion today. Data also shows that Uniswap has roughly $8.81 billion total value locked (TVL) which is just below the $22.36 billion TVL held by Curve Finance.

In terms of 24 dex leaders today, below Uniswap is Pancakeswap with $848 million in 24-hour volume. Below Pancakeswap’s 24-hour volume is Trader Joe ($453.7M), Curve ($453.1M), Sushiswap ($401M), Uniswap v2 ($380M), and Spookyswap ($185M). Just recently, The Block Research published a comprehensive 150-page report covering the “2022 Digital Asset Outlook,” and the research covers both centralized and decentralized exchange volumes.

For instance, the vice president of research at theblockcrypto.com, Larry Cermak, explained in a tweet on December 16, that “The Block’s legitimate volume index, the spot volume in 2021 will surpass $14.5 trillion, which is 8 times larger than last the volume we saw last year.” Statistics from the study and a report authored by Yogita Khatri further show that dex trade volume reported over $1 trillion in trade volume in 2021.

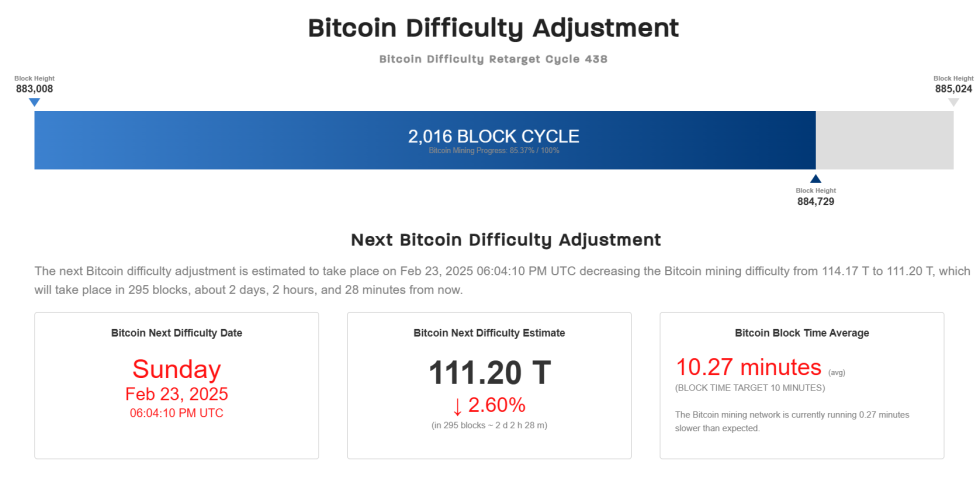

“Overall, monthly dex volume peaked in May 2021 at $162.8 billion, and the most considerable month-over-month growth was in January, with a 137.3% gain,” the 2022 Digital Asset Outlook report notes. “However, the volume has not fully recovered from the May crash, and the dex-to-centralized exchange spot volume ratio remained under 10% throughout the year.”

In addition to the dex volumes, the report highlights the use of dex aggregators. According to the study, dex aggregators like 1inch only represent 13.9% of the overall dex volumes. “1inch was the leading dex aggregator throughout the year with a market share of 64.9%, followed by 0x API (Matcha) at 16.8%,” the researchers detail. The scope of the researcher’s 2022 study delves into numerous other subjects like market performances, derivatives markets, mining revenue, on-chain volumes, stablecoins, and a summary of venture funding in 2021.

What do you think about the decentralized exchange (dex) volumes this year surpassing $1 trillion? Let us know what you think about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments