Bitcoin mining firm Riot Platforms has proposed to acquire its rival Bitfarms for US$2.30 per Bitfarms common share. This acquisition could reportedly make Riot the largest publicly listed Bitcoin miner globally. The deal offers Bitfarms' shareholders a substantial premium despite the volatile cryptocurrency market.

24% Premium

According to the press release, Riot's proposal offers a 24% premium to Bitfarms' one-month volume-weighted average share price. With approximately US$950 million in total equity value, the acquisition aims to enhance Bitfarms' financial strength and promises investors better returns from future growth opportunities. Riot mentioned that it had acquired a 9.25% stake in Bitfarms and is now the largest shareholder in the company.

Additionally, the merger aims to create a Bitcoin mining capacity of approximately 1 GW of current power capacity and 19.6 EH/s of current self-mining capacity. By the end of the year, the combined company is projected to reach up to 1.5 GW of power capacity and 52 EH/s of self-mining capacity, reportedly surpassing any other publicly listed Bitcoin mining company.

Riot Proposes to Acquire Bitfarms for US$2.30 Per Share to Create the World’s Largest Publicly Listed Bitcoin Miner.Read the full press release here: https://t.co/SnBijrL3i7For disclaimers, please visit: https://t.co/6RQFSK9MKb.

— Riot Platforms, Inc. (@RiotPlatforms) May 28, 2024

The acquisition proposal was initially presented to Bitfarms on April 22, but the Board rejected it. Riot has partly blamed the decision on the changes in Bitfarms' management after the exit of its CEO. The Nasdaq-listed firm has now opted to approach Bitfarms' Shareholders to present the acquisitionproposal.

Expansion Across North and South America

The combination will result in a company operating 15 facilities across the United States, Canada, Paraguay, and Argentina. This network, with up to 2.2 GW of total power capacity when fully developed, could position Riot for continued expansion and long-term growth in favorable energy environments.

According to the two entities, the proposed transaction, unanimously approved by Riot's Board of Directors, offers Bitfarms shareholders a mix of cash and Riot common stock. Riot has over US$700 million in cash on hand and access to public equity markets.

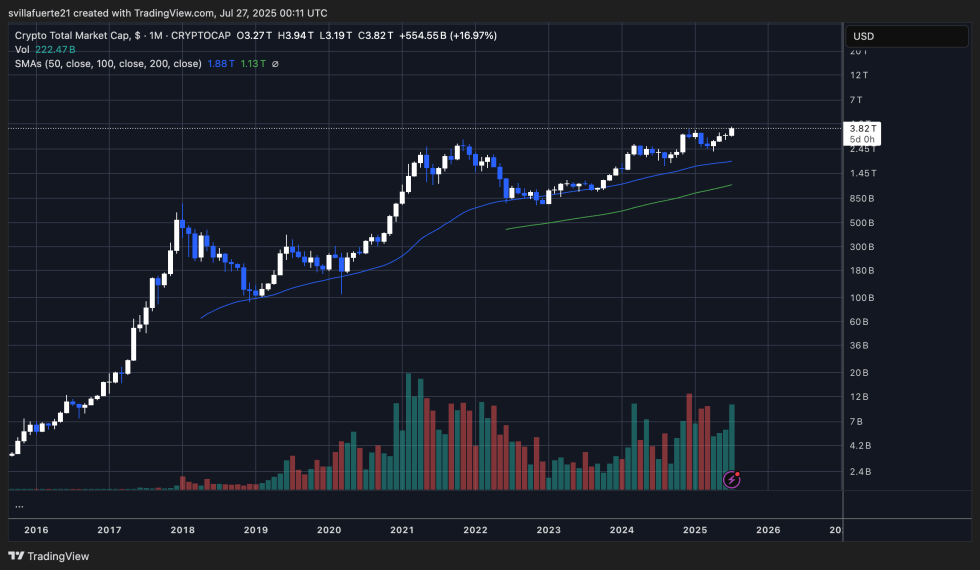

Last year, Bitcoin miners faced a significant setback following a crash in the price of Bitcoin. Mining companies faced a collective loss of $2.8 billion, coupled with dwindling revenues reaching monthly lows. This sudden downturn severely impacted the market capitalization of exchange-listed BTC miners and other digital assets, plummeting to nearly $3 billion in August last year.

Riot Platform and Marathon Digital Holdings were the most affected companies by this downturn, experiencing significant loss in capital. Riot Platform's chart revealed a stark decline, shedding nearly 50% of its value from July highs. Despite a 200% gain since the start of last year, the company relinquished a sizable portion of its profits.

This article was written by Jared Kirui at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments