Obviously they'll use Voltage, Strike, or another commercial Lightning provider to run their nodes and possibly provide liquidity. I'm assuming a cashless world too, which will, in my opinion, come far faster than most people think. The reason for it is that debt, inflation, foreign demand, and commodity issues will play out driving ALL fiat over the next 24 months to be more volatile than BTC--which will be the biggest shock of all to bitcoin critics. Bitcoin is already more stable than several currencies yoy (Turkey, Argentina, Cuba, Venezuela, Russia, Iran, Libya, Congo, Lebanon just filed bankruptcy, Ukraine went bust, etcetera) and unfortunately, we don't hear from many of these citizens on this sub, so we're stuck with our experience of the world through financial privilege and the English language. The next step then, would be a robust credit market begins developing around bitcoin, as the more stable money, a money proffering better lending terms, and the neutral money that enforces rules, which antagonistic currencies can't do anymore, because in a trust-based system, you need trust. That's gone, and will get much worth. CBDC's will make this worse, won't be fungible money, and for the USA, don't at all fix its global USD problems.

The Lightning Network as a P2P proof-of-stake (channels require staking) scaling solution is unique with its velocity of money, and the perfect complement to the immaculate proof-of-work base layer that the world will build around. PTLC's and Taproot will change the LN considerably for the better though.

7000 BTC ($300M)

That's roughly what Target would require for just their online sales on an LN channel, and online sales I must add, make up only 20% of their total sales. I won't bore with too many details, but I used their 2021 Cyber Monday data because in that 24-hour period online sales peak for the year at almost $2B. The avg basket size is $47 per customer, with 42M unique customers globally (US, Mexico, China, UK). Peak shopping time is 5PM-9PM when 60% of sales occur. So considering instant settlement and the velocity of money, then dividing the peak time, into peak sales, on the peak day, would it be wrong to say this channel would require 7000 BTC ($300M) max to support its absolute threshold? I'm Mallardshead.

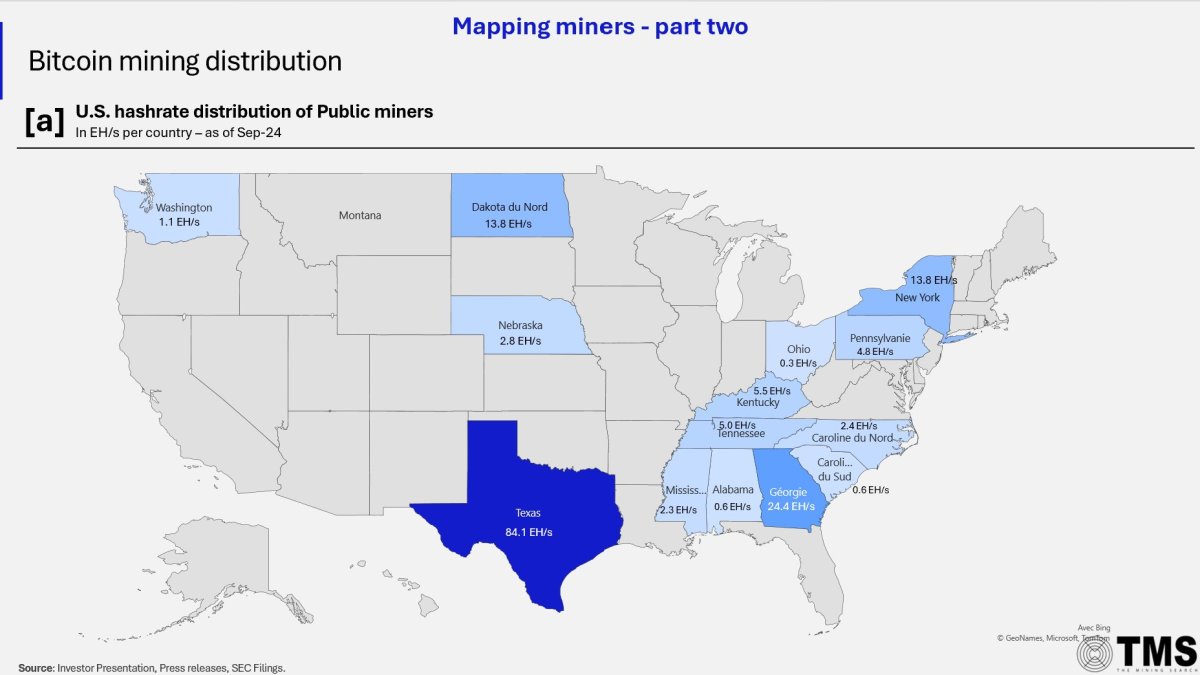

They'll run much lower liquidity on most days, maybe down to even $50M to save on borrowing costs, but I think the LN is where a robust yield curve can start to develop. This all assumes Target doesn't bring/buy their own BTC, which means they'd be left with only 3rd party node management costs, which would be non-existent compared to the 4%+ per transaction the major credit cards charge. 7000 BTC is about how much the largest miner in the US (Marathon Digital) has on their balance sheets currently, and it shows how important putting BTC on balance sheets is right now for companies.

But this is all complete bullish*t. It assumes that bitcoin's trustless network doesn't absorb more global trust (and thus value) than it has now. If it did, those channels would get much smaller in whole BTC terms, and the excess liquidity would start financing more and more growth, leading to more and more abundance, leading to more and more value for the money.

So, this is why I'm not as angry about the 2022 Bitcoin Conference as many others were regardless of the shillery. The conference at large was really all about payments and Lightning in my opinion. Which is excellent, because that entire infrastructure needs to be in place when the world calls upon it.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments