Developing Lightning as a Service (LaaS) removes friction from bitcoin and gives users the experiences they crave.

This is an opinion editorial by Roy Sheinfeld, the cofounder and CEO of Breez, a Lightning Network mobile app.

Ready for a hot take? Check this: Money has no inherent value. And, besides being a special kind of money that allows for disintermediated transfers, the same applies to bitcoin.

As banal as it may sound, money is just a means to an end. As a matter of fact, it’s a means to any number of ends. And those ends are what matter. Money — whether dollars, satoshis or the rai stones of Yap — is not valuable for what it is, but for what it lets us do. We transform money into experiences, and experiences are what make a life, not ledger entries. Everything else is bank propaganda devised to generate interest.

As long as it’s “just” a store of value, bitcoin is even further removed from the ends that matter (unless watching charts is your thing). At least by turning bitcoin into a medium of exchange that can be traded for those valuable experiences, the Lightning Network moves bitcoin closer to what matters.

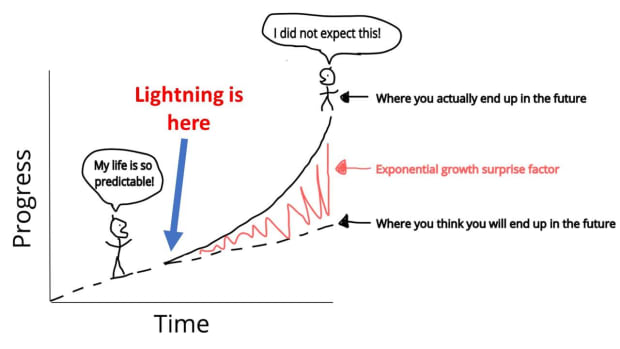

In fact, here’s a general postulate: bitcoin’s value is inversely proportional to the friction between the blockchain and the experiences it enables. Lightning was one big step in reducing that friction, and Lightning itself has taken several steps in the last four or so years to diminish it further, including:

- Mobile Lightning nodes

- On-the-fly channel creation

- Zero-confirmation channels

- LSPs to manage users’ connectivity and liquidity

Still, though it’s painful to admit, there remains more friction in non-custodial Lightning than in the best custodial and fiat solutions, and users will choose whatever gets them to those experiences faster and easier.

Less friction means moving bitcoin closer to creating experiences, which means more value in bitcoin and in life.

The First Key To Reducing Friction: P2P Interaction

The peer-to-peer (P2P) economy refers to disintermediated exchange, like creative people trading the fruits of their creativity — podcasts, videos, fanfic novels, 3D-printed cosplay accessories — with users for cash, without the intervention of banks, payment processors or aggregators.

Each intermediary in an interaction induces friction and increases the distance from the desired experience, and they can’t help it. Banks have to placate shareholders and regulators and make a profit. Aggregation platforms have to placate shareholders and regulators and make a profit. Payment processors have to placate shareholders and regulators and make a profit.

Notice the pattern? While each intermediary claims to be giving people what they want, they’re actually serving different groups who want different things at the same time. That intermediaries always take a cut, induce friction and increase the distance between people and experiences isn’t the result of bad management or evil intentions, it’s just the nature of the beast.

So, why not create something far better for users? Let people interact directly, pay each other directly, exchange goods and services directly. There are even services out there — social networks, messaging services, content aggregators, gaming platforms — that would like to facilitate transactions among their users, but they can’t because legacy intermediaries induce too much (financial, regulatory, UX) friction. Worse still, the centralization induced by these large data networks increases their power over each user and, therefore, increases the risk of abuse to all users.

The P2P economy isn’t some billionaire’s pipe dream; it describes a world where we’re closer to the experiences we value and to each other. That’s what Lightning was made for. We just need to make it happen.

The Second Key To Reducing Friction: Fitting The Right Application To The Experience

A lesson we’ve drawn from developing Breez is that different kinds of experiences (ends) need different payment interfaces (means). For example, the point-of-sale (PoS) terminal and podcast player that are included in our app are meant to feel like their own little self-contained interfaces, tailor-made for their respective purposes (or as close as we could get with the technological limitations of running a node on a phone).

But you can only cram so many activities and experiences into a non-custodial Lightning payment app. And, however clever, charming and good looking a team behind the payment app may be, they’re not necessarily best placed to devise new ways of applying P2P payments to new types of experience. We know how to make Lightning mobile and how to improve its UX, but when it comes to commerce, music, video streaming or any other vertical solution, experts in those fields know better how to craft the best experience.

Indeed, the PoS mode and the podcast player are just scratching the surface of what’s possible. We implemented them according to the KISS principle. Though they have scaled and attracted new users, they’re basically demo versions implemented to showcase how people interface with the P2P economy.

Could others with fine-grained expertise of those and other kinds of experience come up with better ways to apply P2P money to P2P interaction? Of course they could. And would those better applications achieve scale that our neophyte, outsider attempts never could? Absolutely.

And that’s the point. The better we apply the tech, the closer people get to the experiences they want, the more they will use the tech, the faster Lightning will scale. The scale we’re aiming for is not X orders of magnitude; we’re shooting for a world where kids roll their eyes whenever an adult says “Back in the fiat days…”

Achieving scale is a matter of reducing friction, and multiple, tailor-made apps that apply Lightning technology optimally to life’s many worthwhile pursuits is the best way of minimizing friction and expanding the P2P economy. It’s not about making the best wallet that can do everything; it’s about adapting Lightning — the means — to whatever end users want and whatever kinds of experience they want in exchange.

LaaS Liberates Lightning

Those who understand the technical requirements of running a non-custodial Lightning app will have realized already that adapting Lightning payments to any number of existing and yet-unimagined applications is incompatible with running a node in a single app. Lightning is far too technically demanding to scale the P2P economy as we have described it. Running the kind of always-on node required is an experience that few users, developers, creators or vendors out there will relish.

We’re envisioning Lightning as a Service (LaaS). LaaS is about using Lightning to remove friction from life, from the experiences we crave. The point isn’t to improve the user experience in the app, but to improve the users’ experience of Lightning as a whole that gives them more value in their lives.

And LaaS is doable. Our vision for LaaS has three major components:

1. A Lightning Software Development Kit (SDK)

As it stands, anyone seeking to integrate Lightning payments to their existing business faces a steep learning curve. Accepting payments over Lightning requires them to run a node, secure liquidity with a Lightning service provider (LSP), manage fiat exchanges, perform swaps on and off the Bitcoin blockchain, manage a wallet, and so on. A non-custodial SDK would give P2P entrepreneurs and existing web utilities access to those functions without having to start from scratch.

With a well-designed SDK, developers could select the Lightning functions they need from a menu and integrate them quickly and easily into their own applications. Instead of having to learn the Lightning tech stack, a Lightning SDK will let developers simply plug it into their own tech stacks.

2. Hybrid Architecture

Lightning needs to be immediately available wherever and whenever people want to make payments. Locking a user’s functionality into a single app or on a single device would require the user to adapt to the technology, which is backwards. That’s friction.

At the same time, though, KYC friction and global, cross-market expansion requires a P2P, non-custodial solution. As soon as LSPs start acting like banks, regulators will start treating them like banks. That’s friction too.

The solution is a hybrid architecture based on sovereign remote nodes, but that locates those nodes in the cloud rather than on users’ local devices. Any service could access these nodes from any device, but as long as the users’ keys are locally stored, users would maintain custody of their own funds, minimizing the operators’ regulatory profile.

P2P plus minimal friction equals scale.

3. Decentralizing Liquidity

There is no credit on Lightning. The liquidity to settle any transaction needs to be preloaded onto the network. While this imposes a significant liquidity burden on those seeking to process users’ payments, it also presents the rich opportunity of a snowball effect: the more liquidity the network contains, the more transactions it can process, the more transaction fees the operators can collect, the more liquidity they have to invest in the network, and so on.

As Lyn Alden recently put it:

“Once there are tens of thousands, hundreds of thousands, or millions of participants, and with larger average channel balances, then routing a payment from any arbitrary point to any other arbitrary point on the network becomes exponentially easier and more reliable.”

In order to get the snowball rolling, we must distribute the burden of preloading the network with liquidity by onboarding new LSPs. By attracting LSP collaborators, we will raise the liquidity level of the network overall, turning the snowball into an unstoppable avalanche of liquidity.

A Postscript On Shortcuts And Friction

A dear, old teacher of mine always used to say, “Doing it the right way is the shortcut.” Like so much wisdom gained from experience, this was infuriating to hear as a young person, which makes it no less wise.

The thoughts above about how to scale Lightning and catalyze the exponential growth of the P2P economy never even flirt with the idea of third-party custodians. And yet I would be the first to admit that connecting users via third-party custodians would make everything so much easier. Throw together a jazzy interface for an app in a few weeks or so, have your developers implement a database in the backend to manage users’ transactions, cut everything down to a single node and a handful of big payment channels, and you’re off. Less hassle for Lightning operators, a tighter network and a shallower learning curve for Lightning users.

We could push this even further. For all its revolutionary potential, bitcoin can be a pain in the neck. Private keys can get irretrievably lost or stolen. The network needs a certain amount of energy to run. A satoshi can only be in one place at any given time, limiting financial innovation. Why not just tell everyone that we’re moving their bitcoin around, when in fact they have no bitcoin … and neither do we? Same database, same interface, infinitesimal hassle, free Lambos for everybody.

I'm joking, of course. It’s been tried. Repeatedly. FTX. BlockFi. Genesis. Solana. It’s already a cliché that “the story of cryptocurrency is in large part a story about rediscovering traditional finance.” And not only will operators lose users’ money (or magic beans, as the case may be) sooner or later, but the network would consist of a limited number of choke points, begging to be regulated, throttled and censored.

At which point we’d have to learn from our mistakes, start over from scratch, and do it again the right way. Fortunately, it’s still early days, and we can still do it right the first time. An omniscient being able to view all possible timelines would assure us that the sometimes tedious path of sovereignty and self-custody is, in fact, the shortest route to our P2P future. Though LaaS envisions a slightly different network than we have now to realize the future of Lightning, the principles and technological integrity that make Bitcoin worthwhile must remain inviolate.

This is a guest post by Roy Sheinfeld. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments