From day one, we knew that for crypto to achieve mass adoption, it would need to co-exist with the traditional financial system. That the key was rooted in building intuitive, user-centric products that integrated seamlessly into and out of a growing ecosystem of centralized and decentralized networks. And with the proper focus, all these interlocking solutions could agree on a unified purpose: to increase the ease and inclusion of financial access.&

It’s with this mission in mind that we set out to build an all-in-one suite of crypto products and services, and aligned with global regulators and legacy partners to orient their function toward ethical asset stewardship.&

Since 2013, we’ve worked tirelessly to bridge these two spaces, and established a time-tested reputation as a trusted crypto guide. For these reasons, it’s been difficult to watch the tides of public opinion turn on the digital asset class following recent events in the space. However, it’s important to remain clear-eyed during transitional times, and face reality head on.

Read along as we chronicle a brief timeline of developments and conversations concerning tighter regulations in the crypto space.

FTX’s sinking ship

The collapse of FTX and its subsidiary, Alameida Research, has not only affected partnerships and trust among crypto companies, but it’s forcing regulators to increase their control over the activities of “virtual asset service providers” (VASPs). Companies associated with the virtual/digital asset sector are seeing the accelerated adoption of regulatory rules aimed at reducing perceived consumer risk.&

JP Morgan came to a similar conclusion in November 2022. According to an article from Bitcoin.com, the global investment bank predicted new limits and greater transparency requirements for VASPs will likely take effect as early as this year.

So far, government agencies are also applying increased scrutiny to the digital asset space in an effort to prevent further unfair asset management and market manipulation. In many cases, new legal guardrails are being considered and adopted to regulate the crypto sector. As a result, ongoing conversations around creating a new set of prudential norms for VASPs who fail to comply are starting to see firm deadlines.

In testimony given to the U.S. Senate Committee on Agriculture, Nutrition, and Forestry on December 1, 2022, Chairman of the Commodity Futures Trading Commission (CFTC), Rostin Behnam, cautioned that if the government does not act soon, customers will continue to lose money to predatory acts. Behnam warned that without proper oversight, it’s only a matter of time before Congress will need to reconvene to address a similar, if not more catastrophic, event to those observed in the latter half of 2022.

In turn, the CFTC Chairman asked for more authority from lawmakers to regulate digital assets at the agency. While the CFTC, which typically oversees derivatives markets, does have the authority to crack down on fraud and misconduct, spot markets lay outside its jurisdiction.

The SEC takes charge

Then, on December 7, CNBC reported that the Chair of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, expects the SEC to be the primary regulator of crypto companies, because he believes “most of the tokens are securities.” At the same time, the SEC started a regulatory process, and announced it will begin overseeing the following areas:

- The public sale of crypto projects (such as Bounty, airdrop);

- The sale and purchase of tokens, and any profits incurred from these operations;

- Tokens based on proof of stake (PoS) algorithms;

- Investments made with crypto assets, and any activity made on Crypto Asset Service Providers (CASPs) in this field.&

While tighter restrictions could help ameliorate some of the reputational risks firms have faced due to partnerships with crypto companies, it is unclear how this will end up impacting the companies themselves. One concern is that certain assets, such as exchange tokens, will still be viewed as liabilities by the regulator. However, some institutions fear the measures don’t go far enough.

Not enough for the FCA

On December 15, Coindesk reported that incoming FCA Chairman, Ashley Alder, went so far as to question whether crypto platforms were deliberately evasive and designed to launder money. An agency spokesperson later walked back the statement, and clarified they are striving to work with crypto firms who can meet their expectations, citing an internal count of 40 businesses that have already gained registration. The agency presented this as evidence of standards being within reach for diligent applicants.

Pressure around consumer protections

The regulatory fallout from 2022 events is also extending into the insurance industry, which is showing increased apprehension about offering services to those harmed by crypto events, such as the implosion of FTX. On December 19, Reuters reported that some insurers have been reluctant to underwrite asset and director and officer (D&O) protection policies for crypto companies.

Several market players are suggesting that insurers limit or refuse coverage for customers who experience financial harm or bankruptcy as a result of trading digital assets, citing inherent risk. Such a decision would leave crypto exchanges and market participants alike uninsured against any losses incurred from hacks, theft, or lawsuits.

Tighten up or break apart

Taking the above mentioned events into consideration, it is clear the crypto space has some public perception ground to make up. Much like the tired platitude about bad apples, portions of the public view the whole lot as a spoiled bunch. That’s why it’s imperative that industry leaders take this ensuing chapter in crypto’s evolution as the regulatory wake up call that it is. It is no longer sustainable to allow nefarious actors to define DeFi’s future.

In an effort to be prepared for what may lay ahead, it’s safe to conclude that the crypto sector will likely face the following challenges:

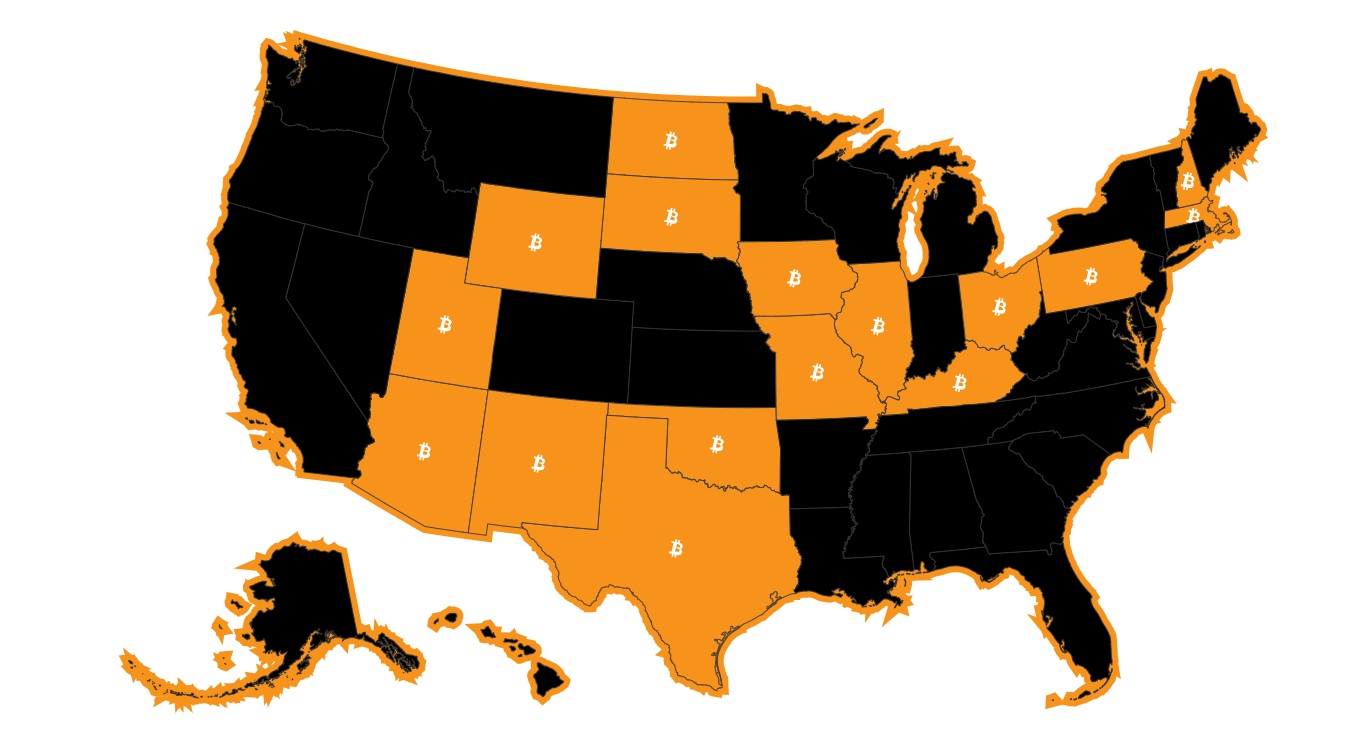

- The accelerated adoption of regulatory legislation governing the crypto industry in various countries/jurisdictions;

- An increase in the number of state-level inspections, and control needs or mechanisms;

- The development of enhanced prudential standards for capital and asset management;

- An increase in expenses for insurance and auditing, commensurate with market volatility and/or reputational risk;

- A more conservative approach to collaboration with crypto startups, due to perceived risks for third-party businesses and/or investors.

While these compounding situations are in active development, it’s undeniable that we are living through a crypto industry sea change. For those trying to position themselves in relation to these forces, perhaps the natural world can lend some wisdom. Where the tides and currents carve immutable features into the landscape, regulations are going to make similar impressions on the crypto ecosystem. It’s time to adapt, or risk getting washed away.

Disclaimer: Information provided by CEX.IO is not intended to be, nor should it be construed as financial, tax or legal advice. The risk of loss in trading or holding digital assets can be substantial. You should carefully consider whether interacting with, holding, or trading digital assets is suitable for you in light of the risk involved and your financial condition. You should take into consideration your level of experience and seek independent advice if necessary regarding your specific circumstances. CEX.IO is not engaged in the offer, sale, or trading of securities. Please refer to the Terms of Use for more details.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments