Summary:

- Gary Gensler’s SEC argued against the deal with allegations of unregistered securities over the VGX token and the proposed plan to repay Voyager’s stranded customers.

- New York’s Department of Financial Services also scrutinized the deal and accused the bankruptcy crypto lender of operating illegally within the state.

- Reports said 97% of Voyager’s creditors had voted in favor of the Binance deal as of Wednesday, February 22.

The Binance.US $1.02 billion proposal to scoop up assets from underwater crypto lender Voyager faces stiff opposition from federal and state regulators who claim the deal could fall outside the purview of the law.&

Indeed, the U.S. Securities and Exchange Commission and the New York Department of Financial Services (NYDFS) both filed against the agreement between Binance.US and Voyager Digital.

Gary Genler’s regulator scrutinized Voyager’s VGX token over unregistered securities claims and argued against the deal’s proposed path for repaying distressed customers of the bankrupt crypto lender. Per the filing on February 22, Voyager must provide proof that the agreement does not violate securities laws.

The transactions in crypto assets necessary to effectuate the rebalancing, the redistribution of such assets to Account Holders, may violate the prohibition in Section 5 of the Securities Act of 1933… It is the Debtors’ burden to present credible evidence that the provisions of the Plan are feasible and not in violation of applicable law

Gary Gensler’s federal regulator previously asked both parties to halt the deal on the basis that Binance.US did not boast sufficient financial strength to complete the deal. The agreement received conditional approval from U.S. Judge Michael Wiles in January shortly after the commission’s inquiry.

In a separate filing, the NYDFS echoed similar concerns from the securities watchdog while introducing new allegations of illegal business operations. The New York regulator and Attorney General Letitia James alleged that Voyager digital denied customers of lawful protection by offering its services without a license in the past.

New York’s watchdog added that Voyager may still be running an illegal virtual currency business in the state at the time of the filing.

SEC And NYDFS Target Alleged Crypto Non-Compliers

This is not the first time both watchdogs have teamed up to take on ventures in the crypto industry. Recently, the two regulators cracked down on the regulated crypto trust company Paxos and its Binance-branded stablecoin BUSD.

While the Gensler’s commission served Paxos a Well notice alleging securities violations, the NYDFS ordered the company to immediately stop minting new BUSD stablecoin tokens.

The federal watchdog also fined crypto exchange Kraken $30 million, forcing the platform to shutter crypto staking services for U.S. customers.

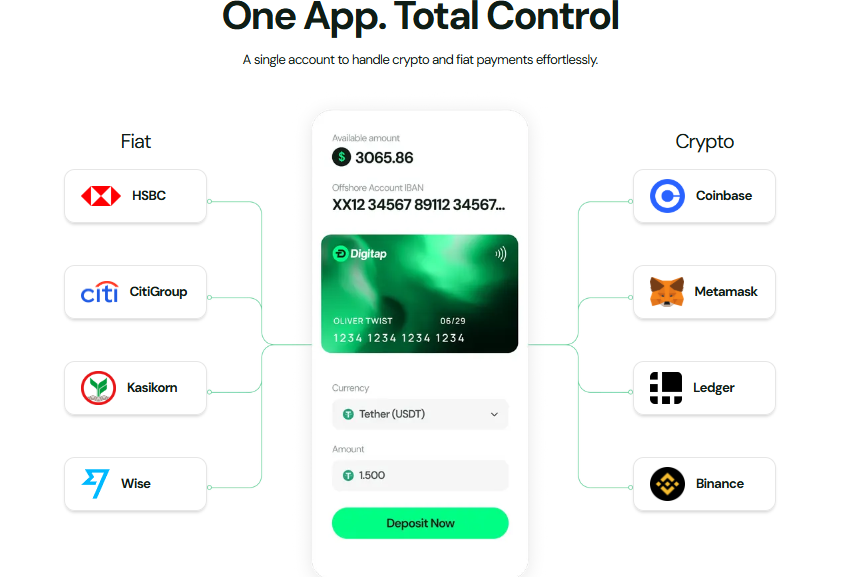

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments