The US Securities and Exchange Commission has approved standards that could speed up spot crypto ETF approvals, as each application would not need to be assessed individually.

The US Securities and Exchange Commission has approved a set of listing standards for commodity-based trust shares, opening the door for digital asset listings without requiring individual approvals.

The decision, detailed in SEC filings on stock exchanges like the Nasdaq, NYSE Arca, and Cboe BZX, on Wednesday, would streamlines the process under Rule 6c-11, significantly reducing approval timelines, which have taken several months in the past.

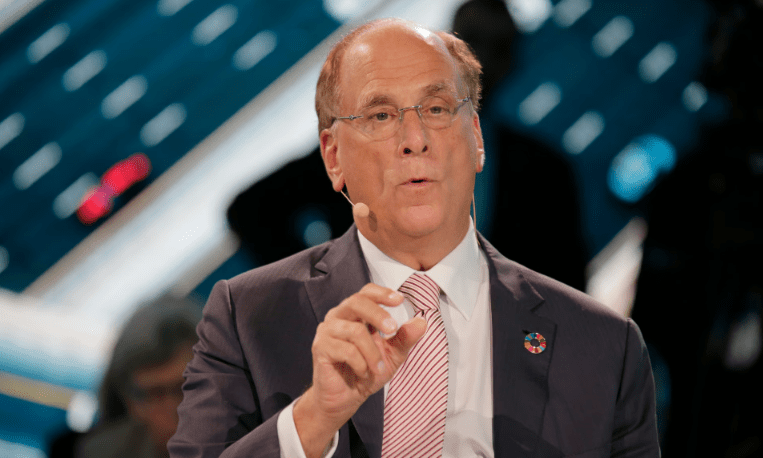

“By approving these generic listing standards, we are ensuring that our capital markets remain the best place in the world to engage in the cutting-edge innovation of digital assets,” SEC Chair Paul Atkins said in a separate statement.

It comes as spot ETF applications for the likes of Solana (SOL), XRP (XRP), Litecoin (LTC) and Dogecoin (DOGE) await official approval.

The SEC was facing deadlines from October onwards to decide on those cases, in addition to a handful of others.

To be eligible for listing, a crypto spot ETF must hold a commodity that either trades on a market that is part of the Intermarket Surveillance Group with surveillance access, or underlies a futures contract listed on a designated contract market for at least six months with a surveillance-sharing agreement in place.

Related: SEC, Gemini Trust reach agreement over crypto lending dispute

Alternatively, it may be eligible if it is already tracked by an ETF with at least 40% exposure listed on a national securities exchange, the securities regulator said.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments