I reported my 2021 earnings from staking last year as "Other Income" and still haven't received my income tax return. The value of my earnings (paid out in cryptocurrency) only amounted to a little over $80, yet the IRS found the need to send me a letter in the mail asking to clarify what those earnings were. I responded to that letter by faxing them another form specifying exactly which cryptocurrency I received and in what amounts. Unfortunately, the platform that I used to earn those staking rewards didn't provide me with any forms to show them. The IRS also didn't provide us with any guidelines on how to report staking rewards. Should I just report those earnings if and when I choose to sell the cryptocurrency?

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

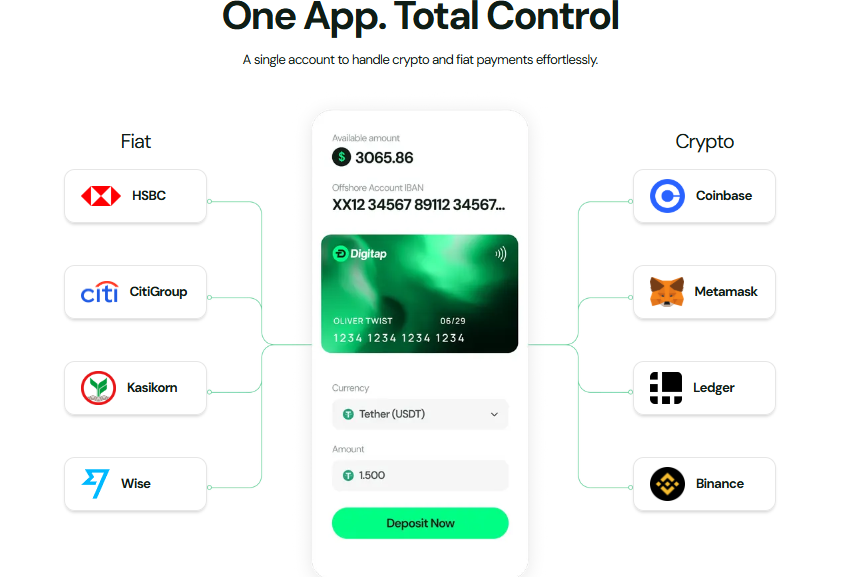

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments