Key Takeaways:

- The Total Value Locked (TVL) in Solana has dropped 40% in the past month, mirroring a broader decline in activity across its network.

- The memecoin frenzy on Solana is also fading, contributing to periods of stagnation for SOL’s price.

- In technical terms, the SOL price is likely to visit $110 before encountering strong support.

The Solana (SOL) token — once seen as a high-speed, low-cost Ethereum killer — is at a crossroads. The network is also experiencing a large retracement after several weeks of incredible growth fueled by DeFi innovation and the suddenly enormous popularity of memecoins. The cryptocurrency SOL, which previously surged to nearly $300, is now settling almost 52% below its all-time high, still trading in a dangerous position and with more space for down movement. The million-dollar question: is Solana’s star going dim, or is this just a temporary pause on the way to becoming a significant player in the crypto world?

A $5 Billion TVL Plunge: What Just Happened?

One of the most alarming indications is the drastic decrease in Solana’s Total Value Locked (TVL). The total value locked (TVL) within Solana’s DeFi protocols, or the aggregate value and sum of assets that are locked within protocols on the network, has collapsed by a staggering 39.2% over the past 30 days. For some context, this is Solana’s largest month over month loss since FTX’s spectacular collapse in November 2022 rocked the entire crypto ecosystem to its very foundations.

Crypto Market Update

Solana TVL drops $5B in 30 days.

Source: @Cointelegraph https://t.co/7NUfiPFWCL

— Getcryptofast (@getcryptofast) February 27, 2025

Indeed, at the height of Solana’s success (#2 in TVL) on January 24th of this year, its TVL was over $12.1 billion, while it is (again) currently at $7.4 billion. Particularly troubling about this drop is that TVL is generally viewed as a barometer of a blockchain’s health. In general, a growing TVL indicates greater user adoption, developer activity, and overall confidence in the ecosystem. On the other hand, a falling TVL may be seen as a sign that investors no longer have confidence and are withdrawing funds from the network, which can create a self-perpetuating cycle of collapsing liquidity and price erosion.

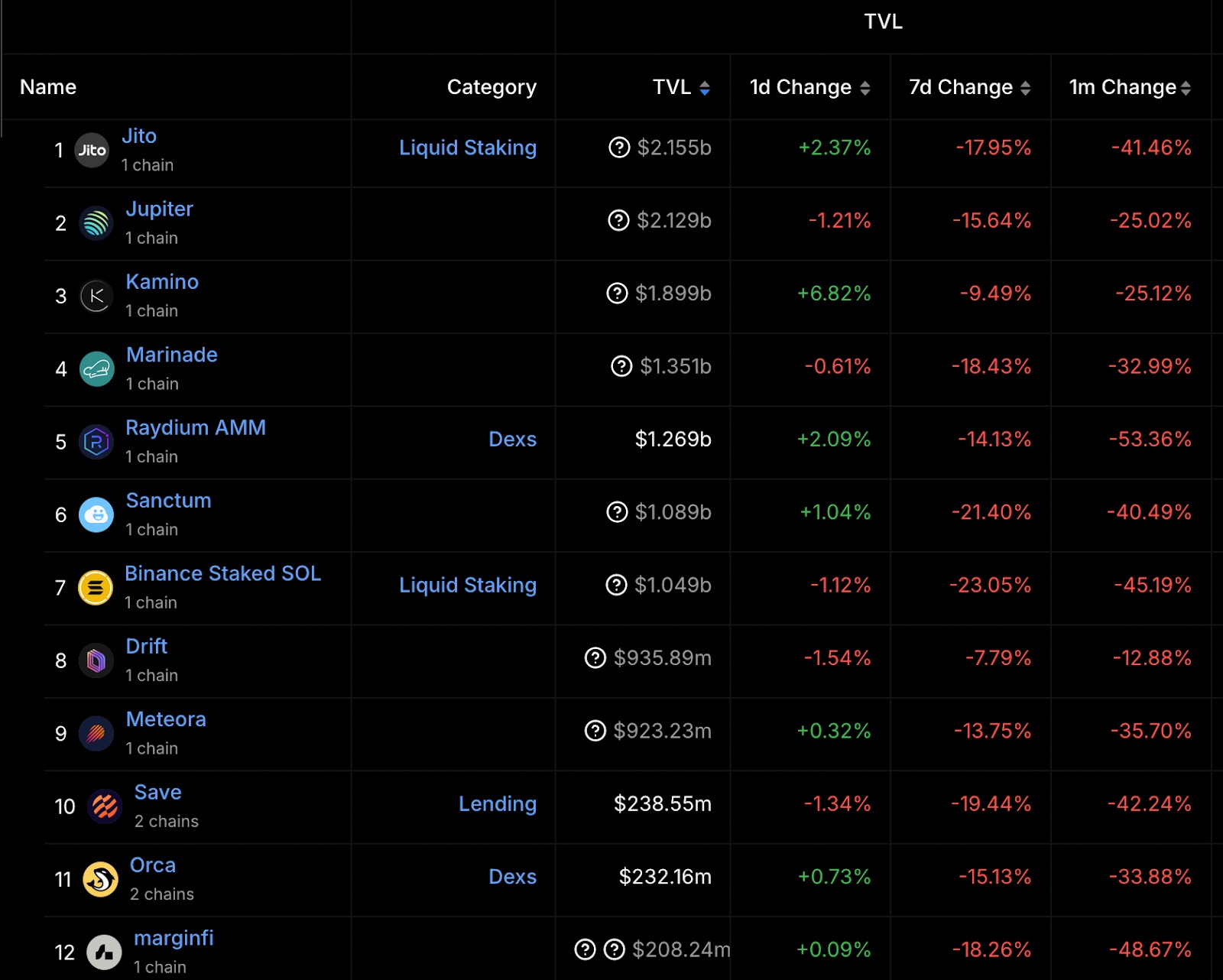

Solana’s on-chain volumes and TVL. Source: DefiLlama

Analyzing the DeFi Dip: What Protocols Are Being Most Impacted?

The TVL drop has not been consistent across all Solana-native DeFi protocols. However, some platforms were knocked harder than the others, data from DefiLlama reveals. The most impacted was Raydium — a popular automated market maker (AMM) on the Solana network that has seen its total value locked (TVL) plunge 53% in the last 30 days. On the other hand, more robust dApps such as Jupiter DEX (the top swap aggregator), Jito (liquid staking protocol), and Solend (lending platform) also faced significant outflows, seeing their TVL decrease between 25% to 42%.

TVL on Solana’s top dApps. Source: DefiLlama

This widespread DeFi activity decline has clearly and directly reflected in Solana’s on-chain volumes. Trading volumes that once hit a healthy $97 billion a week in mid-January are now at just $11 billion a week. This sharp drop in transaction volume signals a significant slowdown of the Solana network which naturally puts downward pressure on the SOL price.

More News: Wintermute’s $38M Solana Withdrawal Sparks Fears Ahead of $2B Token Unlock

The Memecoin Mirage: When Does the Fun End?

A core pillar of Solana’s former success boost has been the rise of an active, and at times hyperactive memecoin market. These quirky tokens were born of internet culture and brought a new set of users to the Solana ecosystem, coupled with a speculative frenzy that led SOL to new heights. But as is often the case with memecoins, the good times could not last.

In the meantime prices of Solana memecoins are crashing as the entire memecoin market on Solana is going through what appears to be a painful correction. Some of the most popular Solana memecoins on the market have been cut in price by 50%, 70%, or even 90% since their all-time highs. Source: CoinGecko. The combined market cap of Solana memecoins has fallen from a peak of $25 billion in December 2024 to just $8.3 billion now — a staggering 68% drop in under three months.

Solana-based tokens and memecoins plummeted. Source: CoinGecko

This memecoin meltdown not only reflects the volatile nature of these assets, but also signals a broader decline in both investor risk appetite and in waning enthusiasm for speculative plays in the Solana ecosystem. In addition, the falloff in memecoin activity means fewer transaction fees and less demand for the SOL token itself.

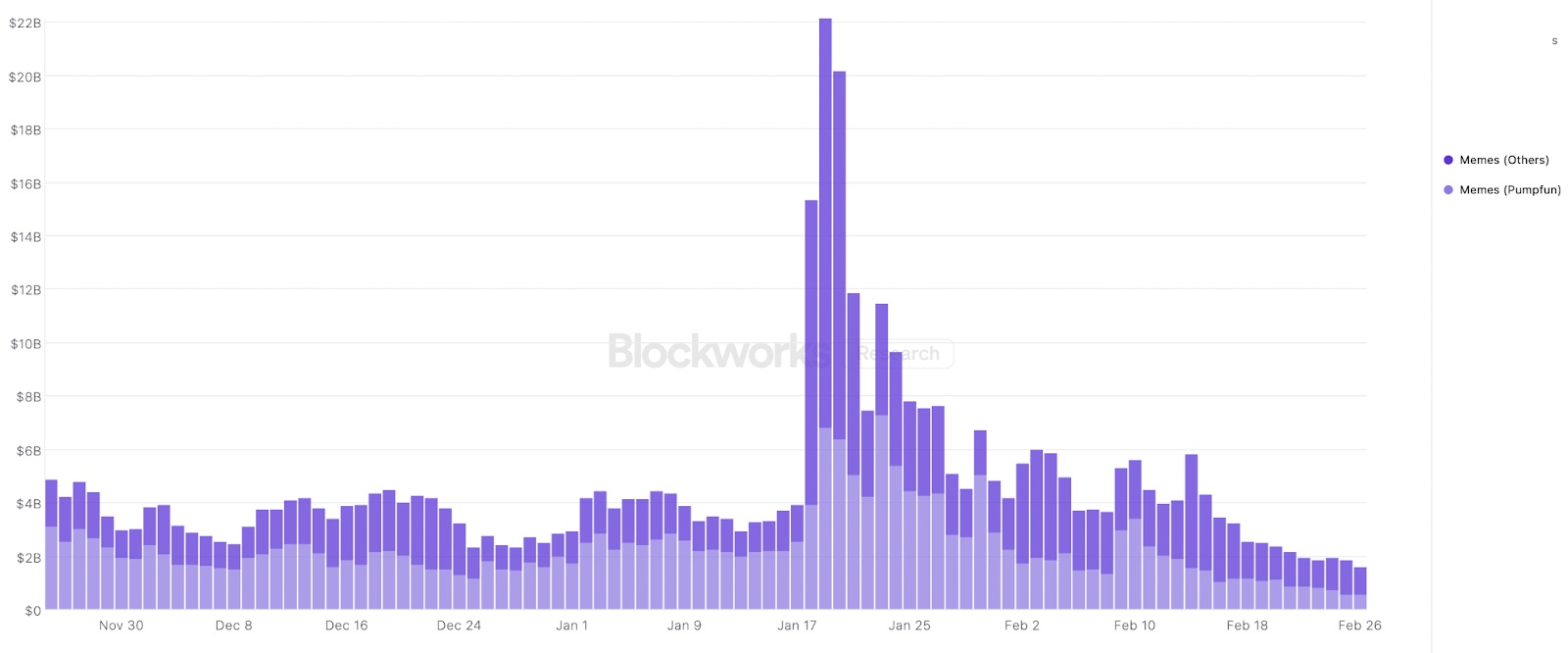

Memecoin trading volume on Solana cooled down. Source: Blockworks Research

NEW: Meme token launches on https://t.co/SuKv4oN4gO have dropped from ~71K per day to ~25K since Trump’s $TRUMP token announcement.

Meanwhile, trading volume on Raydium has collapsed from $3B to $145M, as https://t.co/SuKv4oN4gO pivots toward profit maximization. pic.twitter.com/rMnGDTMIVe

— Cointelegraph (@Cointelegraph) February 27, 2025

More News: Meme Coin Mania on Solana Cools Down: Is the Party Over?

Technical Warning Signs: Will $110 Be The Next Stop?

From a technical analysis standpoint, Solana’s price behavior is emitting some alarming signals. The appearance of “double-top” formation on daily frames is a good bearish sign as it indicates the previous upward trend has lost momentum, and suggests an imminent and notable price correction.

At the moment, SOL is trading close to the double-top neckline as well, at about the $135 mark. A sustained break beneath this neckline would likely spark another sell-off, potentially sending the price down to the 110−120 range. This area represents a key support level, as indicated by the previous price action, and may be the bottom for the current correction.

SOL/USD chart. Source: TradingView

More News: Solana Shorts Surge: Are Memecoin Scandals Crashing the Party?

A Silver Lining: Oversold Conditions and Expert Opinions

Bearish outlook aside, there are reasons to be optimistic for the outlook of Solana. The Relative Strength Index (RSI) is currently lingering in oversold territory, hinting that the selling pressure could be reaching exhaustion. This may signal a transient rebound ahead, even if the broader downtrend persists.

In addition, a few crypto analysts argue that Solana is fundamentally undervalued at its current price levels. The popular analyst Gum, for instance, has postulated that the lowest Solana price could be around “10% higher than the last price Galaxy and other funds bought the FTX Locked $SOL,” which he thinks was about $110 before a bounce.

I could be wrong but think the absolute lowest we could go on Solana would be around 10% higher than the last price Galaxy and other funds bought the FTX Locked $SOL

This would be about $110 as the minimum before a bounce

Not sure what would happen next and not saying it will…

— gum (@0xGumshoe) February 25, 2025

Solana: Endurance or Regression?

Solana is currently facing significant challenges. As we can see from the drop in TVL, the memecoin crash and the bearish technical lines, it seems to be a period of bearish sentiment with the potential for further retracement ahead. But Solana does have a lot of strengths that could see it through this storm. Once again, its high transaction speeds, low fees and vibrant developer community are attractive figures.

Solana’s culture is built on competitive sportsmanship and relentless execution

If this is you, join us in NYC this May: https://t.co/PdfLXtbFIo pic.twitter.com/v9bqfthigh

— Solana (@solana) February 27, 2025

Only time will tell, but Solana’s prospects for recovery will hinge on attracting new users and developers, the innovation within its DeFi ecosystem, and re-establishing trust with investors. It will be rocky going forward, but Solana is not done yet.

The post SOL Experiencing Downtrend: TVL Drops, Memecoin Mania Wearing Off and Price at Risk of Falling Below $110 appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments