Reuters

Particular Report: Binance's books are a black field, filings present, because it tries to rally confidence 16 minute readDecember 19, 20228:35 PM UTCLast Up to date ago 18 - 23 minutes

LONDON, Dec 19 (Reuters) - The world's largest crypto trade, Binance, is battling to shore up confidence after a surge in buyer withdrawals and a steep drop in the value of its digital token.

The change stated it dealt with internet outflows of around $6 billion over 72 hours last week "with out breaking stride" because its funds are strong and "we take our duty as a custodian critically." After the collapse of rival trade FTX last month, Binance's founder Changpeng Zhao promised his firm would "lead by instance" in embracing transparency.

But a Reuters analysis of Binance's corporate filings exhibits that the core of the enterprise – the enormous Binance.com change that has processed trades value over $22 trillion this yr – stays principally hidden from public view.

Binance declines to say where Binance.com is predicated. It doesn't disclose primary financial info resembling revenue, revenue and money reserves. The company has its own crypto coin, but doesn't reveal what position it performs on its stability sheet. It lends clients money towards their crypto belongings and lets them commerce on margin, with borrowed funds. However it doesn't element how massive those bets are, how uncovered Binance is to that danger, or the complete extent of its reserves to finance withdrawals.

Binance isn't required to publish detailed monetary statements as a result of it isn't a public firm, in contrast to U.S. rival Coinbase, which is listed on the Nasdaq. Nor has Binance raised outdoors capital since 2018, business knowledge show, which suggests it hasn't needed to share financial info with exterior buyers since then.

And as Reuters reported in October, Binance has actively prevented oversight. Zhao authorised a plan by lieutenants to "insulate" Binance's primary operation from U.S. regulatory scrutiny by establishing a brand new American trade, in accordance with firm messages and interviews with former staff, advisers and enterprise associates. Zhao denied signing off on the plan and stated the unit was arrange with recommendation from prime regulation companies.

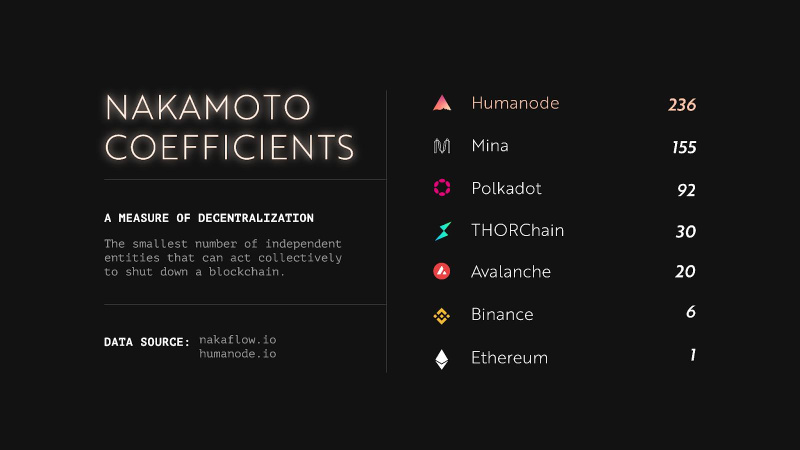

Binance's big position within the crypto market – it accounts for over half of all trading quantity – has made its operations a keen matter of curiosity for U.S. regulators. The company is beneath investigation by the U.S. Justice Department for attainable money-laundering and sanctions violations, and Reuters reported this month that some prosecutors consider they have gathered adequate proof to charge Binance and a few prime executives.

In an effort to look inside Binance's books, Reuters reviewed filings by Binance models in 14 jurisdictions where the trade on its web site says it has "regulatory licenses, registrations, authorisations and approvals." These places embrace several European Union states, Dubai and Canada. Zhao has described the authorisations as milestones in Binance's "journey to being absolutely licensed and controlled around the globe."

The filings show that these models appear to have submitted scant information about Binance's business to authorities. The general public filings do not present, for instance, how much cash flows between the models and the primary Binance.com change. The Reuters analysis also discovered that several of the models seem to have little activity.

Former regulators and ex-Binance executives say these local companies serve as window dressing for the primary unregulated change.

"They're co-opting the nomenclature of regulation to create a veneer of legitimacy," stated John Reed Stark, a former chief of the U.S. Securities and Change Fee's Office of Web Enforcement. Stark stated Binance's operations have been extra opaque even than those of FTX. "There's absolutely no transparency, no daylight, no confirmation of any type about its monetary position."

Binance Chief Technique Officer Patrick Hillmann stated the Reuters evaluation of the models' filings in the 14 jurisdictions was "categorically false." "The amount of corporate and financial info that needs to be disclosed to regulators in these markets is immense, typically requiring a six-month-long disclosure process," he stated. "We're a personal company and aren't required to publicize our company funds," he continued, evaluating the trade to privately-held companies akin to U.S. candy maker Mars. In a press release, Mars stated it was "absurd" to match its company governance and monetary reporting necessities with Binance's, including that its goods and providers are "extremely regulated."

Hillmann additionally famous that FTX's founder stands accused by U.S. authorities of fraud. If those allegations are true, he stated, "it will have been fraud regardless of what laws have been in place."

PIECES OF A JIGSAW Binance's surge in outflows final week was attributed by analysts to concern over how crypto exchanges maintain consumer funds and the Reuters report on the DOJ investigation. The change additionally halted withdrawals of some crypto tokens. On Friday, Binance's makes an attempt to reassure buyers have been set back when an accounting firm it employed to confirm its reserves suspended all work for crypto companies.

There are glimpses of Binance's finances in public feedback by Zhao, previous firm statements, blockchain knowledge and venture capital deals.

Binance has stated it has over 120 million customers. Its trading volumes totalled $34 trillion in 2021, Zhao stated in June. He advised an interviewer last month that "90-something %" of Binance's revenues rely upon crypto trading. The company is worthwhile and has "pretty giant money reserves," he added. Binance has remodeled 150 venture investments totalling $1.9 billion since 2018, based on PitchBook knowledge. Zhao additionally created a $1 billion fund to spend money on struggling crypto corporations after the fall of FTX.

Dependable estimates of Binance's trading-dependent revenues are scarce, nevertheless, regardless of the public availability of buying and selling quantity knowledge.

Binance expenses charges of as much as 0.1% on spot trades, with a extra complicated payment construction for derivatives. On spot trading volume of $4.6 trillion in the yr to October, Binance might have earned revenue of as much as $4.6 billion, Reuters calculated, based mostly on knowledge from researcher CryptoCompare. Charging fees of as much as 0.04% on its derivatives volumes of $16 trillion, Binance might have earned revenues of as much as $6.4 billion.

John Todaro, a senior analyst overlaying crypto and blockchain companies at U.S. investment financial institution and asset manager Needham & Company, and Joseph Edwards, an unbiased investment marketing consultant, stated the Reuters calculations seemed to be in the appropriate vary. Binance's promotions corresponding to zero-fee buying and selling and other discounts might mean the revenues have been decrease, Edwards stated. A 3rd crypto analyst who declined to be named also agreed with the figures.

Binance's Hillmann did not comment on the Reuters estimates. "The overwhelming majority of our income is made on transaction charges," he stated, adding that the trade has been capable of "accumulate giant company reserves" by maintaining expenses down. Binance's "capital structure is debt free" and the corporate retains its cash created from charges separate from the belongings it buys and holds for customers, Hillmann stated.

Binance allows customers to deposit collateral within the type of crypto and borrow funds to leverage the value of their derivatives trades by as a lot as 125 occasions. For the consumer, this will result in large positive factors or big losses. Hillmann stated Binance backs all consumer deposits for derivatives and spot trading with its own reserves at a ratio of one to at least one – which means deposits ought to be safe and straightforward to withdraw. Binance, he stated, has strict liquidation protocols that unload customers' positions if their losses exceed their collateral's value. If customers' positions turn out to be unfavorable "because of extreme market volatility," Binance has "very-well capitalized" insurance coverage funds to cover the deficit, he stated. Hillmann did not present specifics and Reuters could not independently verify all of his statements.

Requested concerning the scale of any losses at the change this yr, Hillmann stated: "Binance's danger department manages what is likely one of the business's most risk-averse packages. This protects our customers and our platform."

The guarding of Binance's financial info by Zhao, a Canadian citizen who was born and raised in China, echoes the strict culture of secrecy he has enforced all through his firm's rise, the Reuters report in October confirmed. The article was certainly one of a collection of studies this yr by the information company on Binance's monetary compliance and relationship with regulators the world over.

Even Binance's former chief monetary officer, Wei Zhou, didn't have entry to the company's full accounts during his three-year tenure, in response to two people who worked with him. Zhou, who left last yr, didn't reply to requests for remark.

Reuters Graphics "FULL TRANSPARENCY" Zhao and other executives have persistently declined to publicly determine which entity controls the primary change. But in a personal courtroom submission filed in 2020 in an arbitration case in the Cayman Islands, Chief Compliance Officer Samuel Lim stated it is owned and operated by a Cayman Islands company, Binance Holdings Restricted.

This yr, Binance has gained licenses or approvals from authorities in places including France, Spain, Italy and Dubai. Zhao lauded these advances, saying in Might that Binance's registration as a crypto service provider in Italy would permit it to operate "in full transparency." Yet not one of the models registered with native regulators provide a clear window into the primary Binance trade, the Reuters analysis showed.

Reuters requested authorities in all 14 jurisdictions about their oversight of Binance's local models. Of the eight that responded, six – in Spain, New Zealand, Australia, Canada, France and Lithuania – advised Reuters their position didn't contain supervising the primary trade, and stated the models have been solely required to satisfy native requirements on reporting suspicious transactions.

Reuters additionally requested representatives of the local Binance models and associates about their relationship with the primary Binance trade. Only one responded, a South African agency referred to as FiveWest. Its managing director, Pierre van Helden, stated Cape City-based FiveWest receives a "minimal yearly license charge" from Binance to facilitate crypto derivatives buying and selling for Binance's South African users.

"How Binance operates globally is unclear to us," van Helden stated. He added that Zhao's company was "cooperative" on compliance and stated FiveWest has common meetings to ensure necessities are met.

In Italy, Binance's public corporate filings element simply the unit's capital base and its possession by a separate Binance firm in Eire. The Italian company, Binance Italy S.R.L., has its listed tackle in a block of outlets and flats in the southern city of Lecce. It did not reply to a request for remark, nor did the Organismo Agenti e Mediatori authority with which it's registered.

Simply two of the Binance models analysed by Reuters supply extra substantial details in their filings.

One, a Lithuanian firm referred to as Bifinity UAB, presents probably the most detailed image. Bifinity described itself in one regulatory submitting as the "official fiat-to-crypto funds provider for Binance." Fiat means dollars, euros and different conventional currencies.

Bifinity also disclosed that Binance and its corporations are its "primary strategic business partners." In a 2021 annual report, Bifinity reported 137 million euros ($145 million) in internet revenue and belongings of 816 million euros. Bifinity stated it had made funds of 421 million euros to a single related celebration, with some 185 million euros in "associated expenses," however did not specify whether or not this celebration is Binance.

Bifinity, whose annual report stated it has 147 staff, doesn't have an internet site or publicly present any contact details. The corporate's chief government, Saulius Galatiltis, didn't respond to requests for comment. At its registered tackle at a enterprise centre in Lithuania's capital Vilnius, Bifinity just isn't listed on the tenants' board.

The other Binance unit that gives greater than barebones monetary particulars is in Spain. It registered in July with the Spanish central bank and reported meagre revenue of some 1.5 million euros last yr and a profit of just 9,000 euros. Reuters couldn't attain anyone from the unit, Binance Spain SL, for comment. A reporter visited its registered tackle, at a co-working area in Madrid. The receptionist stated a small Binance Spain staff had relocated a month in the past, without leaving contact details.

Within the Gulf, Binance has gained a license or permission this yr in Abu Dhabi, Bahrain and Dubai. Zhao advised Bloomberg in March that he will probably be based mostly for the "foreseeable future" in Dubai. Filings by Binance's Dubai entities give no particulars of its monetary activity or its ties to the primary Binance platform.

Even for some staff inside the company, such particulars have been unclear.

Binance didn't disclose international profit figures throughout its software for a license in Dubai, in response to an individual with direct information of the appliance. Almost all shoppers within the United Arab Emirates registered with Binance's foremost trade, and till no less than late summer time the licensed Dubai firm was not experiencing vital trading revenues, the individual stated.

Reuters was not capable of contact the unit, Binance FZE, registered to a WeWork office by the Dubai World Trade Centre. Binance's Middle East and North Africa head didn't reply to a request for comment. Nor did Dubai's Digital Belongings Regulatory Authority.

"PROOF OF RESERVES" Many crypto exchanges, including Binance rivals Huobi and OKX, function from offshore places such as the Seychelles – as did Bahamas-based FTX. Requirements on corporate transparency and financial reporting are sometimes looser in such jurisdictions than in america.

Coinbase (COIN.O), the most important U.S. change, listed on Wall Road in 2021. Like other public corporations, it should file audited quarterly earnings statements and annual monetary reviews. In its newest earnings statement, Coinbase reported knowledge together with revenue, revenue, money holdings and trading volumes.

"It's actually night time and day," stated Mark Palmer, head of digital belongings analysis at U.S. monetary providers agency BTIG, of the difference between disclosures by a listed company and different offshore exchanges.

"Coinbase is a publicly traded company and is required to share that info with buyers, whereas we are a personal firm and would not have public buyers to whom we're beholden," Binance's Hillmann stated. "The primary cause to go public is to boost money, however as Binance doesn't need to boost cash, there isn't a have to go public presently."

A Coinbase spokesman, Elliott Suthers, stated the corporate's financials have been reviewed quarterly by Deloitte, one of the "Huge Four" accounting companies, "so clients don't should rely on our phrase." "We consider exchanges have a duty to share their financials with their clients," Suthers stated. "We encourage other exchanges to take this similar strategy."

Some privately held exchanges reveal financial knowledge during fundraising, as did FTX previous to its collapse. Binance, nevertheless, has not raised cash from outdoors buyers since 2018, in response to knowledge from enterprise info supplier Crunchbase. "We shouldn't have VC investments, so we don't owe anyone any cash," Zhao advised CNBC on Dec. 15.

U.S. prosecutors last week charged FTX founder Sam Bankman-Fried with defrauding fairness buyers and clients of billions of dollars. It has emerged that money was secretly shifting from FTX to Bankman-Fried's hedge fund, Alameda Analysis, which functioned as a market maker, a supplier that deepens liquidity by buying and selling the same belongings.

Reuters couldn't determine if Binance or Zhao additionally personal any market-making companies that function on its platform. In December 2020, the SEC issued a subpoena to Binance.US, the separate American trade, requesting it provide information about all its market makers, their house owners, and their trading activity.

As a part of a "commitment to transparency," Binance final month revealed on its website a "snapshot" of its holdings of six major tokens and promised to share an entire set of knowledge at an unspecified future date.

Knowledge firm Nansen stated the holdings, value round $70 billion on the time of the Nov. 10 snapshot, had fallen to $54.7 billion by Dec. 17 after withdrawals and worth fluctuations. Two "stablecoins" which are pegged to the greenback – Binance's BUSD and market chief Tether – accounted for nearly half of its holdings. Round 9% of the belongings have been in BNB, its in-house token which Binance itself has issued, the Nansen knowledge confirmed.

BNB is the fifth-largest crypto coin in circulation with a market worth of around $40 billion, business knowledge show. Holders of the token obtain discounts on Binance's buying and selling fees. Zhao has stated that Binance does not use BNB as collateral. Alameda used FTX's in-house FTT token as collateral when borrowing from FTX and other lenders.

After FTX's collapse, Zhao stated audits of crypto exchanges weren't assured to stop bankruptcies. "More audits are really good, but I'm unsure if they might forestall this specific case," he informed a TechCrunch interviewer.

Zhao informed a convention in April that Binance is "absolutely audited." Requested by the Monetary Occasions who was auditing Binance's monetary outcomes and stability sheet, Zhao stated the company had "multiple auditors in multiple locations … I don't have all the listing in my head."

He now advocates so-called "proof-of-reserves" checks on the crypto holdings of exchanges. The system is meant to permit customers to verify that their holdings are included in checks of blockchain knowledge and that the trade's reserves match shoppers' belongings.

Binance hired accounting agency Mazars to verify Binance's bitcoin holdings. The firm examined the holdings as they existed at the finish of someday in November. In a Dec. 7 report, Mazars discovered that Binance's bitcoin belongings exceeded its customer bitcoin liabilities. It stated the examine, referred to as an "agreed-upon procedures engagement," was "not an assurance engagement" through which auditors personally log off on their attestations of accounts. However, Zhao tweeted, "Audited proof of reserves. Transparency."

Mazars later deleted the webpage containing the report. Its communications director, Josh Voulters, stated on Friday it had "paused" its proof-of-reserves checks for crypto companies "because of considerations relating to the best way these stories are understood by the public." Voulters didn't reply to requests for extra detail.

While this checking system provides a degree of insight into an change's reserves, it's no substitute for a full audit, seven analysts, legal professionals and accountancy specialists informed Reuters.

In offering solely a restricted snapshot of an change's crypto, the system lacks safeguards, two legal professionals stated. Others stated it could not yield the identical degree of detail on company funds as a standard audit.

"When it comes to the stability sheet from Binance, there actually is not any colour," stated Todaro, the analyst at Needham & Company.

((reporting by Tom Wilson, Angus Berwick and Elizabeth Howcroft in London; Further reporting by Mathieu Rosemain in Paris, Andrius Sytas in Vilnius, David Latona in Madrid, and Olzhas Auyezov in Almaty; modifying by Janet McBride))

Our Requirements: The Thomson Reuters Belief Rules.

Elizabeth Howcroft

Thomson Reuters

Stories on the intersection of finance and know-how, together with cryptocurrencies, NFTs, digital worlds and the money driving "Web3".

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments