On-chain data shows that stablecoin sharks and whales have been strongly accumulating recently, something that could be positive for Bitcoin.

Sharks & Whales Of Stablecoins Like DAI & USDP Are Accumulating

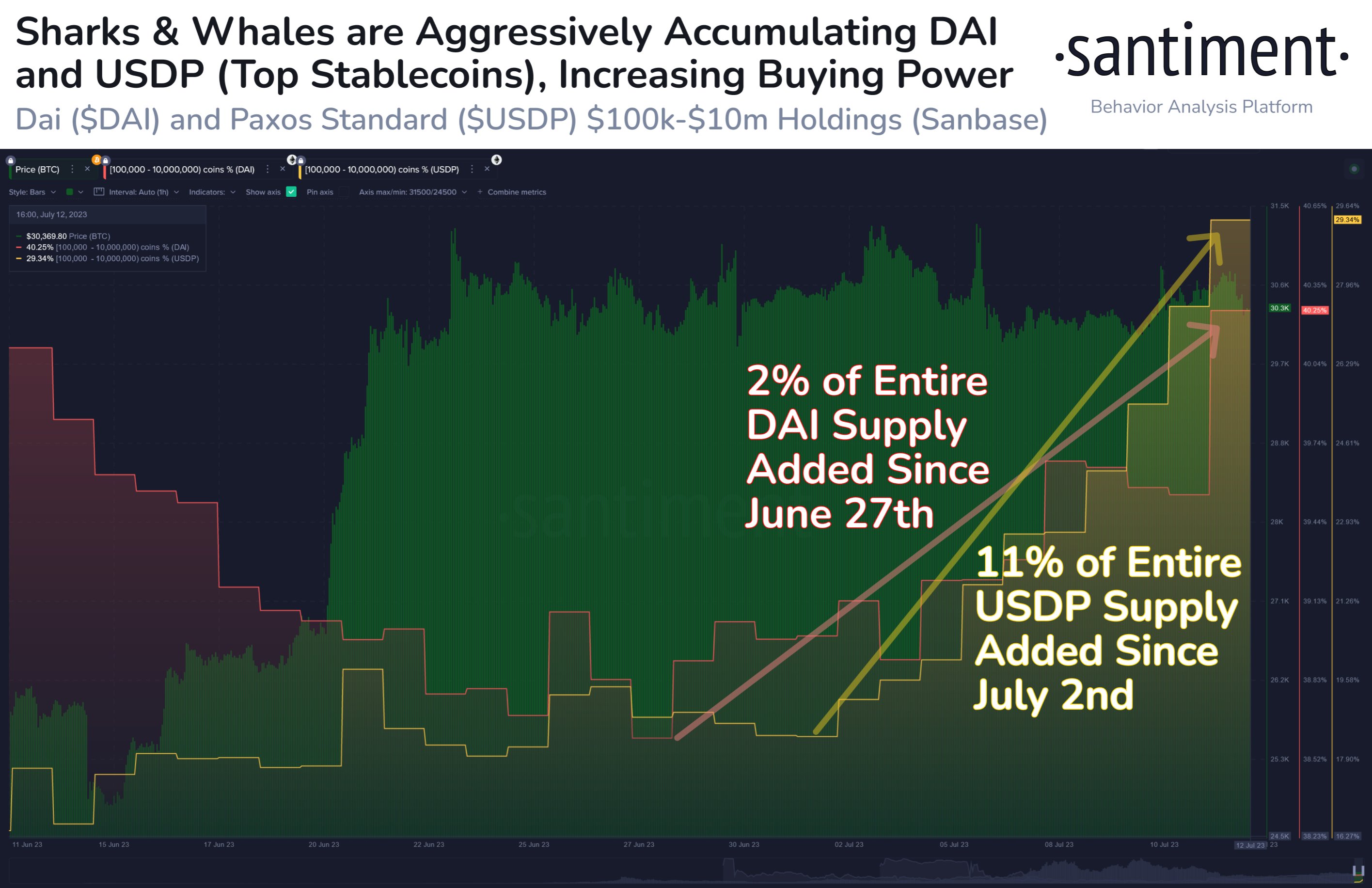

According to data from the on-chain analytics firm Santiment, large holders of some stablecoins have been expanding their holdings recently. The relevant indicator here is the “Supply Distribution,” which measures what percentage of the total supply of an asset (in this case, a stablecoin) is being held by which wallet groups in the market.

The addresses are divided into these wallet groups based on the total number of coins that they are currently carrying in their balances. The 1-10 coins cohort, for instance, includes all addresses holding between 1 and 10 tokens of the asset.

In the context of the current discussion, the investor groups of interest are sharks and whales. These are the large investors in the market, who hold some power due to the sheer scale of coins that they can potentially move at once.

Generally, their holdings lie in the $100,000-$10 million range, so in the case of stablecoins, the relevant address group would be the 100,000-10 million coins cohort (as the stables being considered here are those pegged to the USD, one token of theirs has a value of $1).

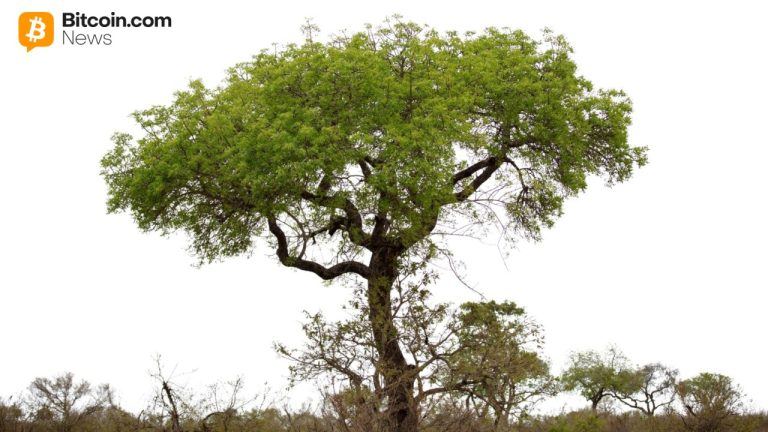

Now, here is a chart that shows the trend in the Supply Distribution of the sharks and whales for two stables: USDP and DAI.

As displayed in the above graph, the sharks and whales of both of these stablecoins have expanded their supplies recently. In the case of DAI, these humongous investors have bought 2% of the entire circulating supply of the stable during the last couple of weeks or so.

Following this buying spree, the combined supply of the addresses holding between $100,000 and $10 million in the stablecoin has grown to about 40% of the circulating supply.

As for USDP, the stablecoin’s sharks and whales have added 11% of the total supply to their addresses in the past eleven days. This has taken their combined holdings to 29% of the supply.

Usually, investors shift their coins into stables whenever they want to escape the volatility associated with the other cryptocurrencies in the sector. When such holders eventually feel that the time is right to jump back into the other coins, they simply exchange their stablecoins for them.

This shift naturally provides a bullish boost to the asset that they swap into. Thus, the supply of the stables may be looked at as the available “buying supply” for volatile coins like Bitcoin.

Since the sharks and whales of USDP and DAI have loaded up their supplies, Bitcoin and others may benefit from it when they use these reserves for buying (which may not be in the near future, however).

BTC Price

At the time of writing, Bitcoin is trading around $30,500, down 1% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments