On-chain data shows stablecoins have recorded more than $4 billion in inflows in the past month. Here’s why this could be relevant for Bitcoin.

Stablecoin Market Cap Has Enjoyed Some Notable Growth Recently

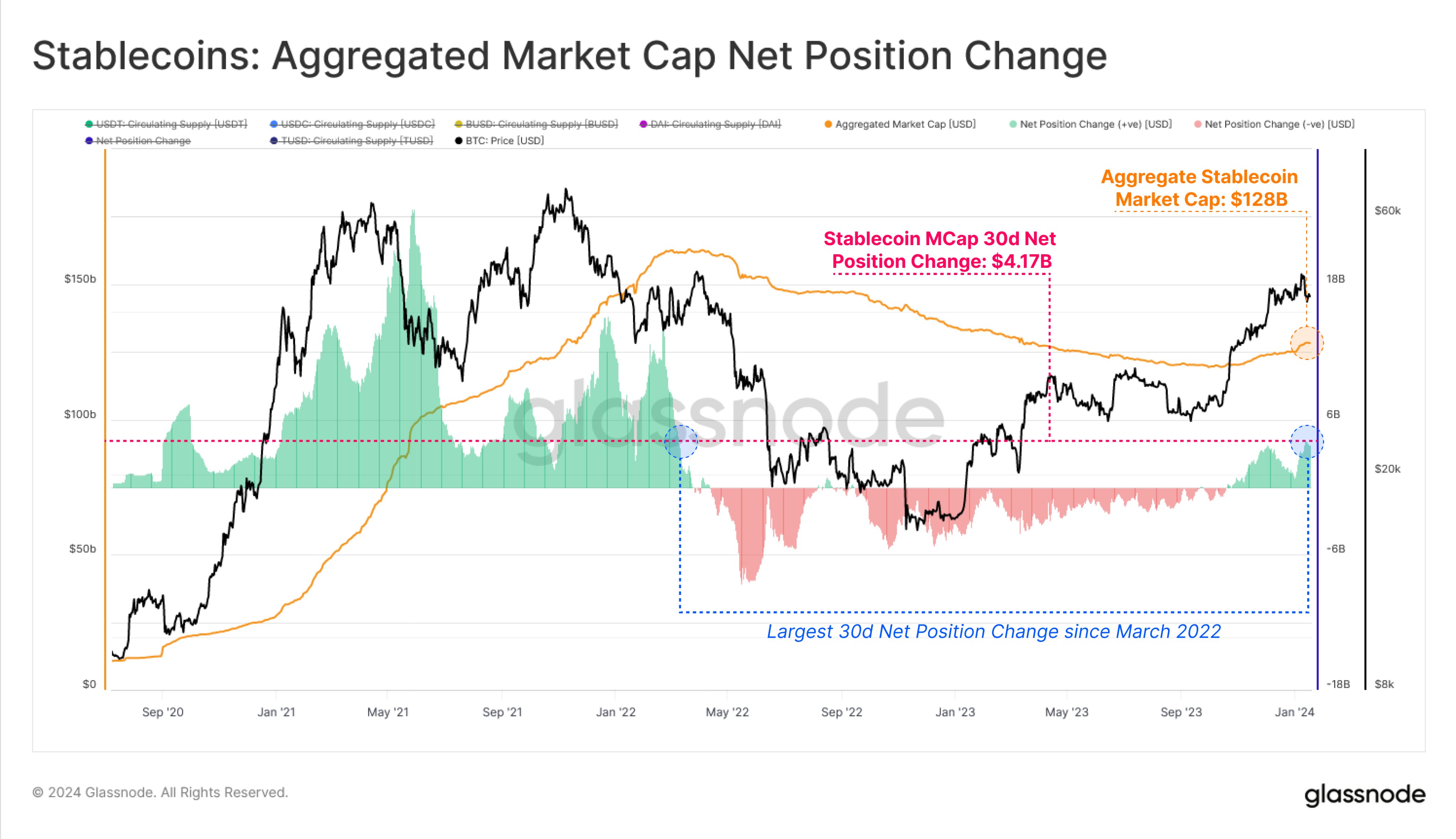

According to data from the on-chain analytics firm Glassnode, the aggregate supply of stablecoins has been going through an expansion since October of last year.

The relevant indicator here is the “aggregated market cap net position change,” which keeps track of the monthly changes happening in the total stablecoin supply (or market cap, as they are equivalent in the case of these assets tied to the USD).

When the value of this metric is positive, it means that the supply of the stables has gone up during the last 30 days. On the other hand, negative values imply a decline has occurred in this space.

Glassnode has only included the major stablecoins in the data for this indicator. To be more specific, Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), and TrueUSD (TUSD) are the assets of interest.

Now, here is a chart that shows the trend in the aggregated market cap net position change for these stablecoins over the last few years:

As displayed in the above graph, the stablecoin market cap has enjoyed net inflows over the last couple of months, as the net position change has been positive.

The 30-day net position change has recently hit the $4.17 billion mark, which suggests the market cap of these stables has just witnessed its largest increase since March 2022. Following these latest inflows, these fiat-tied tokens now make up for an aggregate market cap of around $128 billion.

Now, what does this increase mean for the wider cryptocurrency sector? Generally, there can be two reasons why the supply of the stablecoins would go up. First is a rotation of capital from Bitcoin and other assets.

When the investors want to escape the volatility associated with these other coins in the market, they may seek safe-haven in these stables, which are only as volatile as the USD. Thus, holders selling these coins in favor of the stables can lead to an increase in their supply.

The other reason behind a rise in the market cap of these assets is naturally a fresh capital inflow. The former factor can be bearish for the prices of the other assets, at least in the short-term, but this latter reason is always a bullish development.

The recent spike in the stablecoin net position change, though, has come as Bitcoin has plunged, potentially implying that while some fresh capital may have come in, a rotation from BTC and others has definitely seemed to have occurred.

In either case, though, the long-term consequence of the stablecoin supply going up should still remain bullish, as capital locked in these fiat-tied coins usually tends to find its way back to the volatile side once investors feel it’s time to buy into Bitcoin and others.

BTC Price

Bitcoin has observed a plunge over the past day, in which the coin briefly went down towards $40,700m but has since made some recovery back to $41,400.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments