Stellar (XLM) has been following the general sentiment in the market and trending to the downside in the last 24 hours. Bitcoin, Ethereum, and other larger cryptocurrencies were rejected at critical resistance levels and now seem poised to push the sector into support.

At the same time, the Stellar Development Foundation (SDF) published its Q2, 2022, report celebrating “steady progress on its 2022 roadmap”. The non-profit organization claims the network has experienced improvements in terms of scalability, demand, and participation.

One of this quarter’s major milestones is Project Jump Cannon which is set to provide Stellar with a “robust execution environment for smart contracts”. In January, this network announced the implementation of smart contracts with a tentative launch date set for December 2022.

The announcement was made by Tomer Weller, Vice President of Technological Strategy at the SDF, who has been supervising the implementation of these capabilities with WebAssembly (WASM) runtime. The SDF claims WASM will provide its smart contracts with a secure, scalable, and easily accessible environment.

In addition, the SDF claimed the network has benefited from the introduction of Protocol 19. This update facilitates the “creation of payment channels” or second-layer payment solutions that support “high-throughput use cases”, the report claims.

The Stellar network also expanded its ecosystem in Q2, 2022, with the deployment of MoneyGram Access. Global crypto to fiat on/off ramp financial service that allows MoneyGram customers to send and receive remittances without the high cost of using legacy payment rails.

The SDF has been consolidating major partnerships with international exchange platforms, such as with CoinMe and Mercado Bitcoin. The organization also announced that Novatti will deploy a digital version of the Australian Dollar (AUD) on the Stellar network.

Stellar Faces Macro-Economic Headwinds

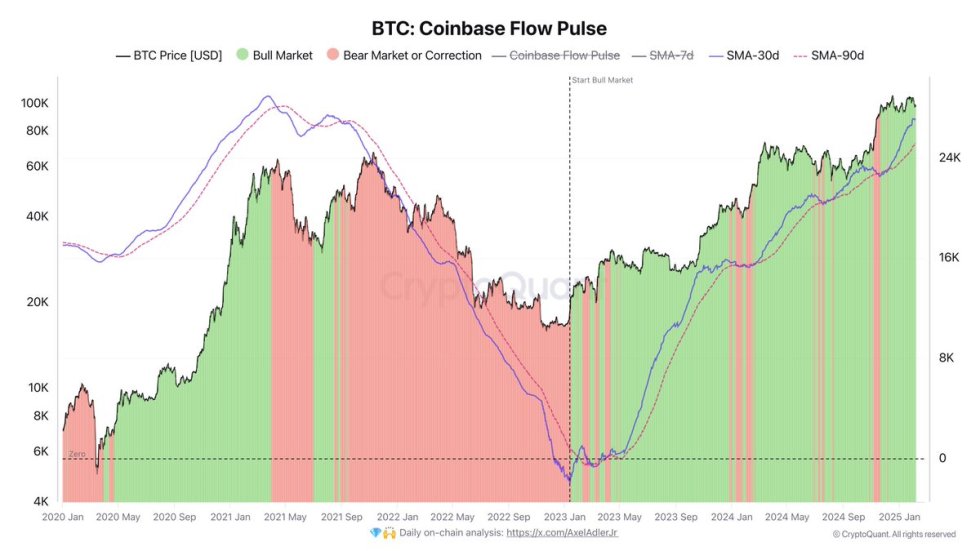

Despite the network updates, partnerships, and use cases, Stellar (XLM) is reacting to the macro-economic environment. The milestones announced by the SDF are counterweighted by a global economic environment of high inflation, interest rates hike, and less liquidity across global markets.

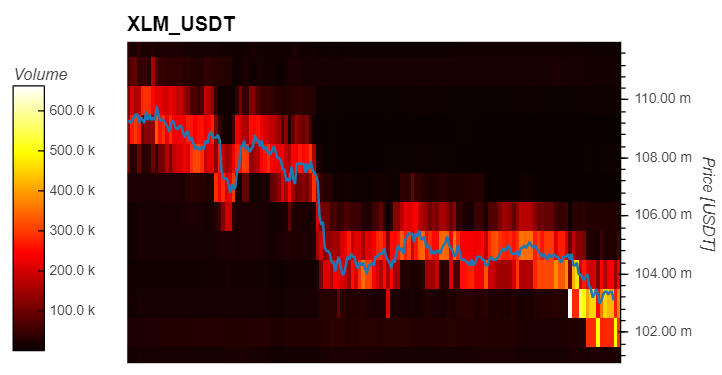

On short timeframes, XLM’s price records important support below its current levels. Data from Material Indicators shows there are around $1 million in bid orders waiting to potentially operate as support if the price of XLM continues to move to the downside.

Material Indicators record an increase in buying pressure from small investors. Unless larger investors jump into the market with bid orders, this trend suggests a potential re-test of lower levels.

XLM’s price and the crypto market could see a push to the upside if U.S. public companies’ earnings season contributes by showing positive results, Director of Macro for investment firm Fidelity Jurrien Timmer hinted at that possibility.

Q2 earnings are encouraging so far, but remember, we have 9% inflation, and earnings are generally considered in nominal terms. So there is less than meets the eye here. Expected earnings growth for 2022 remains at +10%, but without the energy sector, it’s only +4.3%. pic.twitter.com/HLSIfjWGoC

— Jurrien Timmer (@TimmerFidelity) July 26, 2022

SDF’s report hints at long-term appreciation for Stellar and its native token, but current macro-conditions are unfavorable. If XLM and major cryptocurrencies can preserve their current levels beyond this week, that could be a potential sign of a sustainable bullish price action.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments